Briefing Romania

Another successful bond auction

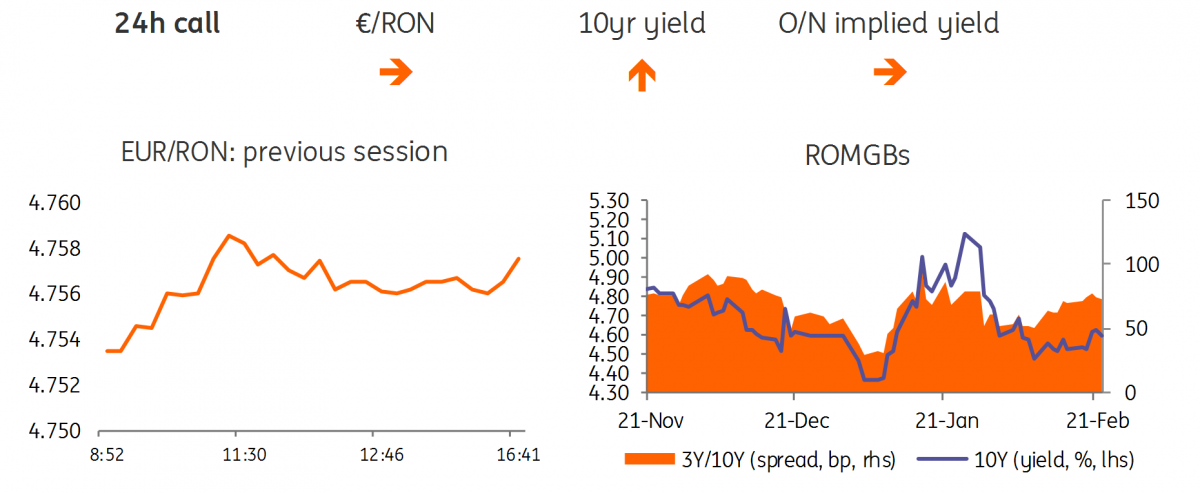

EUR/RON

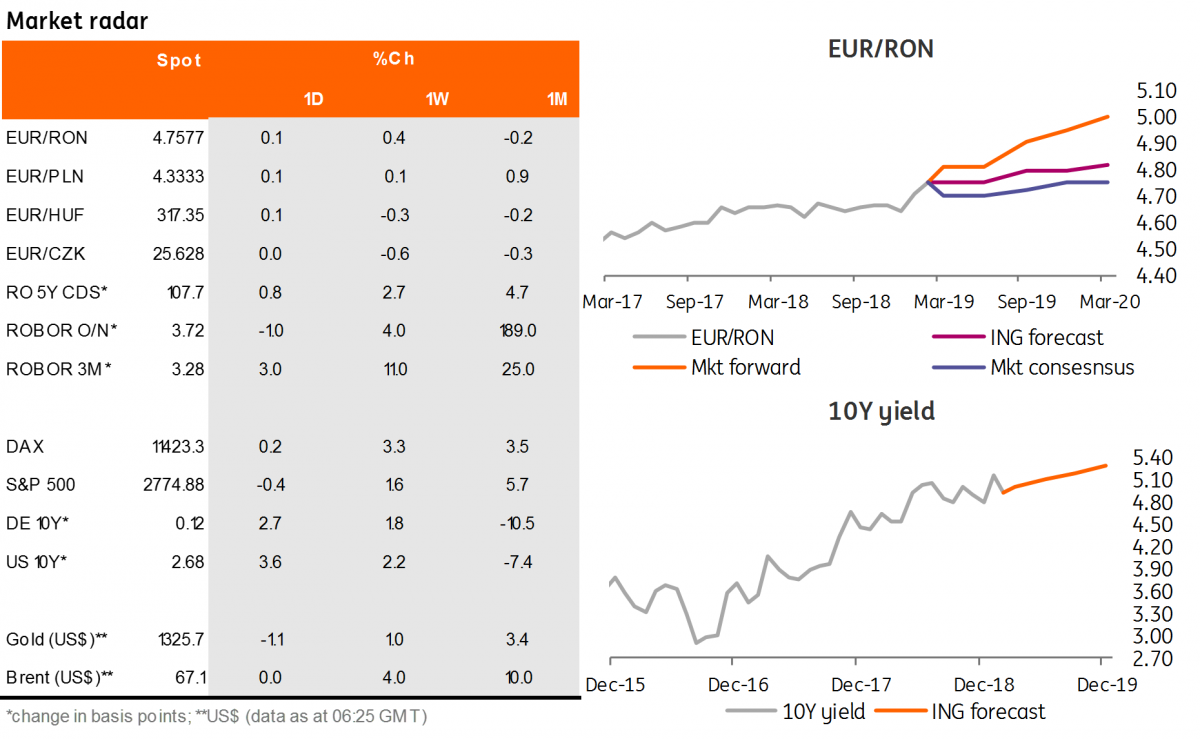

The Romanian leu continued to trade within a 4.7500-4.7600 range yesterday. The market seems to be looking to test the 4.7700 level, which could take place after the cyclical selling interest for the purpose of budget payments ends.

Government bonds

We had mixed interest in Romanian government bonds yesterday, with some upward adjustments in the mid-segment and a bit of buying interest at the shorter end, maybe on the back of the approaching RON5.9 billion (DBN035) redemption. But the day was energised by yet another pretty successful primary market auction. The RON300 million June 2023 bond attracted quite a good 2.27x bid-to-cover ratio. Though it had to pay close to the secondary market closing bids, the MinFin issued RON410 million at a 4.27% average and 4.30% maximum yield. Well done, we say.

Money Market

Cash rates dropped almost 400 basis points throughout yesterday’s trading session, closing just above 4.00%. Hence, it seems that this time, many have waited until the very last minute of the reserve maintenance period before deciding to finally hit some bids in the market. While technically, today is the last day of the reserve period, we don’t really see rates continuing to shift lower until the impact of the monthly budget payments and DBN035 redemption becomes clearer.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap