Briefing Romania

Government bonds in strong demand

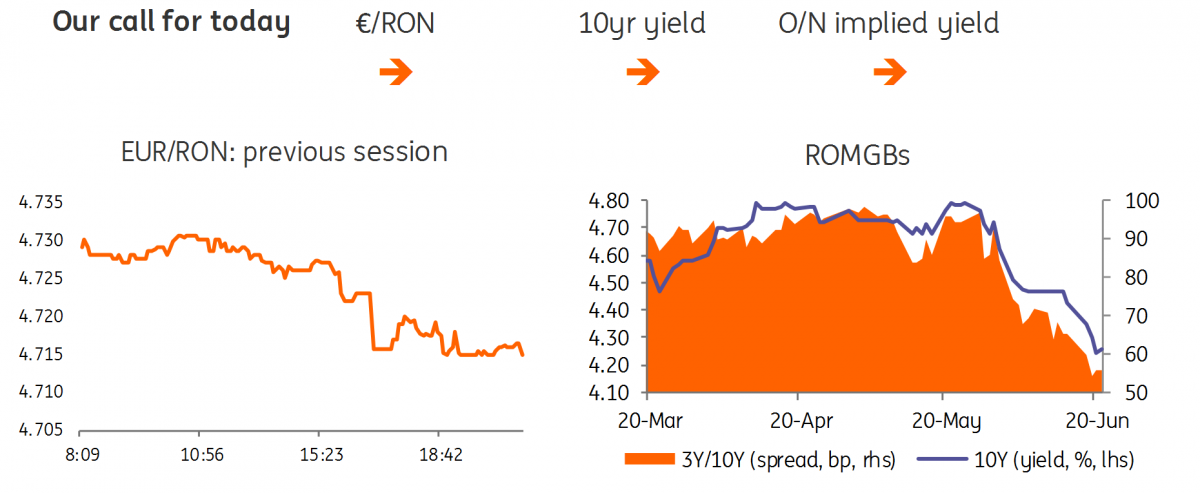

EUR/RON

The upward trend in the EUR/RON has abated amid impressive demand for Romanian government bonds (ROMGBs). Due to the late release of the auction results, after-hours trading has been quite intense and – on decreased liquidity due to local market closing – the pair dipped below 4.7200. Due to this limited liquidity, we assume that the selling interest wasn't satiated yesterday and we could see a second round coming today.

Government bonds

Yesterday was one of those days in the Romanian bond market when demand for ROMGB’s was particularly intense. ROMGB’s rallied close to 20 basis points during the day, with the longer end in greater demand. Some correction of about 6-7 basis points occurred after the auctions, which brings us to the main topic: the RON500 million Apr-2026 auction gathered spectacular total demand of RON2.39 billion. The Ministry of Finance generously upsized the initial target to RON1.56 billion allocated at 4.24%/4.27% maximum and average.

In this context, it's easy to overlook the fairly reasonable RON657 million demand for the Oct-2020 auction, upsized as well, from RON300 million to RON493 million, at a 3.42% average yield.

Money market

The last day of the minimum reserve period finds carry below the 1.50% deposit facility. There is still downward pressure on longer tenors implied yields, though the magnitude of the shift seems to be declining. With 1Y trading just above the 3.50% Lombard rate, we feel that the downside potential for the FX swap implied yields will be quite limited from here on.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap