Briefing Romania

Strict liquidity control?

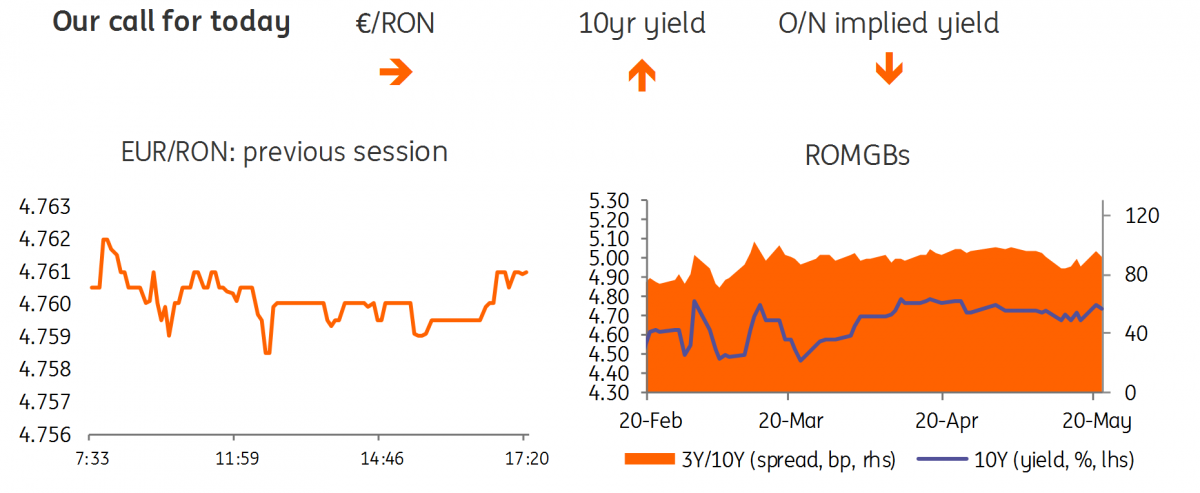

EUR/RON

The Romanian leu continues to trade remarkably stable around 4.7600 against the euro, seemingly untroubled by risk sentiment or other regional currencies. With no major data in sight this week on the local front, we expect the same pattern to hold.

Government bonds

The April-2026 auction came out relatively on the weaker side, mainly due to the wide tail accepted by the Ministry of Finance: 4.72% average yield and 4.76% maximum have been paid for RON500 million out of RON728 million in total demand. The curve followed a bear steepening pattern, with the long end shifting some five to six basis points higher.

Money market

As expected, the central bank organised a one week deposit taking auction yesterday, draining RON7.57 billion from 21 banks. The liquidity surplus is nevertheless a lot higher than that, as indicated by the drop in the cash rates back below the deposit facility. In fact, the entire curve shifted lower, 1M implied yields dropping by some 40 basis points to around 3.05%. In our view, this indicates that the market doesn’t really perceive the central bank’s pledge for “strict” liquidity control as being backed by action in the near term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap