Briefing Romania

RON400 million up for sale in 1-year auction

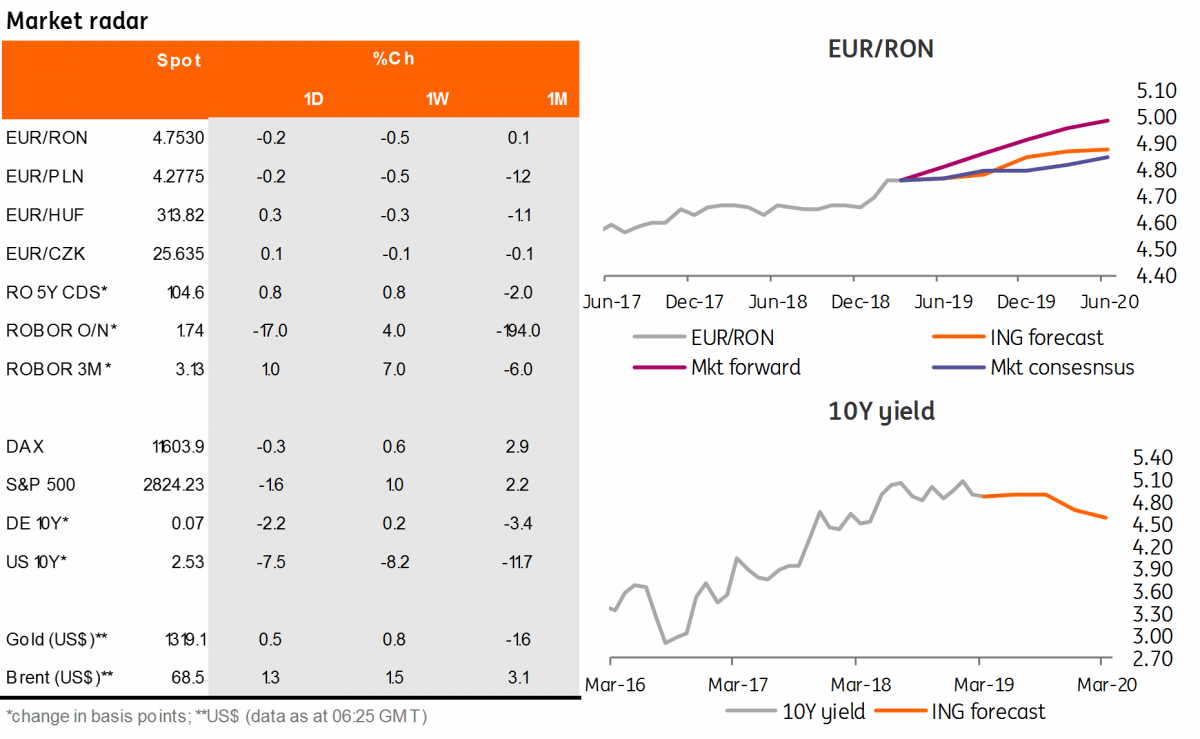

EUR/RON

The Romanian leu traded within the already established 4.7500-4.7600 range, closing the day around 4.7530, 30 pips below the opening level. The Federal Reserve’s dovish signal didn’t seem to reverberate too deeply in the emerging markets FX space, but some time might be needed for the markets to readjust. For today, we expect the same 4.7500-4.7650 trading range to hold.

Government bonds

Romanian government bond yields seem to have stabilised somewhat in recent days. The market has likely priced in most of the bank tax changes, though the final form of the bill is yet to be released. Today, the Ministry of Finance auctions RON400 million in 1-year T-bills. FX swap implied yields are trading a bit decoupled from the 1-year Robor (3.80% vs 3.50), with the latter likely being more relevant for the auction bidders. Nevertheless, the asset swap has been consistently negative in these shorter tenors. We expect supportive demand around 3.20%.

Money Market

The money market curve continued to re-price slightly higher, with rates from 1-month to 1-year trading in a quite narrow and inverted 4.00-3.80% range. This might seem unreasonably high, but with FX trading close to historic highs on a regular basis, the paying interest still prevails on forwards.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap