Briefing Romania

Leu moving further into uncharted territory

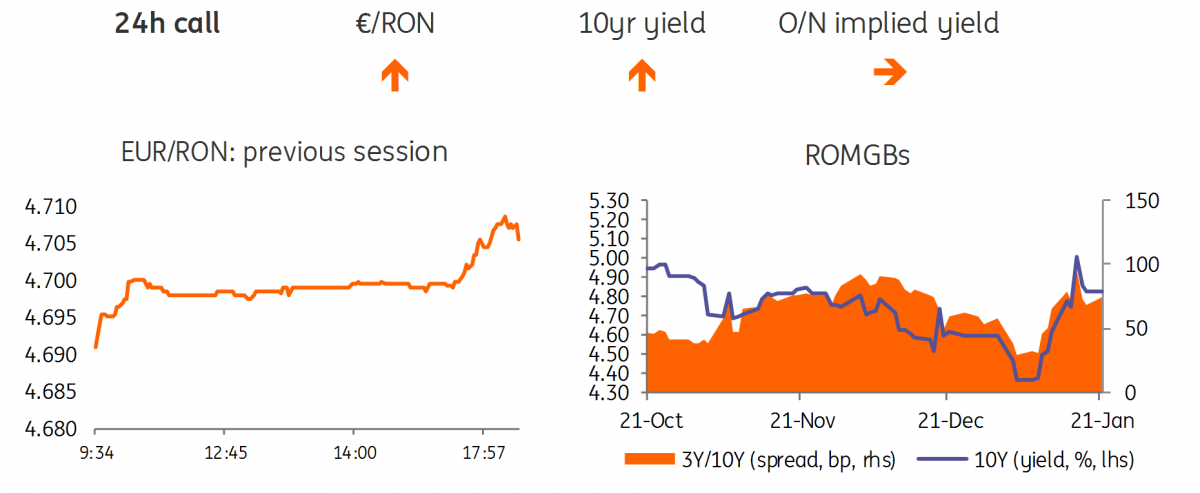

EUR/RON

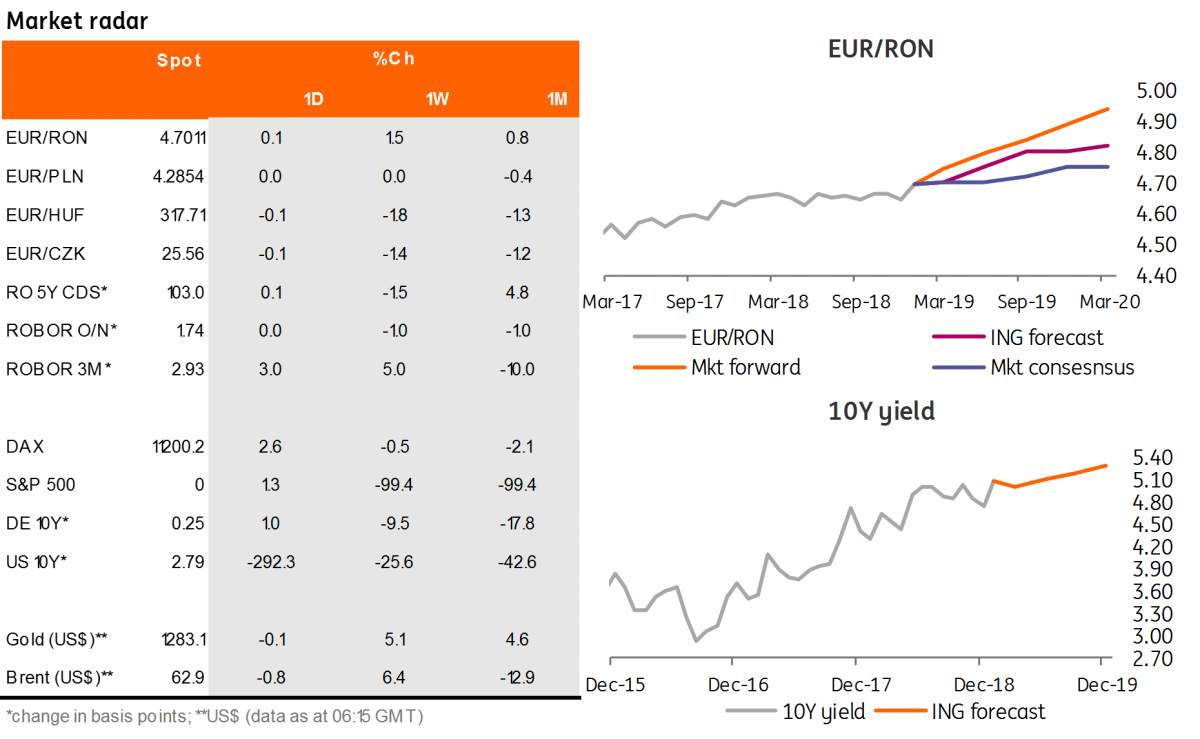

The Romanian leu continues to hit fresh highs as the market tests a new comfort zone. There are no hard ceilings from the National Bank of Romania yet, which seems focused mainly on smoothing the pace of depreciation. As the new reserve period is about to begin, the higher carry will likely help in that respect.

Government bonds

Again some mixed trading in ROMGBs, with overall buying interest prevailing. Still, the liquidity is not impressive and this generates more ample yield moves than suggested by the actual trading volumes. The Ministry of Finance auctions a new 5Y benchmark today (June 2024). A new ISIN could deter demand until liquidity improves, and the recent auction pattern is not encouraging either. Hence, we expect some partial allocation around 4.75%.

Money Market

Upside pressure on the longer-dated FX swaps continued on Friday, along with the upside move in the EUR/RON. The 1M to 1Y curve became slightly inverted towards the end of Friday’s trading session, reflecting banks’ expectations for higher carry in the short term. A rollover of the one-week deposit-taking auction from the NBR is not likely to generate much demand but at least it could signal central banks’ stance against the current liquidity surplus backdrop.

The week ahead

For the week ahead, the record US government shutdown seems destined to enter its fifth week on Saturday with the financial strain it is placing on the 800,000 workers who aren’t receiving their paychecks undoubtedly increasing. One important implication is that we are not getting the usual data flow from the US, as statisticians have also been furloughed, which makes gauging the performance of the US economy very challenging. Together with the economic headwinds that the shutdown has generated, this heightens the likelihood of a first-quarter pause from the Federal Reserve.

In the Brexit world, while some cross-party compromise, and in turn an application to extend Article 50, is getting more likely, we aren’t there just yet. In the meantime, the countdown to 29 March continues, and with no imminent resolution in sight, the economy is likely to remain turbulent.

This week will bring insight into eurozone sentiment in January. 2018 saw confidence indicators contract by the month, but perhaps the start of the year brings hope. We don't expect any significant changes at the European Central Bank meeting. ECB President Mario Draghi will probably try to sound somewhat more dovish without giving away any hints at possible changes in the ECB’s stance. Obviously, the downside risks to the growth outlook already signalled in December have not receded, but at the same time, it is still too early to sound the alarm bells. As regards Germany, the Ifo index will not yet show any turnaround in sentiment. Instead, expect more weakening on the back of increased uncertainty.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap