Briefing Romania

Central bank sees year-end inflation at 4.2%

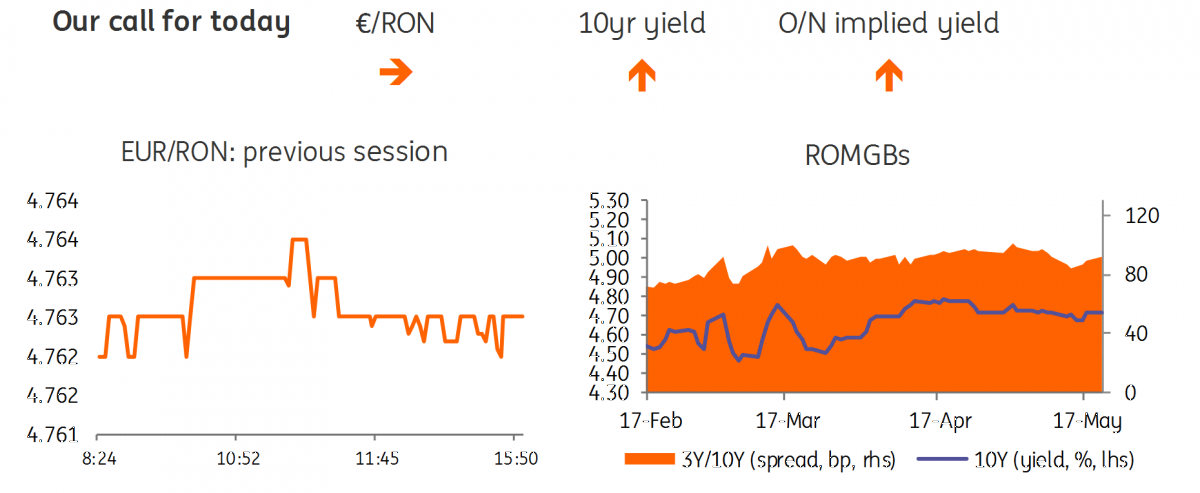

EUR/RON

The Romanian leu traded in a narrow range again, ignoring the depreciation of regional peers. The higher funding rates, which we expect to start today, should help to further contain the upside potential of the EUR/RON.

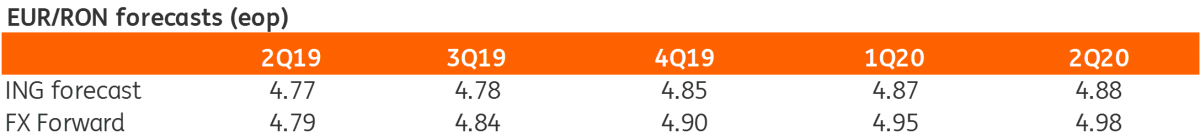

Government bonds

There was little reaction to central bank Governor Mugur Isarescu's presentation of the May 2019 Inflation Report, despite the fact that he announced quite a striking upward revision of the central bank’s inflation forecast: from 3.0% to 4.2% for December 2019. The yield curve shifted some 1-2 basis points higher without much trading going on. For today’s RON500 million April 2026 auction, we expect good demand and marginally higher bids compared to the 4.71% average yield where it was issued a month ago.

Money market

In anticipation of new instruments suggested by Governor Isarescu for strictly controlling the system’s liquidity, we will likely see a plain one week deposit taking auction today. The curve has already adjusted to higher levels with the 1M implied yield now around 3.50% and the 1Y just above 4.00%. We expect the carry to remain below the central bank’s key rate of 2.50% as most of the banks will likely set aside some liquidity reserves for the monthly budget payments due on 25 May.

The week ahead

The trade story will remain the key driver of market moves this week, with the ratcheting up of tensions intensifying market concerns about the outlook for the global economy. We see little reason for optimism in the near term, as the market is likely to be looking towards the G20 summit in June when President Trump is expected to sit down with President Xi to discuss the trade impasse.

In the US, the only data release of note will be durable goods orders, which will be heavily depressed by the swing in Boeing aircraft orders; 44 planes were ordered in March compared to just 4 in April.

Even though markets will focus a lot on the German IFO survey this week, the recent rollercoaster ride regarding trade means that it should be taken with a large pinch of salt. Both consumer confidence and PMIs in the eurozone will also be in focus - a close look at new export orders from the PMI seems especially interesting as they plummeted last month.

With no important macroeconomic data on the local front, we expect the EUR/RON to trade within 4.7550-4.7750 range.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap