Briefing Romania

Paying interest returns to the money market

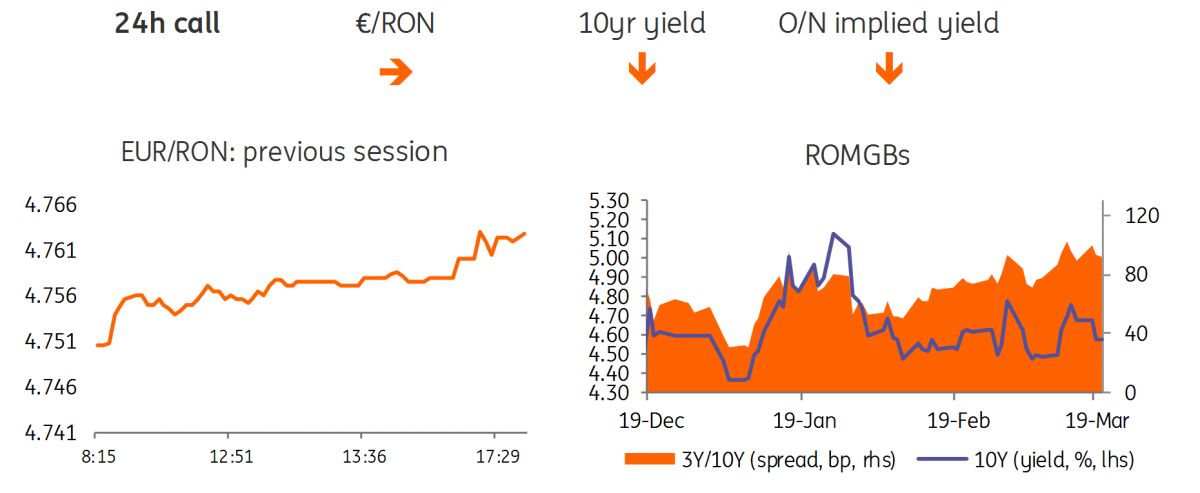

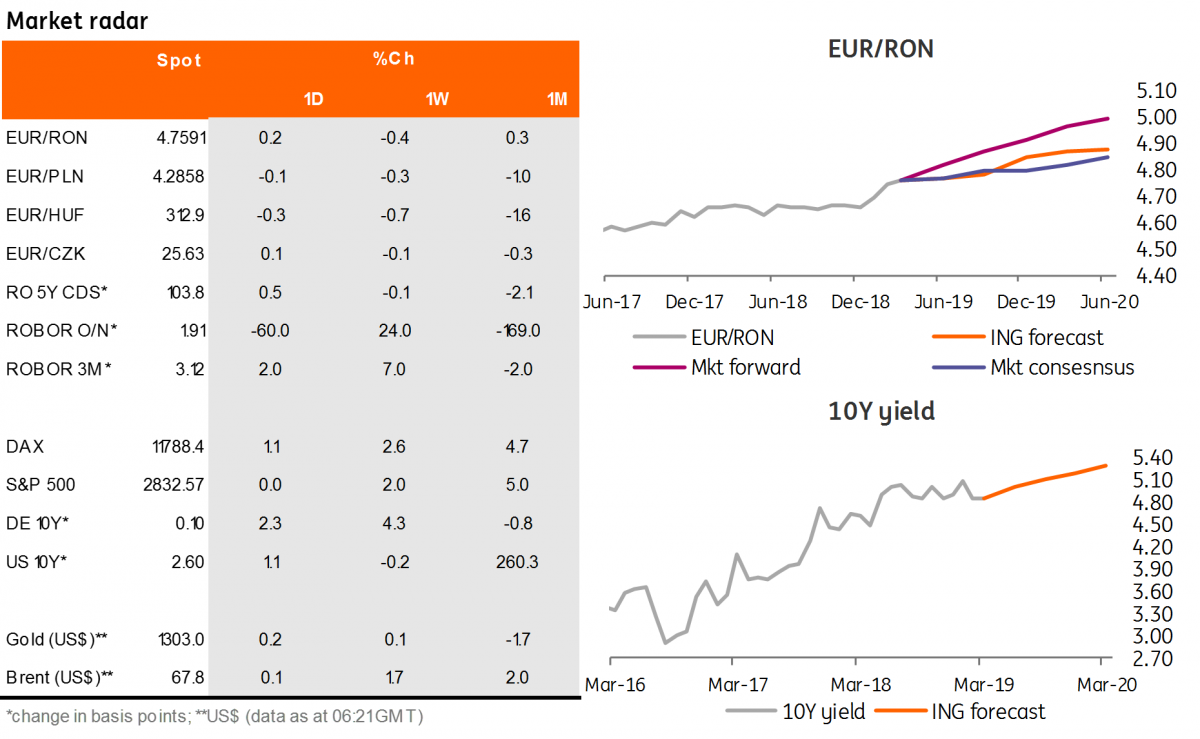

EUR/RON

The Romanian leu decoupled from its regional peers, testing the 4.7600 level against the euro. The turnover has been increasing as well, suggesting that the upside pressure is not transitory. We expect a 4.7500-4.7650 trading range for today, as the market is likely aware of official offers around 4.7700.

Government bonds

A quiet day in the Romanian government bond market which witnessed slightly better bids across the curve. The market is now likely awaiting the Eurobond retap since the budget bill is now approved and the S&P review is behind us. The latest Ministry of Finance’s data has shown ROMGBs offshore holdings at 20.7% of the total in December, the largest share since October-2014, suggesting limited incremental demand left in the pipeline.

Money Market

As expected, cash rates are trading close to the deposit facility again as banks didn’t risk placing everything with the central bank at Monday’s deposit auction. In longer tenors, the upside pressure on EUR/RON triggered paying interest across the curve, which shifted by up to 10 basis points higher. The three-month implied yield is now at 4.20%, quite close to the five-year highs seen in February 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap