Briefing Romania

Good old managed floating

EUR/RON

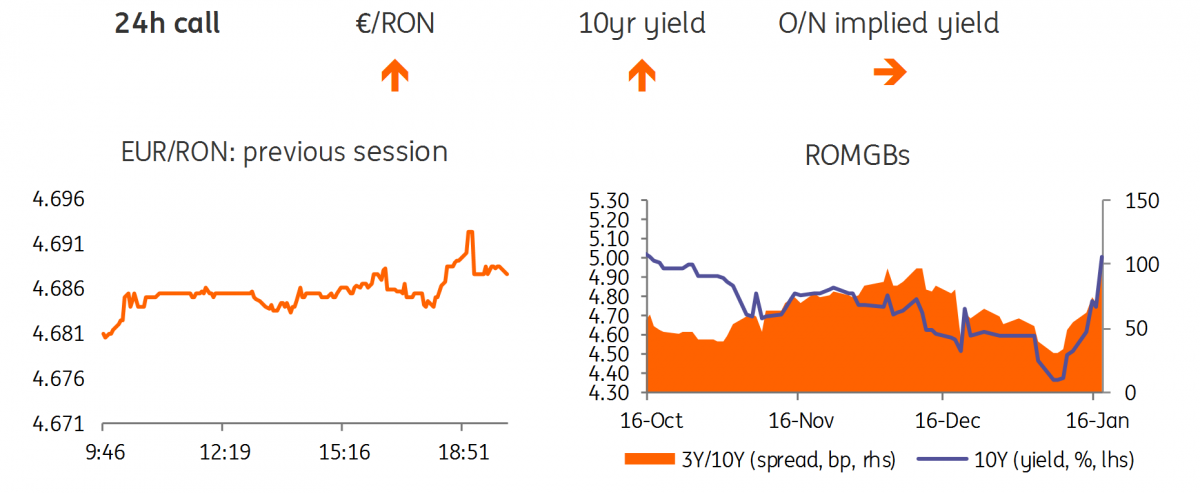

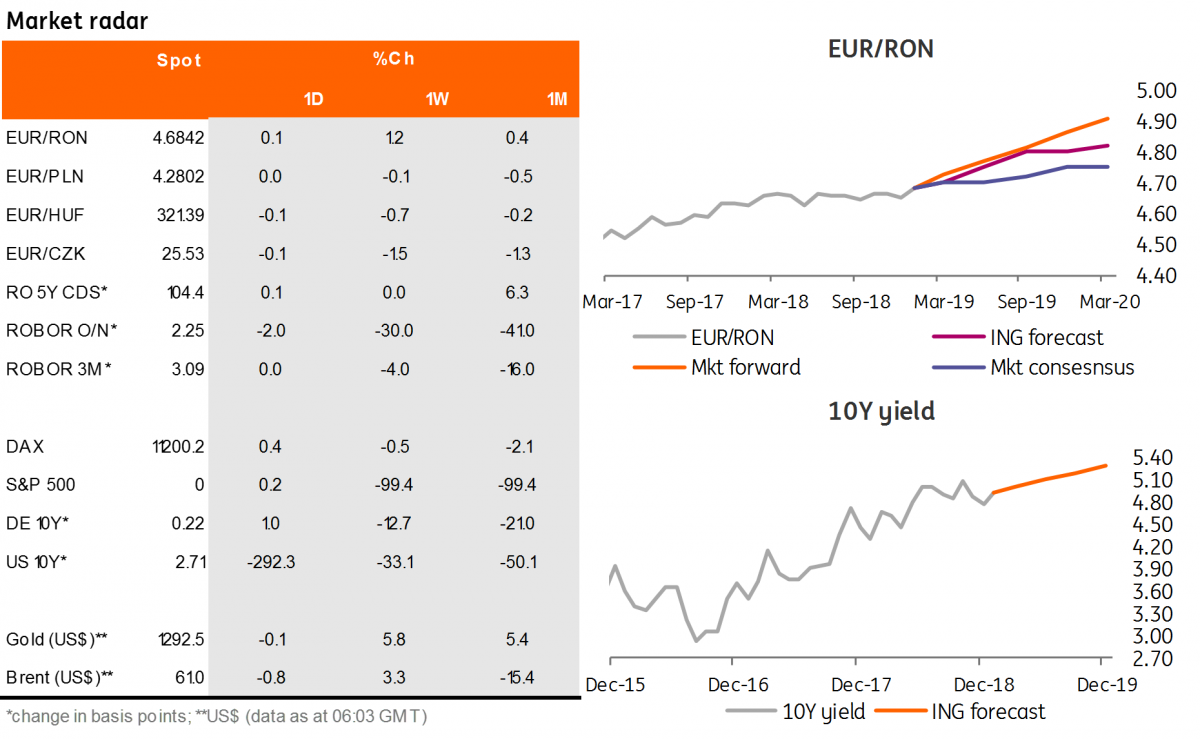

The Romanian leu traded again quite intensively yesterday and mostly to the upside as it tested the 4.69 towards the end of the trading session. The official fixing printed another high and to this point it confirms our view that the central bank is aiming to smooth the speed of the Romanian leu's weakening, rather than stop/reverse it. The usual spike in turnover ahead of local fixing seems to confirm that the NBR remains hands on.

Government bonds

Similar to regional trends but amplified by the lower liquidity, Romanian government bond yields resumed the upward move, particularly in the longer end which shifted up to 15 basis points higher. The MinFin’s EUR100 million December 2023 auction didn’t go that well, though we cannot call it a fail either. EUR83.5 million have been allocated at 0.97% average and 1.00% maximum yields, with the total demand of 1.3x seriously scattered considering the 1.37% average of rejected bids.

Today we will have a RON400 million February 2029 auction where we look for a partial allocation the top end of current market levels, i.e.5.05%. Moreover, a RON500 million 1Y T-bills will also be auctioned. Here we could have a better demand from local ALMs looking to rollover some investments in shorter tenors, but still expect the average yield in the 3.40% area, which is the current bid for Feb-2020 tenor.

Money Market

Cash rates covering the current reserve period continue to point lower with overnight rates trading just above 1.50% deposit facility. Some paying interest in longer tenors pushed the curve 8-10 basis points higher. An eventual rollover of the deposit taking auction by NBR on Monday is not likely to attract a strong demand given that the maturity will cover as well the 25 January when the deadline for monthly budget payments is. Hence a bit of steepening in the front end could still be expected.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap