Briefing Romania

Hawkish central bank rhetoric

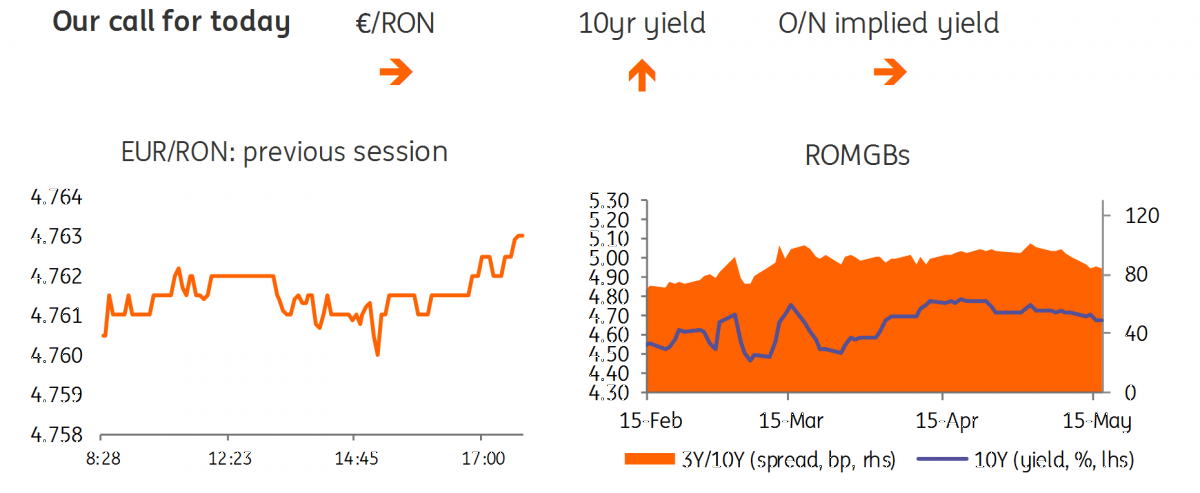

EUR/RON

No shock waves hit the Romanian leu following the National Bank of Romania's (NBR) rate setting meeting. The EUR/RON traded in the same tight range of 4.7600-4.7650 on slightly higher turnover than in the previous days. We don’t foresee any changes today.

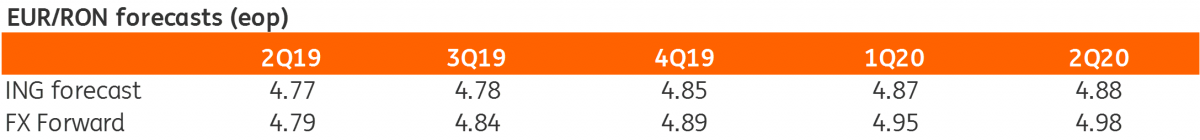

Government bonds

NBR Governor Mugur Isarescu delivered the anticipated hawkish speech yesterday but that didn’t seem to impress the market too much. As we already mentioned, this rhetoric must be backed by action in order to be credible. Hence, the yield curve traded broadly flat despite the impressive GDP print. Today, the Ministry of finance plans to sell RON500 million in an Oct-2021 auction. The demand could shift slightly higher following the latest inflation data and NBR meeting. Some relief coming from low funding rates could be supportive only to the extent that low funding is not perceived as transitory. We expect a relatively successful auction at the higher end of secondary market trading range, which is around 3.84%.

Money market

The implied yields for funding have reached levels not seen for quite some time, trading around 0.90%. It is all temporary but still quite impressive given the general tight monetary conditions discussed by the central bank. The forward curve shifted lower again, with the front end benefiting the most from the low carry.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap