Briefing Romania

EUR/RON turnover at historic highs

EUR/RON

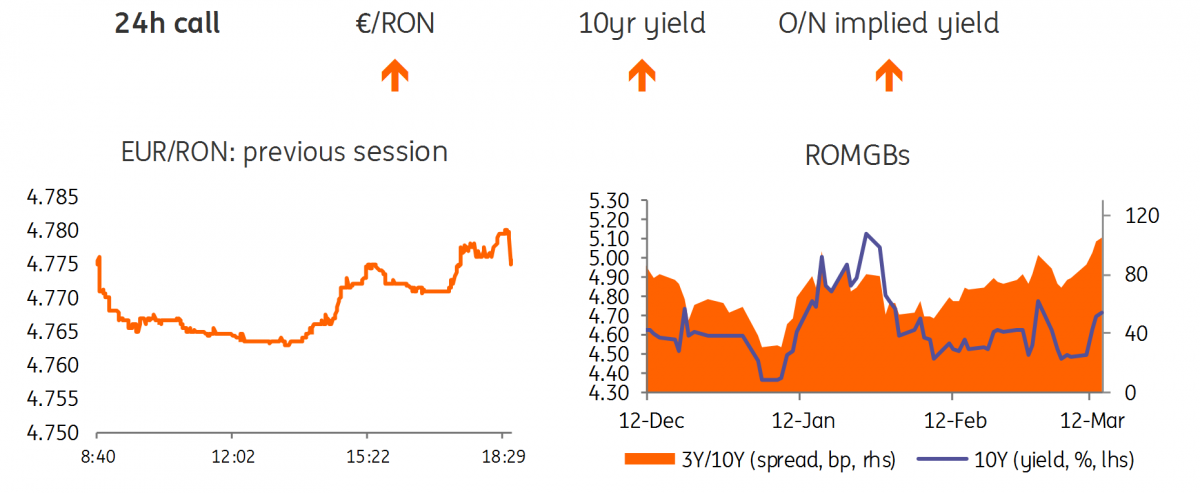

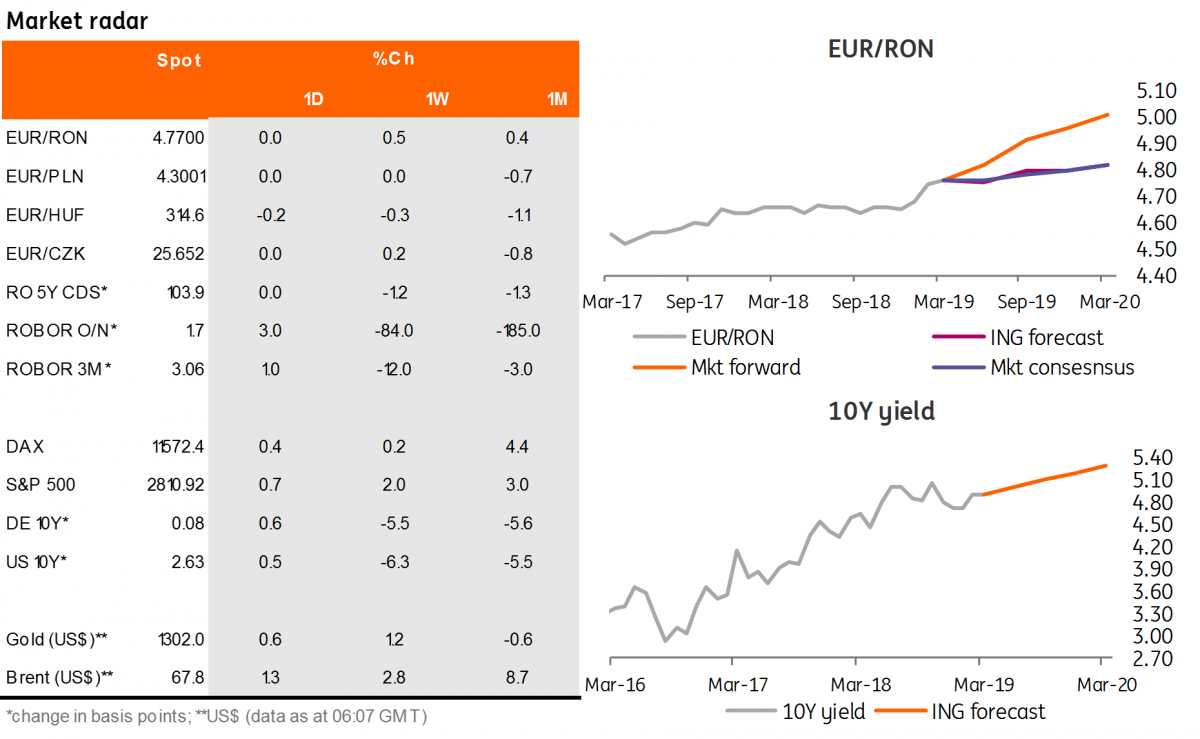

The EUR/RON had another test above 4.7700 yesterday, touching 4.7800 in the after-hours trading session. The historically high turnover is supporting the idea of official offers coming in to protect the Romanian leu. Unless these official offers curb the trend again, we see a 4.7650-4.7800 trading range for today, with an upside bias.

Government bonds

Selling interest dominated again yesterday in the Romanian government bond market. Somewhat negative data has been released (higher CPI, widening trade balance, etc) and the upside pressure on the EUR/RON raises questions about whether the liquidity backdrop will remain supportive.

S&P's decision on its outlook for Romania (expected this Friday) could also play a role. In this context, today’s RON300 million June-2024 auction seems to have come at the wrong time. Nevertheless, the target amount is not that impressive and we believe that some marginal yield concessions from the Ministry of Finance will do the job. Hence, we expect an average yield around the secondary market mid-levels of 4.40%.

Money Market

The upside move in the EUR/RON triggered paying interest along the FX swap curve, with implied yields shifting up to 40 basis points higher in the 1M-3M segment. Cash rates, on the other hand, remain below the deposit facility and we don’t see much potential for these to inch proportionally higher with the longer end. That is, unless yesterday’s EUR/RON turnover repeats for a couple of days.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap