Briefing Romania

Good 10-year auction

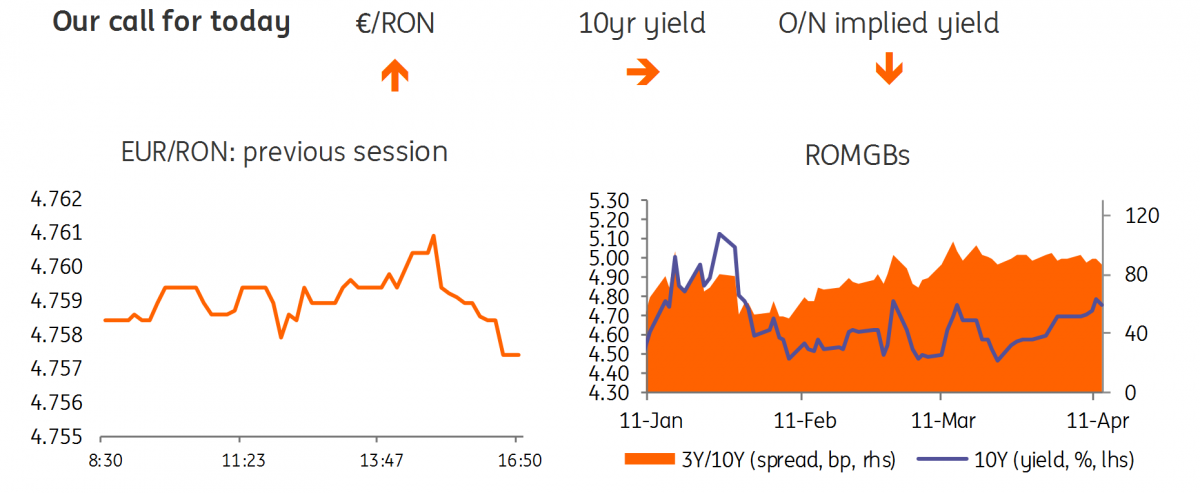

EUR/RON

The Romanian leu remained captive in a tight range around 4.7600 against the euro, on below average turnover. Today’s current account data – which we expect to be weak again - could animate the market a bit.

Government bonds

Romanian government bonds recovered some 1-2 basis points of the previous day’s losses. The RON400 million 1Y T-bills auction attracted total bids of only RON220 million, at an average yield of 3.44%. All bids have been rejected by the Ministry of Finance, presumably due to the low demand rather than the yield itself. On the other hand the RON300 million Feb-2029 auction came in a lot better, at least demand-wise. As anticipated, the 5.00% mark acted as a trigger for investors. Out of the total RON775 million bids, the Ministry of Finance allocated RON322 million at 4.98% average and 5.01% maximum yields. It's worth noting the average of all yields stood at 5.02%, hence quite well clustered demand.

Money Market

Cash came in a bit cheaper yesterday, closing around 3.30%. We could have a few calmer days for the tenors covering the current reserve period, for whatever trades on the next reserve seem to be priced above 4.00%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap