Briefing Romania

NBR revises its inflation forecast marginally higher

EUR/RON

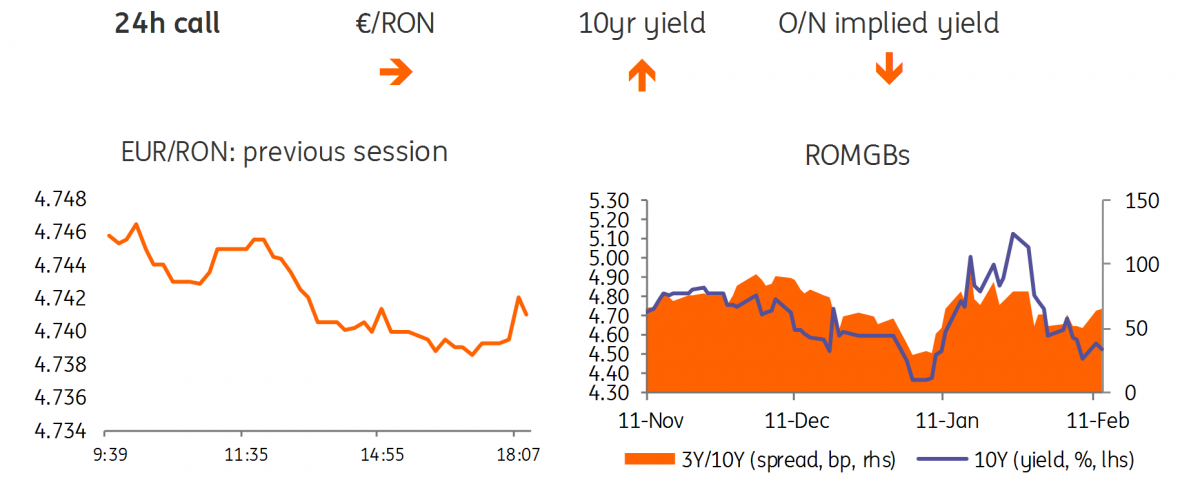

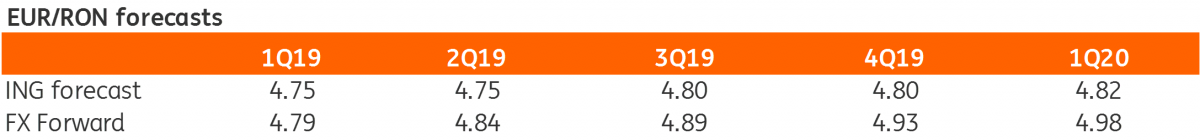

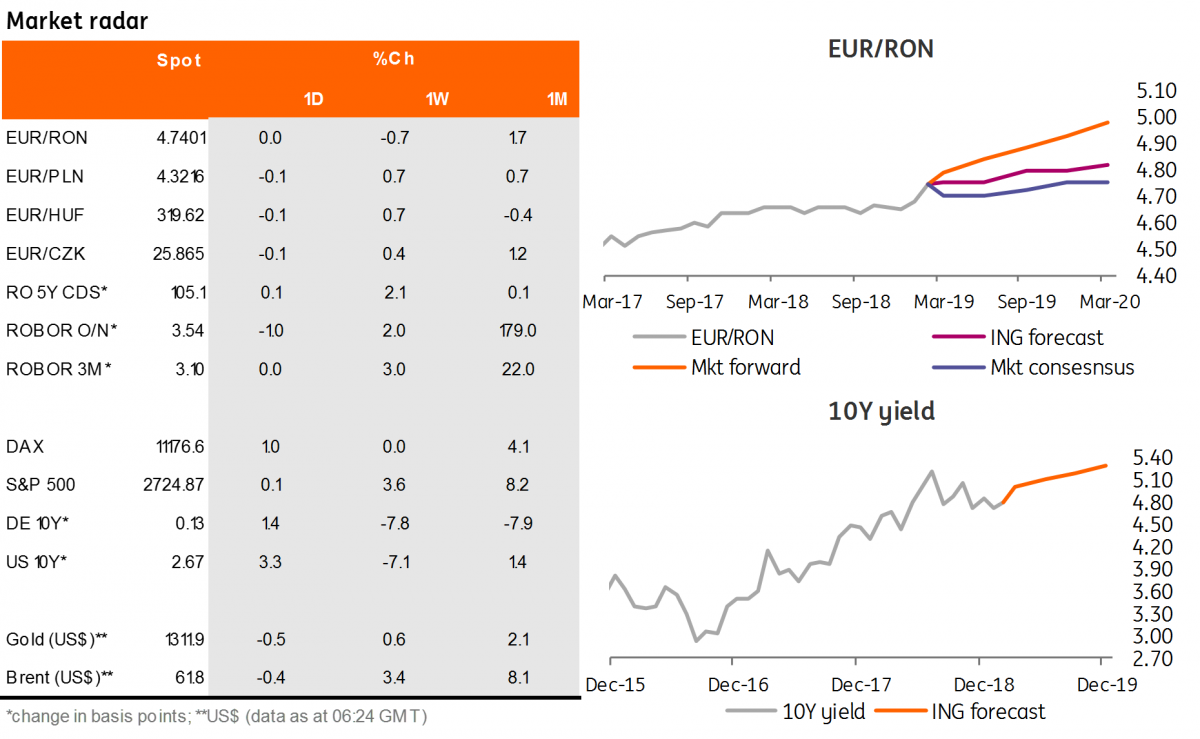

With no repo auction yesterday and cash rates still above the Lombard rate, the EUR/RON traded within a 4.7400- 4.7450 range on low turnover and closed just above 4.7400. In yesterday's presentation of the February 2019 inflation report, NBR Governor Mugur Isarescu mentioned the widening external deficits as a source of increased risk and concern. Absent any structural reforms, the correction can only come via a combination of FX depreciation and interest rate moves, which the central bank hopes to avoid.

Government bonds

Romanian government bonds didn’t seem to react to the marginal upward revision of the NBR’s inflation forecast. The central bank is now forecasting end-2019 inflation at 3.0% and 3.1% for end-2020. With core inflation seen at 3.3% by end-2019 and 3.4% by end-2020, it seems that the NBR is forecasting stable regulated prices in election years and continued excess demand.

The April-2026 auction came out positively overall at with a 1.69x bid-to-cover ratio. The Ministry of Finance upsized from the RON300 million target and allocated RON334 million at a 4.50% average and 4.54% maximum, slightly above our call.

Money Market

The downward trend in cash rates took a break yesterday, possibly as the market was expecting a repo from the central bank. Hence, we are still around 4.00% in the short dates. We expect the downward trend to resume today.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap