Briefing Romania

EUR/RON testing a new range

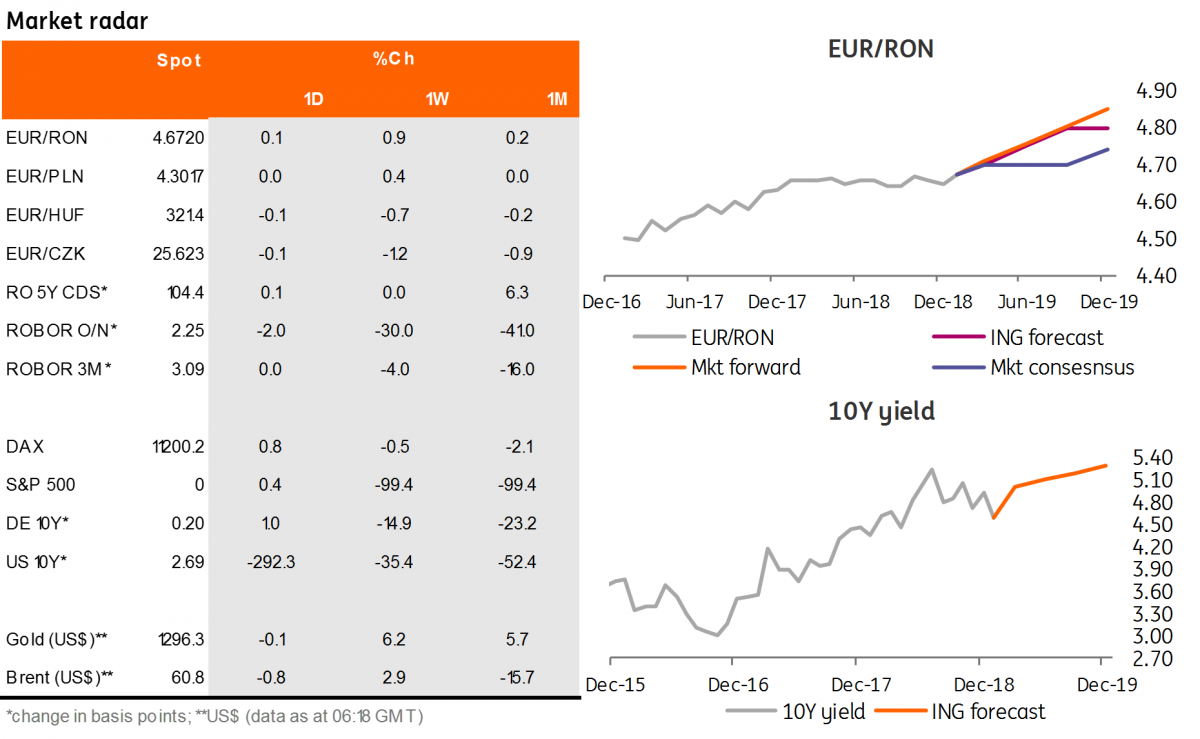

EUR/RON

A new historical high for the EUR/RON official fixing was marked yesterday, making front-page headlines in domestic media, though we are only talking about a 52 pips move. This pretty much reflects the still high FX impact on consumer expectations in Romania. The currency pair consolidated above 4.6700 on above-average turnover. Because this is mostly uncharted territory, we would expect the central bank to smooth volatility and maybe step in at some point to suggest the limits of its tolerance. Nevertheless, the upside pressure doesn’t seem to be that strong at the moment and could be partly carry driven.

Government bonds

Another day of steepening for the ROMGB curve, though at a slower pace than in the previous days, with a c.10 basis points drop in the short tenors and 2-3 basis point increase in longer ones. Today we will have the first serious test for the primary market this year, with an April 2026 auction for RON400 million. International investors could be the ones driving the auction, as local demand (banks and pension funds) is probably still assessing the impact of the bank tax and new capital requirements. We expect the issuance target to be filled around the 4.50% area.

Money Market

Cash rates continue to gradually shift lower towards the deposit facility and are now trading around 1.75%. The National Bank of Romania monthly bulletin has shown a surplus liquidity of c.RON1.9 billion for December 2018. January is usually not a month of impressive budget spending (actually a budget surplus is more traditional this month), though the current market rates suggest that some spending did occur most likely in the first days of 2019. Nevertheless, system liquidity could become more balanced towards the end of the month as the auction calendar progresses.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap