BriefING Romania

Key rate on hold, a dovish twist in language

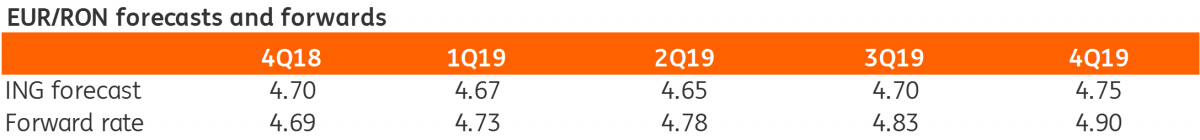

EUR/RON

The EUR/RON closed slightly higher yesterday, around 4.6630 on somewhat higher turnover. In a press briefing following the National Bank of Romania's board meeting, Governor Mugur Isărescu didn’t touch on the subject of FX directly but reading between the lines, the bank's sensitivity to FX movements remains high. We still believe that FX stability will be the main driver of interest rate decisions, particularly if depreciation pressure on the leu intensifies.

Government bonds

ROMGBs had another good day overall, as the curve closed the day 1-2bps lower, after correcting a bit as aggressive buyers following the NBR announcement got their orders filled. The overall dovish twist in the governor’s speech didn’t seem to impress the market too much though. In evaluating the monetary policy reaction so far, governor Isarescu struck a dovish note by saying that monetary policy this year “had to do more than it should have done”, reiterating the monetary policy “overburden” in the policy mix and suggesting less would need to be done in the future. The inflation forecast has been maintained close to the upper bound of the target band for the year-end, likely in an attempt to avoid de-anchoring inflation expectations. The 5Y auction for EUR-denominated domestic market bonds met with good demand at a 1.93x bid-to-cover ratio and an average yield of 0.96%, but the Ministry of Finance decided to reject all bids.

Money Market

Cash rates seem to have settled just above the key rate after Monday’s repo auction. Some interesting comments regarding banks' liquidity were made yesterday by Governor Isarescu. He mentioned that “the role of the central bank is to ensure money market liquidity” which can be done at the key rate but also at the Lombard rate, but he also stated that covering normal liquidity needs at the Lombard rate “would not be a good thing as the Lombard has some different functions”. He also suggested that the time for a cut in minimum reserve requirements for RON liabilities is likely approaching as the current liquidity deficit is “quasi-permanent”.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap