Briefing Romania

Strong Sep-2023 auction

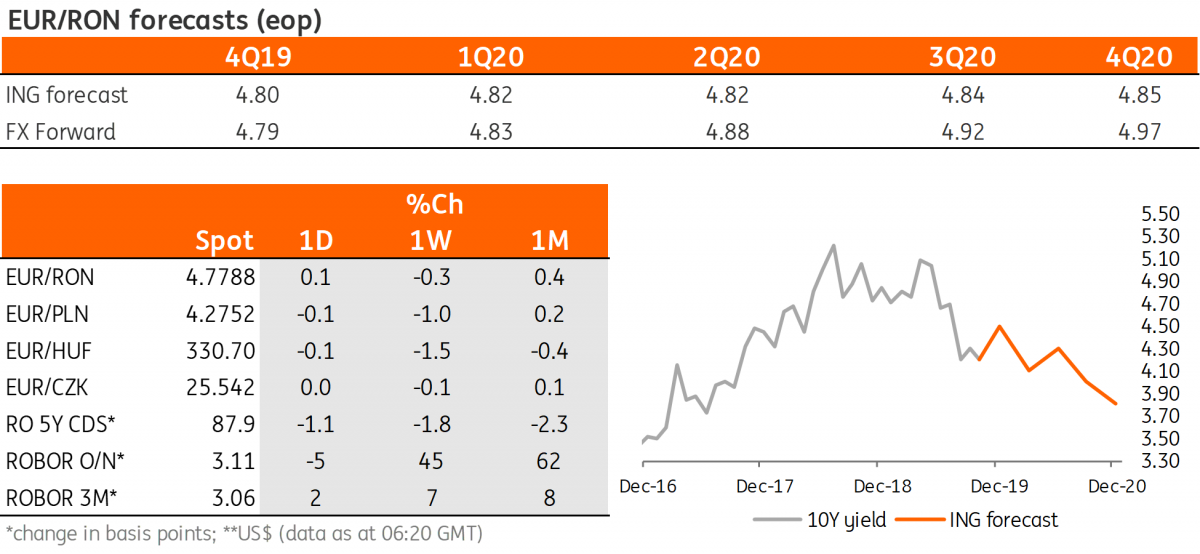

EUR/RON

Somewhat counterintuitively, the EUR/RON re-tested to the upside yesterday, trading close to 4.7800 once again. The relatively low turnover doesn’t suggest strong underlying pressure, hence we expect the same 4.7700-4.7800 range to hold today.

Government bonds

We didn’t get it quite right on yesterday’s primary auctions outcome. The 6M T-bills were rejected by the Ministry of Finance, probably as the total demand didn’t cross the targeted RON500 million. The Sep-2023 auction on the other hand came in remarkably successful demand-wise, with RON1.75 billion in total demand, for the RON500 million targeted. In the end, RON 1.16 billion has been allocated at 4.07% average and 4.09% maximum yields, slightly better than we had expected. Otherwise, the secondary market activity remained subdued.

Money market

The downside move in cash rates accelerated yesterday and short-term rates closed only marginally above 3.00%. The drop in funding matched a drop in the longer tenors as well, though to lesser extent. Overall, we maintain our call for a gradual but relatively slow improvement in liquidity conditions.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap