Briefing Romania

Romanian leu strengthened on bond inflows from international investors

EUR/RON

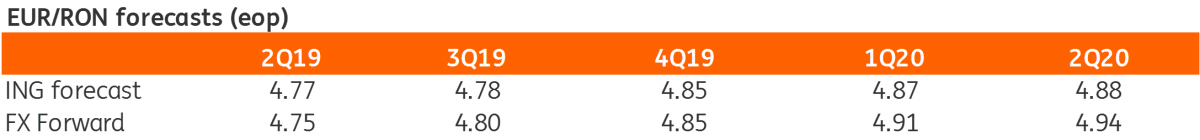

The EUR/RON broke the 4.7400 support level yesterday on heavy turnover likely on the back of strong demand for the 10Y local currency government bond auction, closing the day near 4.7300. For today, we could see some stabilisation, with medium-term risk remaining to the upside as non-debt flows are favouring a weaker RON. For today, we could see a 4.7300-4.7500 range.

Government bonds

The ROMGB yield curve bull flattened yesterday, catching up with regional markets. 2Y yields dropped a couple of basis points, while 10Y yields closed c.6 basis points lower after a very strong auction in the long-end. The Ministry of Finance’s Feb-2029 bond auction for RON0.5 billion bought impressive demand of RON2.1 billion with RON1.3 billion allocated at an average/maximum yield of 4.78%/4.79%. The 6M T-bills auction was rejected due to low demand of RON379 million vs RON400 million offered, despite average yields submitted at 3.19%, below the 6M ROBOR level.

The Ministry of Finance released the budget execution data for the first four months of the year. It posted the widest fiscal shortfall as a percentage of GDP since 2013, at -1.1%. Revenues are expanding robustly at 11.0% year over year in January-Aril 2019, but below the 16.1% plan for the full year. At the same time, expenditures surged by 15.9% in the first four months versus the same period of 2018, above the 14.4% budgeted increase for the whole year. This has failed to impress the bond market as the external risk-off mood prevails.

Finance Minister Eugen Teodorovici reaffirmed the commitment to the -2.76% budget deficit target, according to Bloomberg, which quoted him saying that the government will “amend its governing programme to bring it up to date with the latest developments in the market”. We view the current budget gap target as a soft one, with the -3.0% of GDP threshold being the line in the sand though even this might be hard to meet in a scenario of no policy change. We expect the 2019 budget deficit to stay within Maastricht limits, but overshooting is likely in 2020 if policy is unchanged.

Money market

Implied cash rates dropped c.25 basis points below the key rate level of 2.50% as the NBR, somewhat unexpectedly, did not announced a one week deposit sterilisation auction. Strengthening pressure for the RON likely had some influence on the NBR's decision, which was contrary to the latest Board decision of “tightening control over money market liquidity”. NBR Board member Daniel Daianu was quoted this morning by Bloomberg saying that the central bank “sticks by its money control vow despite the deposit pause” and it is “looking for new tools for liquidity control”. The implied forward curve steepened as the long end dropped to a lesser extent with 1Y implied yields inching c.10 basis points lower, near 3.9%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap