Briefing Romania

Liquidity squeeze already?

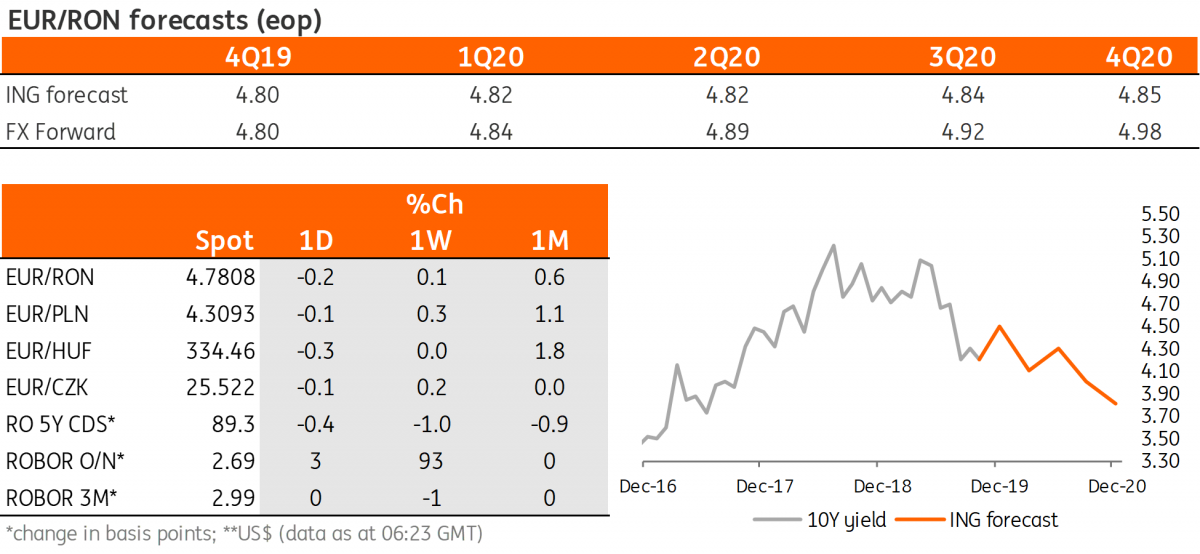

EUR/RON

The EUR/RON continued to trade intensively on Friday, with the turnover well above this year’s average. For most of the day the pair inched gradually lower from 4.7900 to 4.7800, but the end-of-day brought it higher again, closing around 4.7850. With carry spiking above the Lombard rate of 3.50%, we should see diminished depreciation pressure on the RON and look for a stabilisation within a 4.7800-4.7900 trading range.

Government bonds

The new higher-yield environment revitalised some buyers of ROMGBs. Though nothing spectacular yet, Friday’s trading session saw some mixed interest rather than the predominant selling pattern we’ve been seeing recently. Today we are going to have two primary market auctions, for RON500 million in Aug-2022 and RON300 million in Oct-2034. We expect good demand for the former, though yields are likely to come in on the high side of the secondary market bid level of 3.75-3.80%. For the latter, we expect limited interest and the question here will be if the accepted yield goes above 5.00% or not.

Money market

In line with our view, money market implied yields spiked on Friday. The cash rates have been trading above the 3.50% Lombard rate, with most of the curve up to 1Y adjusting higher. 1M to 3M rates are now trading above Lombard. We believe that tension will persists for the days to come as Ministry of Finance spending will take some time to filter through the market. It goes without saying that we expect limited-to-no demand for today’s NBR deposit taking auction.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap