Brexit unknowns mean important UK budget decisions left until later

UK Chancellor Philip Hammond has confirmed that austerity will 'end', but the difficult choices on how this will be funded will be left until after Brexit. For now, the Chancellor is in 'wait-and-see' mode as uncertainty surrounding 'no deal' builds

With five months to go until the UK formally leaves the EU, the bottom line of today's budget is that a lot hinges on how Brexit negotiations pan out between now and then.

Perhaps unsurprisingly, most of the spending measures in Chancellor Hammond's budget were well-flagged in advance. As had been announced over the summer, the centrepiece of the government's spending plan is to increase funding for the National Health Service (NHS) over the next few years.

But in a welcome piece of news for the Treasury, the Office for Budget Responsibility (OBR) - the government's independent forecaster - has gifted the Chancellor with a significant revision to tax revenue forecasts, as well as a small upgrade to GDP growth next year to 1.6%. These are expected to fully-fund both the NHS and other minor pledges contained in the latest budget.

The Chancellor confirmed he could implement an emergency budget in the spring if needed and we also suspect this would also be quickly followed with a Bank of England rate cut/additional QE

But the bigger challenge for Hammond comes from his government's other major pledge: to bring austerity to an end. While the Chancellor announced that this would amount to an overall real spending increase of 1.2%, the key question of how this will be funded - while sticking to the government's fiscal targets - has largely been left until next year. It is widely believed that the government will need to look at tax rises to help square the funding circle, and there were some subtle hints at this in today's budget with the announcement of new taxes on tech firms. But given the government's thin majority in Parliament, there is limited appetite for substantial tax rises at this point.

Of course, Brexit is the Treasury's other major conundrum, and the Chancellor has opted to leave some headroom in the pot for a disruptive 'no deal' scenario. If this were to happen, there would likely be significant disruption to supply chains, and it's likely that the resulting confidence shock would see growth slow sharply. Hammond confirmed that he could implement an emergency budget in the spring if needed to provide offsetting support, and we also suspect this would also be quickly followed with a Bank of England rate cut/additional QE.

Uncertainty surrounding future trade is likely to persist well beyond March next year, keeping a lid on overall UK growth in the medium-term

If an agreement is reached with the EU, and subsequently approved by Parliament - which remains our base case - then Hammond is banking on a "deal dividend" of higher growth to provide some of his much-needed funding to end austerity.

In our opinion though, this boost may be relatively limited. True, taking the disruptive 'no deal' tail risk off the table may help unlock some hiring and investment decisions. However, the focus is likely to quickly turn to the length of the transition period, which at 21-months, is unlikely to be long enough to either negotiate a trading relationship in full or give businesses the time to adjust. In effect, this means that uncertainty surrounding future trade is likely to persist well beyond March next year, keeping a lid on overall UK growth in the medium-term.

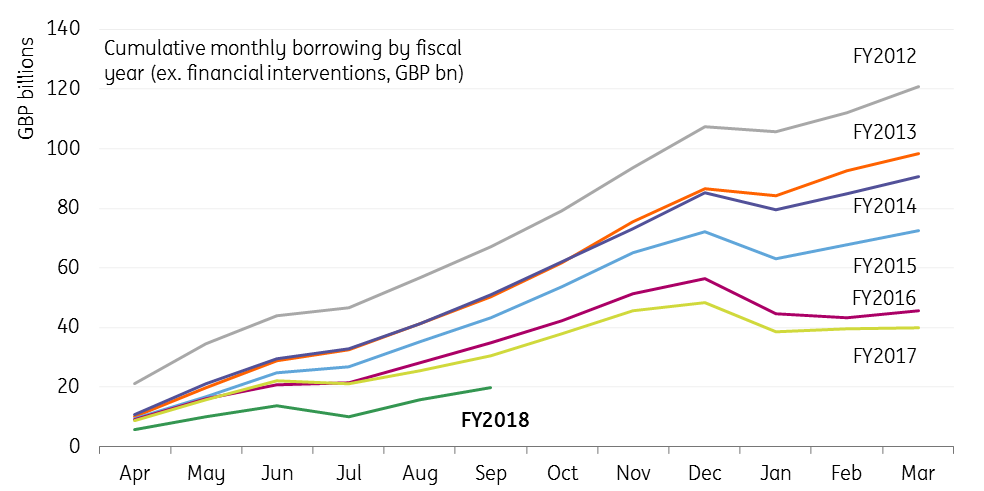

The Treasury's budget numbers have been better than hoped this year

One major near-term political headwind taken off the table

Away from the nitty-gritty economics of the budget, one political question mark that had been lingering over recent weeks was whether or not the Northern Irish Democratic Unionist Party (DUP) would vote against the budget later this week, in protest at the recent direction of the government in Brexit negotiations. If the Prime Minister were to lose that vote, it could, in theory, raise serious questions about her future as the leader.

However in the moments after the Chancellor's announcement, the DUP announced that the budget "delivered for Northern Ireland", signalling that the PM may have avoided one tricky political roadblock in the House of Commons.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap