Bank Pulse: Bank lending rates set to rise this year

Bank lending rates are bottoming out, and there is more than anticipated monetary policy changes pointing to increasing lending rates

While the European Central Bank is taking its time phasing out asset purchases, and is not expected to start raising rates until next year, market rates have been inching up. The 10-year Bund and swap rates ended 2021 some 50bp higher. As a result, the eurozone is likely very close to the absolute bottom in interest rates charged by banks too. This is not yet visible in bank lending rates for businesses though. Average eurozone bank rates for businesses continued to fall in November (the latest month for which data is available) to 1.38%, 11bp lower than at the start of 2021. Yet the bottoming out of rates is more visible in rates charged to households.

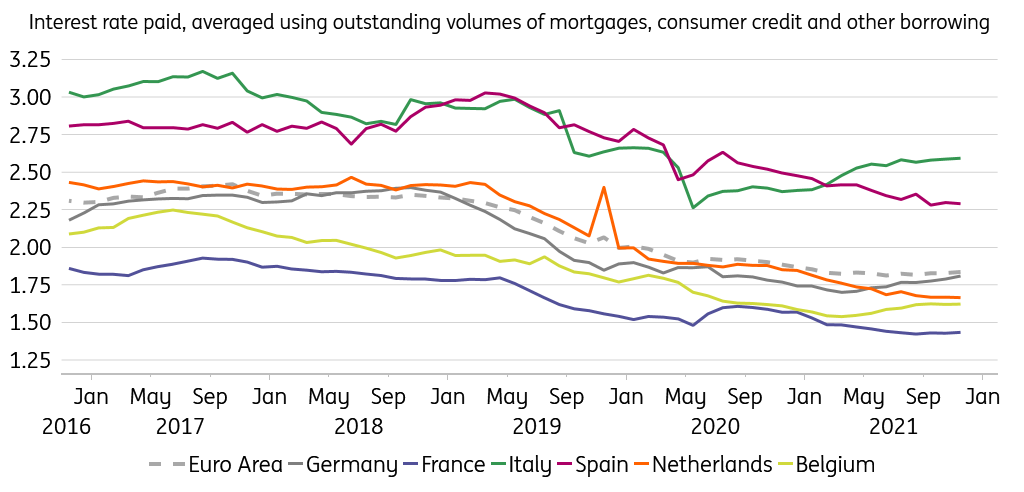

The average rate charged by eurozone banks to households reached an all-time low of 1.81% back in June last year, and it has been creeping up ever so slightly since. The November reading shows an average rate of 1.84%. True, it takes two decimals to even register this increase. But digging a bit deeper, it emerges that this small eurozone-wide upward drift is driven primarily by slightly more pronounced mortgage rate increases in Germany and Italy. Average German and Italian mortgage rates increased by 17bp and 19bp in 2021, respectively (see chart).

Average household borrowing rates (%)

Zooming in even more, in Germany, most of the mortgage rate increase was in the over 10-year segment. In Italy, rates increased most in the 5- to 10-year segment, but not (yet) in the popular over 10-year segment. The upward trend of Belgian bank rates was as much driven by mortgage rates as by a sustained upward drift of consumer credit rates, coming after a sharp drop in May 2020. Mortgage rates in the other major eurozone economies continued to fall in 2021, although they tended to stabilise towards the end of 2021. Bank rates on consumer credit and other types of credit, while volatile, tended to move sideways in 2021 (with the noted exception of Belgium).

Looking ahead, the announced slowing of ECB asset purchases and anticipation of ECB rate hikes next year are likely to work their way into upward pressure on rates charged by banks. But upward pressure is coming from another side too. Several national supervisors have announced increases in countercyclical buffers (CCyB), primarily to cool buoyant housing markets. German Bafin intends to set a 0.75% countercyclical buffer for all domestic exposures, and a 2.0% buffer specifically for real estate-covered assets by February 2023. The French High Council for Financial Stability (HCSF) and the Irish central bank stopped short of already increasing the CCyB, but they both indicated they expect to do so this year if the economic recovery continues as envisaged. Meanwhile, the Dutch central bank has launched a consultation on its intention to increase the CCyB to 2.0% through the cycle. Any countercyclical buffer increases would put upward pressure on bank rates, mortgage rates in particular. To be clear, this would be a feature of macroprudential policy, not a bug. And while countercyclical buffer increases typically don’t take effect immediately on announcement, banks can be expected to update their pricing quickly. After all, the CCyB applies to all outstanding loans, and not just on new production after the CCyB has taken effect.

While bank lending rates for business loans continued to fall in November, household mortgage rates appear to be past the bottom. Both eurozone-wide monetary policy and national macroprudential policies are likely to put increasing upward pressure on bank rates, for mortgages in particular.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap