Bank of Russia to catch up on 2018 FX purchases

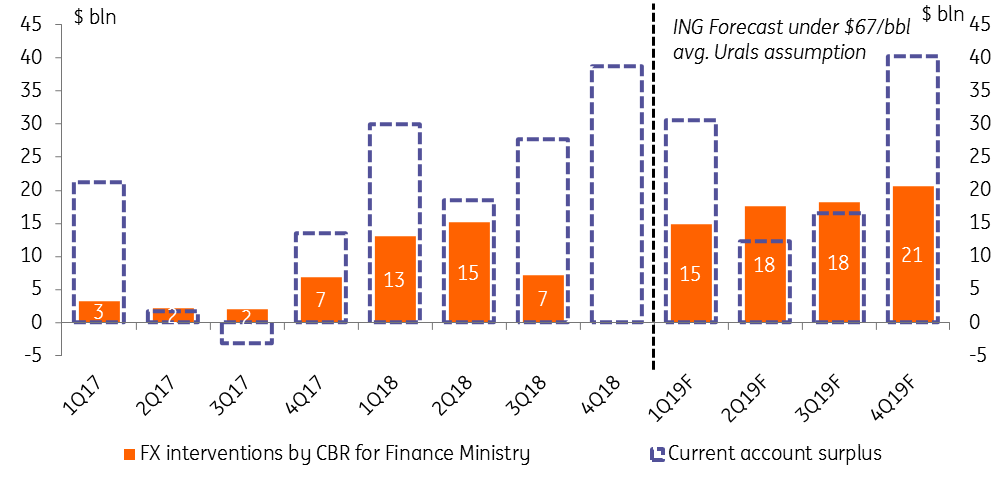

The Bank of Russia's decision to evenly spread $31 billion of delayed FX purchases over the next 36 months does not affect long-term FX forecasts, but highlights the vulnerability of the rouble to external negativity in 2Q and 3Q19, as FX interventions over that period will definitely exceed the respective current account surplus

Today, the Bank of Russia (CBR) indicated that over 36 months starting 1 February, in addition to the initially announced FX purchases, it will be buying RUB 2.8 billion (~$40-45 million) worth of FX daily. This decision has been made in order to catch up on the ~RUB 2.1 trillion (~$31 bln) FX purchases delayed from August-December 2018.

Though this news triggered an immediate negative reaction in the rouble exchange rate, this decision ultimately should not affect long-term RUB expectations as:

- It had been clearly communicated to the market at the moment of FX purchase suspensions that the delayed FX purchases were bound to be caught up at some point in time.

- Historical experience suggests that the budget-rule based FX interventions in Russia reduce the amount of FX available to finance the accumulation of foreign assets by the private sector - therefore reducing private capital outflow.

Therefore, under ING's house view, assuming $67/bbl average Urals price, today's CBR decision boosts the amount of annual FX interventions by $11 billion to $71 billion, which is ~70% of the expected current account surplus. Our expectations of $30 billion net private capital outflow may appear too pessimistic.

At the same time, the decision to evenly spread the interventions - though positive in terms of predictability and transparency of the CBR FX operations - may result in higher volatility of the rouble exchange rate in mid-year, when the current account surplus is seasonally weak. According to our base case oil scenario, the increased FX interventions should now total $18 billion in 2Q19 and 3Q19 each, exceeding the expected current account surplus of $12 billion and $17 billion, respectively. Under the alternative scenario of an unchanged current oil price, there will be $14 billion of quarterly FX interventions vs. a current account surplus of $5 billion and $8 billion.

As a result, we see a higher risk of rouble depreciation in 2Q-3Q19 in the RUB65-70/USD range before returning to our year-end target of RUB65/USD, which we keep unchanged. From a CBR policy perspective, we welcome the decision to disregard the Balance of Payments seasonality as it combats the market misconception that the Central Bank might still be in an indirect FX targeting mode.

Current account surplus vs. FX interventions (base case scenario)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap