Bank of Canada sticks with looser for longer

The Bank of Canada left monetary policy unchanged and repeated its forward guidance suggesting little prospect of a rate hike before 2023. With Canada already offering a substantial C$100bn fiscal stimulus to offset the second Covid wave, it points to relative outperformance versus the US where we are waiting for a break-through on support

BoC leaves policy mix unchanged

It was always a long-shot to expect changes at today’s Bank of Canada policy meeting so it comes as no surprise they decided to leave their stance unchanged. After all, it was only in October they announced a “recalibrated” quantitive easing programme through shifting asset purchases towards the longer end of the yield curve while lowering the weekly purchases from “at least C$5bn” to “at least” C$4bn.

Back then they also provided forward guidance saying the policy rate will stay at the effective lower bound (0.25%) until the 2% inflation target is “sustainably achieved”, which in their forecasts won’t happen until 2023. All of these viewpoints and policy actions were restated in today’s announcement.

The argument for the October change was household and corporate borrowing costs tend to be more influenced by longer-term government borrowing costs, so by focusing spending there they could flattening the yield curve, giving them more bang for their buck. They reduce their weekly asset purchases without any tightening of monetary conditions – in their view.

The second wave poses real risks

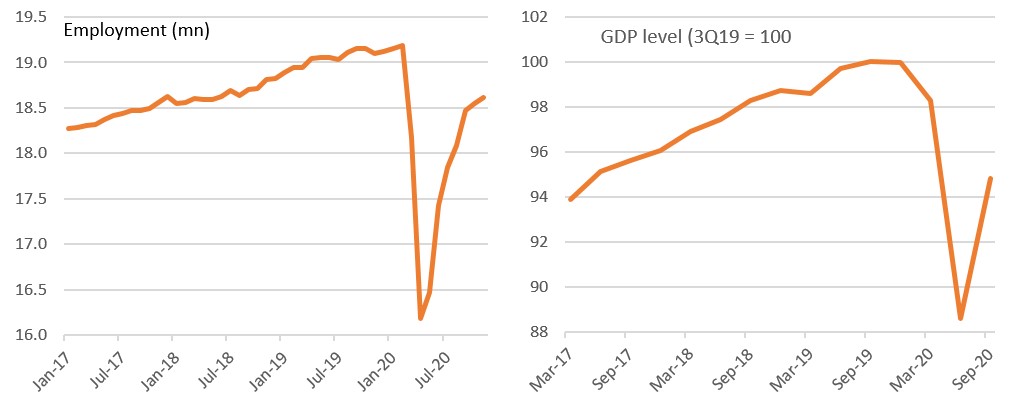

In terms of the economic outlook, while there is the prospect of a vaccination programme, the near-term news surrounding Covid-19 is deteriorating as cases and hospitalisations jump. Restrictions are coming in and that is already starting to weigh on sentiment and activity with the improvements in employment showing signs of losing momentum.

The BoC warned that “new waves of infections are expected to set back recoveries in many parts of the world” while in Canada specifically they suggested the situation will “weigh on growth in the first quarter of 2021 and contribute to a choppy trajectory until a vaccine is widely available”.

Canada jobs and GDP levels

Fiscal support gives Canada an edge

So as with the US Federal Reserve, the Bank of Canada continues to emphasise monetary policy will remain ultra-accommodative for a substantial period of time to help ensure the recovery gains real traction.

However, whereas in the US we are still waiting for signs of a break-through on a fiscal package, the BoC can acknowledge that “The federal government’s recently announced measures should help maintain business and household incomes during this second wave of the pandemic and support the recovery”.

Given this early and aggressive action totaling C$100bn (a little under 4% of GDP) from the Canadian government, it raises the prospect of relative economic outperformance versus the US over the next several months.

FX: BoC stance won't tamper with CAD's appreciation

Many positive factors have been falling in the right place for CAD over the past few weeks.

- Risk sentiment has remained upbeat thanks to vaccine advancements and lately fresh US stimulus hopes, helping the pro-cyclical CAD and further assisting the USD decline.

- Oil prices have recovered significantly in November and managed to “survive” the OPEC+ meeting risk event.

- Domestically, the Canadian jobs market continues to outpace the US one in the recovery, partly thanks to a less concerning contagion picture in Canada.

Today, we received confirmation that the Bank of Canada will not step in the way of further CAD appreciation as the improving financial and economic conditions leaves no need for extra monetary stimulus in the foreseeable future.

The lack of further stimulus by the BoC should allow CAD to retain a relatively attractive carry profile in G10 in 2021, which is one of the factors that can assist an extension of the USD/CAD downward trend. We target 1.25 for 2Q21 and 1.23 for 4Q21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap