Australian inflation rises sharply

Australia joins the ranks of countries experiencing a surge in inflation, though the 3.5%YoY inflation rate for 4Q21 remains well down on US and European peers, and until we see the wage price index figures for 4Q21, the outlook for policy rates is not sealed

| 3.5%YoY |

Australian CPI inflation4Q21 |

| Higher than expected | |

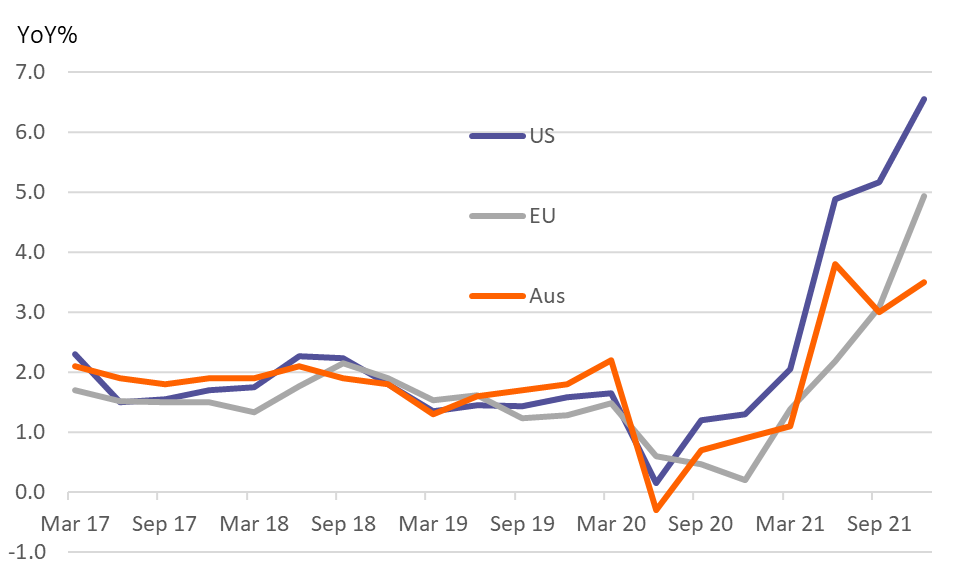

Australian inflation compared to EU and US (Quarterly YoY%)

It's up, but its lower than peers

The 1.3% QoQ increase in Australia's CPI index in 4Q21 lifted the inflation rate to 3.5%YoY, more than the slight increase to 3.2% that the consensus had been anticipating.

But even at 3.5%, Australia's inflation rate remains considerably lower than its US or European peers. And consequently, the aggressive rate hikes that are being priced in for the US, and even market talk about ECB hikes is not so obvious for Australia, despite the market's aggressive expectations for the cash rate.

As well as the headline increase, the trimmed mean inflation rate also rose in the fourth quarter, reaching 2.6%YoY from 2.1% in 3Q21, and the weighted median inflation rate was also higher at 2.7% from 2.2% previously. That said, factors such as energy price spikes still seem to be doing quite a lot of the heavy-lifting for inflation right now, with the transport component topping the list of contributions to the QoQ increase. The increase in contribution to quarterly inflation from service components such as recreation needs to be watched, however.

QoQ inflation by subcomponent (%)

What next for the RBA?

Three-month Australian bank bill futures have an implied yield of about 1.3% - that contrasts with the current overnight cash rate of about 0.05% and cash rate target of 0.1%. So making some allowance for the development of a 3m term premium, markets seem to be expecting upwards of 4 hikes from the Reserve Bank of Australia (RBA) this year.

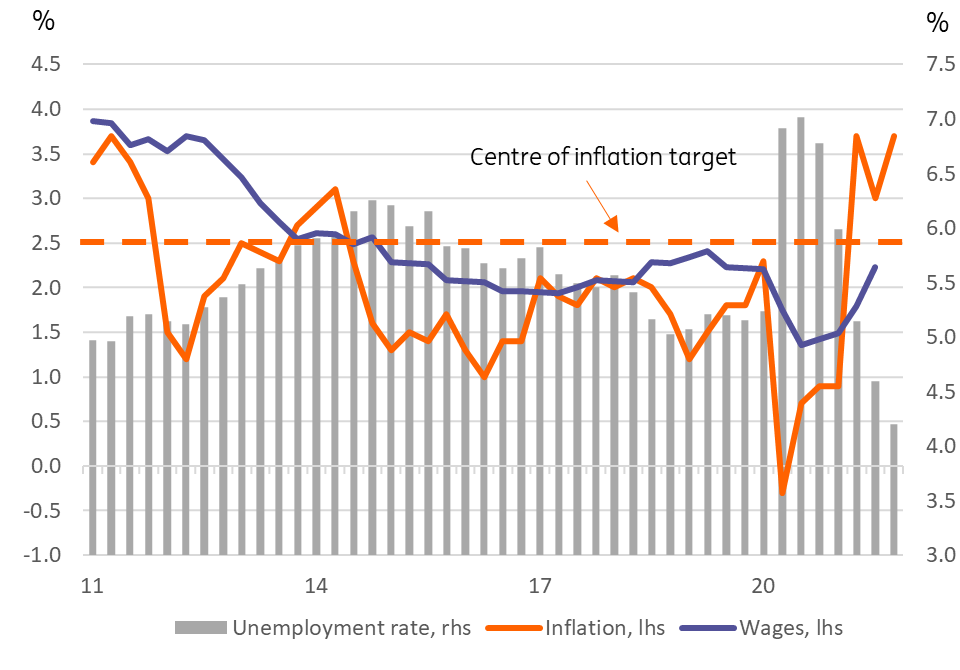

But such strong rate hike expectations remain in sharp contrast to the guidance still being given by the RBA. Although this has been successively toned down from its earlier insistence of "nothing until 2024", the language remains very dovish, with the last statement accompanying the 7-December no change decision noting that for rates to be changed "the labour market (would need) to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time and the Board is prepared to be patient."

Since that statement, we have seen the Australian unemployment rate drop sharply to 4.2%, which ticks one of the required boxes for the RBA to change its mind. Another is the action of other central banks. And with the US FOMC beginning its 2-day meeting today ahead of a likely decision to immediately cease its QE activities and signal a March rate hike, that would seem to tick another box.

Another concern for the RBA is how the Australian government bond market is functioning. 2Y Australian government bond yields are up about 30bp since the end of last year at about 90bp, and 10Y government bonds have also risen about 30bp to around 1.95% now. That's similar, though a bit more than we have seen in the comparable US Treasury bonds.

About the only remaining thing stopping the RBA from taking a more active policy approach to current economic conditions is wages. The 4Q21 wage price index is released on 23 February. That's long after the 1 February RBA meeting and probably won't feature much in the decision making at that meeting though could be a pivotal feature for subsequent meetings.

Consequently, what we anticipate happening is for the RBA to set an end date for its asset purchasing at the February meeting - though it may not cease purchases immediately. However, we anticipate that they will not radically alter their guidance on rates, leaving this dependent on the development of higher wage inflation. That sets us up for a shift in policy guidance at the subsequent meeting on 1 March if the wage-price inflation rate noticeable picks up. A level of 3.5% wages growth would probably be enough to precipitate some imminent policy action, while increases below that pace may still enable the RBA to remain on hold, though with far less of a dovish tilt.

Inflation, unemployment and wages growth (YoY%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap