Australia: Softer inflation hints at pause in rates

The Reserve Bank of Australia's (RBA) recent hint that rates were close to a peak and that a pause may soon be appropriate got a further boost from the February inflation report, which showed a steeper slowdown than expected

| 6.7 |

February CPI inflationYoY% |

| Lower than expected | |

A pause, and maybe even the peak in rates

At 6.7% YoY, Australian inflation for February was much lower than most forecasters had expected (consensus 7.2%, ING f 6.9%). And hard on the heels of the latest policy statement and meeting minutes, which indicated that the RBA was looking for an excuse to pause its tightening, this looks like all the needed excuse. Indeed, if the numbers continue to come in on the softer side, it may turn out that the last rate hike, which took the cash rate to 3.6%, will prove to have been the peak in this cycle.

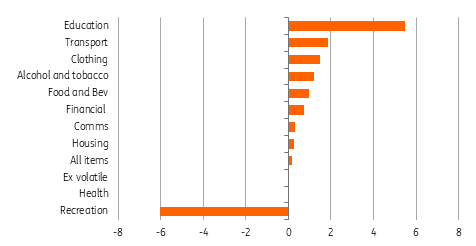

Month-on-month changes in CPI components

Holiday spike unwinding

Looking at the breakdown of the numbers, it is clear that much of the weakness in the February numbers owed to a further unwinding of the December holiday price spike that took inflation briefly up to 8.4%. There was a strong rise in the education subcomponent of more than 5%, and motor fuel increases also lifted the transport component. Clothing, alcohol and tobacco and food and beverages also all rose by more than 1% from the previous month suggesting that price pressures have not disappeared.

At the other end of the spectrum, housing rose at only a 0.25%MoM pace as house purchase prices slowed, offsetting rents which remain strong. And the index excluding volatile items was flat on the month.

We can't rely on much more unwinding of the holiday and recreation component in the months ahead, but base effects will kick in much harder in March, meaning that even with a relatively robust month-on-month increase, we should see the inflation rate drop to the low 6s, and possibly even into the 5's if the month-on-month numbers soften. This will make the RBA's assessment that inflation will not return to the 2-3% target range until 2025 appear even less convincing.

Market reaction muted - already priced in

Bank bill futures were already pricing in some chance of easing by the end of this year before this latest inflation release was announced, and implied rates are actually slightly higher now for the end of 2023 and end-2024 than they were before the numbers were printed - possibly a case of "buy the rumour, sell the fact". 2Y government bond yields, in contrast, dropped slightly after the release as you would expect, and the AUD dropped below 67 cents to the USD and has so far stayed below that level.

We still have one more rate hike pencilled in for the second quarter of this year. This is looking much less likely now, though given the volatility of the data, we'd like just a bit more confirmation before we strip it out, and are mindful that a pause need not mean the peak. Still, it usually does.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap