Australia: Employment surges

After the Reserve Bank of Australia's (RBA) recent statement hinting that peak cash rates might be just one hike away, today's labour data is a timely reminder to be very wary of such forward guidance

| 74,900 |

Full-time employment gainsUnemployment rate falls to 3.5% |

| Better than expected | |

Just one more rate hike? Seems unlikely

With a total employment gain in February of 64,600, driven by a very solid 74,900 rise in full-time employment, and the unemployment rate falling to 3.5% from 3.7% (and only just above its record low of 3.4% in October last year), any suggestion that the peak cash rate is just one hike away sounds difficult to accept today.

Yet that was the hint that the March meeting statement conveyed as it noted, "The Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target" a downward revision from its previous comment in February that "...further increases in interest rates will be needed over the months ahead..." with the strong emphasis on the word "increases" suggesting more than one hike back in February.

"The Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target"

Now it could just be that financial market participants overanalyse statements like this, and read far too much into these tiny changes. We wouldn't rule it out. But you can be sure that there is a very thorough scrutiny of such material before it goes out, and that even such minute changes to statements like this will be debated fiercely before they are released to the public. The comment itself was somewhat surprising, given that at their February meeting, the RBA launched the notion that they expected inflation to fall back within their target range only "...by mid-2025", which is hardly a dovish message. So the March statement was already quite a big overhaul from February.

Another possibility is that the RBA aims to achieve a soft landing with a "not too high, but for longer" policy. This is theoretically possible. But it would be a very confusing message to seek to deliberately convey, and we don't consider it very likely. Transparency and clarity is almost always the preferred route for central banks.

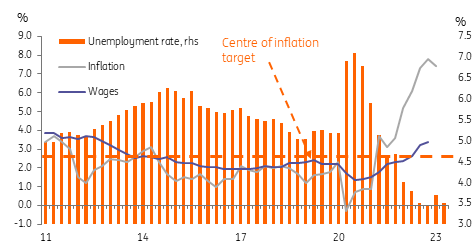

Australian labour data and inflation

Could the minutes shed more light? Probably not

We regularly draw our readers' attention to events like the release of RBA meeting minutes - of which the March edition is due next week. And over the years, we have frequently written that they should be read carefully for further clues about the RBA's intentions. The reality, however, is that there are almost never any smoking guns in these publications. So read them by all means, but don't get your hopes up that all will become clear next week.

One further possibility exists, which is that the RBA has sincerely meant all of its recent hints but has itself been bamboozled by the gyrations in Australia's domestic data, and now too, what is happening in global financial markets. In which case, whatever they wrote earlier this month, probably needs to be put in a "pre-Silicon Vally Bank" context, and treated accordingly. In short, forward guidance, unless linked with perfect foresight (which it never is), is no substitute for months of hard macro evidence.

We retain our peak cash rate call of 4.1% (cash rates currently 3.6%).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap