Australia: Inflation rise means more rate hikes for the Reserve Bank of Australia

Much of the recent inflation disappointment can be put down to one-offs, weather-related and other seasonal effects. But that still leaves inflation higher, and likely to come down slower than otherwise, suggesting that the Reserve Bank of Australia's (RBA) policy of a 25bp increase in the cash rate each meeting has longer to run before its peak

| 8.4% |

December inflationYoY% |

| Higher than expected | |

Holiday in the sun

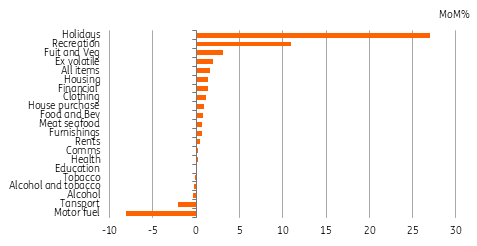

The chart below shows that most of the damage to inflation this month was done from one source, holidays (a subcomponent of the recreation series), and with December being peak holiday time in Australia and overseas visitors making the journey to see family and friends after, in many cases, long waits, it is perhaps not completely surprising to see some price pressure here. In December 2021, holiday prices rose 10.8% from the previous month. In December 2022, they rose a staggering 27% MoM, which is almost double the highest monthly increase in recent history.

Last month, food prices were the big shock to the data, driven higher by poor weather and flooding. The December weather wasn't particularly good either, and food prices, especially fresh fruit and vegetables, were up another 3% from the previous month, though the impact of the food and beverage component was offset this month by some declines in alcohol and tobacco prices.

Clothing bounced back after a big drop in November, and confusingly, housing also delivered a strong lift to the overall index with house-purchase, rents and furnishings all delivering sizeable increases from the previous month.

The quarterly index with which most people are more familiar, showed inflation rising from 7.3%YoY in 3Q22 to 7.8% in 4Q22. Trimmed mean inflation rose from 6.1%YoY to 6.9% over the same period, while the median weighted index inflation measure rose to 5.8% from 5.0%.

Australian inflation month-on-month % by component

More work for the RBA to do

We had already been looking at our cash rate forecast with a view to revising it higher, and this latest data leaves us no option but to increase it. The RBA is hiking the cash rate by 25bp a meeting, and we do not believe this will change. But while we had harboured hopes that base effects would start to quickly bring down inflation, enabling the RBA to stop hiking once rates reached 3.6%, which they would have done by the March meeting, we now believe they will have to keep hiking for at least another 2 meetings, taking the peak cash rate up another 50bp to 4.1%.

The increase in inflation and its implications for policy rates has taken 10Y Australian government bond yields sharply higher. The 10Y yield is up about 13bp from its intra-day lows, and may not have stopped rising yet.

As we note in our introduction, a lot of what we are seeing is still one-offs and seasonal shocks, and we do think that in a few months, those shocks could quickly start to drop out of inflation again. As a result, we still eye lower bond yields as the easier direction of travel now that they have risen on this inflation news. The main risk to this view is that we may not yet have seen an end to the one-offs and seasonal shocks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap