Asia’s PMIs paint grim picture for manufacturing

Asian PMI indices mostly didn't follow in the direction of yesterday's official Chinese numbers and some highlight the economic cost of lockdowns in saving lives

Numbers generally fell, some more than others.

Asia's PMI indices were generally lower and moved further into contraction territory. Though there were some outliers and some notable exceptions to this generalization.

Seven Markit PMIs and Caixin for China

As we noted in our note on the official China figures yesterday, purchasing manager indices (PMIs) are comparative statistics, though they are often incorrectly viewed as outright measures of activity, as they do often correlate well with other measures such as GDP or industrial production.

In other words, if the PMI rises, it means that more firms view conditions as better (or the same) than the previous month. If the previous month was already terrible, then this may still leave conditions in an awful state, even if 100% of firms believe things are no longer getting worse. The fixation with the 50-level as indicative of contraction or expansion is a bit misleading in this respect. In normal times, when indices tend to hover a bit above or a bit below the 50-mark, then this isn't a bad approximation to reality. But in the current environment, we need to be a bit more careful about how we interpret these numbers.

In the following block, we outline the main conclusions for the reporting countries. Note especially the conclusion for China.

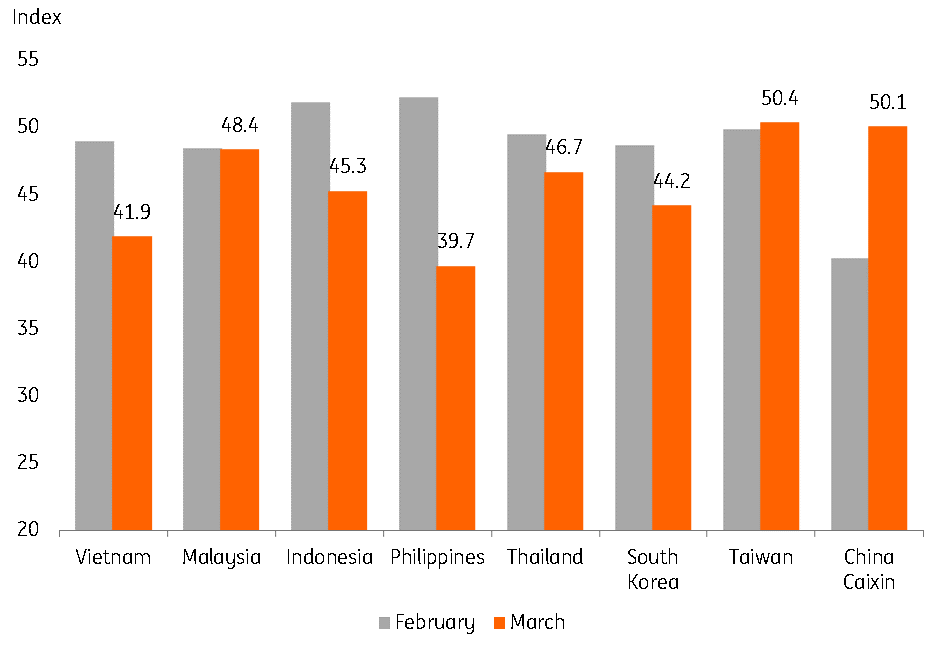

PMIs - March vs Feb

Country details

- South Korea: 44.2 is worse than any reading during the tech slump or trade war and suggests that recent figures for Korea paint too rosy a picture of manufacturing strength.

- Thailand: 46.7 is an all-time low and its third straight reading below 50. This suggests a GDP contraction in the first quarter of the year (was 0.2%QoQ in 4Q19).

- Philippines: The Philippines saw the most severe pullback in activity with both output and new orders stalling and with the index posting its lowest level ever (39.7). The enhanced community quarantine implemented in mid-March may be one of the main culprits for the stark drop-off with curfews in place and businesses shutdown with citizens asked to shelter in place.

- Indonesia: Big drop to 45.3 indicates sharp slowdown even before full lockdown implemented. Could imply further slowdown ahead.

- Malaysia: Still below 50, but steady. Recent restrictions on movement not yet impacting the numbers. Not a great predictor of economic strength though.

- Vietnam: 41.9 is another all-time low. And shows that even though China may be returning to work, it is not business as usual for the countries in China's supply chains.

- Taiwan: The sole exception posting an above-50 reading (50.4 up from 49.9) and increase in the index, which may attest to recent moves to repatriate productive capacity from Mainland China

- China: bounce back to 50.1 indicates that firms see things as almost exactly as bad as in February, just fractionally better. This is not a V-shaped recovery!

Asian PMI time series

What next?

Today's readings, plus those for Singapore and India that follow shortly, are likely to confirm a grim picture for the manufacturing sectors of Asia's economies, with the possible exception of Taiwan, as they head into the second quarter.

In our view, though we may see bouncing PMI indices (as in China), as "bad" conditions "normalize", the prospect for most economies' manufacturing sectors as they head into 2Q20 is for even more weakness, exacerbated where lockdown measures are newly enacted or tightened.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap