April delivers the first marked drop in Hungarian inflation

We have seen the first decisive retreat in headline inflation in Hungary, mostly on the back of base effects, while the structure has improved as well. Given that market stability remains intact, we see the door open for cuts in the effective rate in May

| 24% |

Headline inflation (YoY)ING estimate 24% / Previous 25.2% |

| As expected | |

Both headline and core inflation has dipped below 25%

As expected, April’s inflation release finally showed a marked deceleration in consumer prices as base effects started to kick in. Matching our forecast, headline inflation moderated to 24% year-on-year (YoY), which is 1.2ppt lower than March’s figure. Despite the first signs of a marked disinflationary process, the battle against inflation is not over. The monthly pace of price growth, while slowing, is still stubbornly elevated at 0.7%, which shows that price impulses have not entirely dissipated.

After an upward surprise last month, core inflation retreated to 24.8%, which implies that the structure of underlying price pressures has improved as well. The downward surprise in core inflation comes from services, where prices have not increased by as much as we had expected. While this is good news for inflation dynamics, we can identify a few risk factors which point toward rising services prices in the coming months.

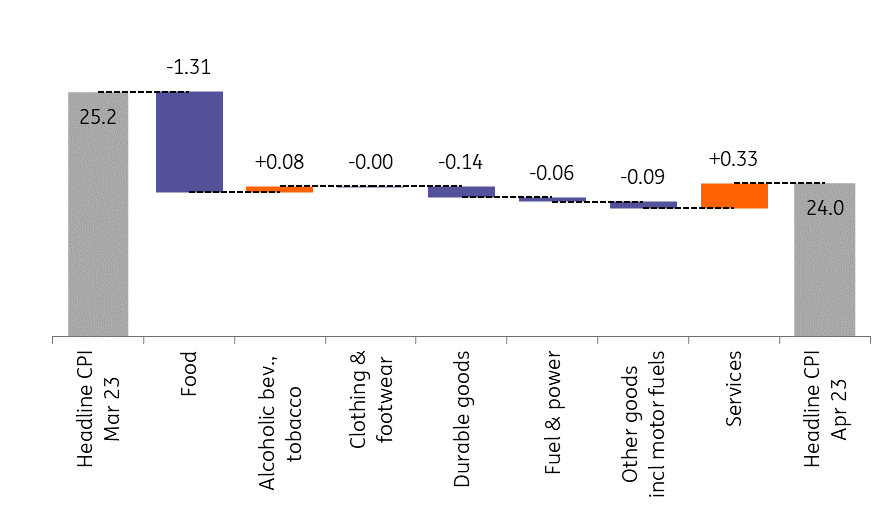

Main drivers of the change in headline CPI (%)

The details

- Food inflation continued to moderate for the fourth consecutive month, as the annualised index retreated to 37.9% YoY. The yearly based drop is entirely attributed to base effects after no change in prices on a monthly basis. The price pressure of both processed and unprocessed foods have moderated on a yearly basis. The former helped core inflation to decline. In the coming months, we expect the disinflationary trend to continue as food sales volume was down by 10.3% YoY in March, supplemented by large negative base effects.

- Motor fuel prices declined on a monthly basis, although to a lesser extent than we had anticipated judging by global oil price developments and HUF performance. In parallel with fuel prices, household energy prices likewise retreated, due to a decrease in household energy consumption, which lowered the weighted average unit price of piped gas. The yearly based moderation of durable goods prices is attributable to base effects, as the monthly pace of growth came in at zero, while last year’s HUF turmoil prompted overarching price increases on the import side keeping the base elevated.

- Services prices rose by 1.7% MoM bringing the annualised index to 14.1%, contrary to our expectations as we were expecting higher repricing. The main culprits behind the jump were price increases in domestic recreational services, which surged by 4.9% MoM, and other services which rose by 3.5% MoM. The pre-announced price increase by financial services providers is partially included in the latter. Going forward, we expect services inflation to remain elevated on further repricing in holiday packages, and more price increases will show up in the statistics from both financial and telecom services providers in the coming months.

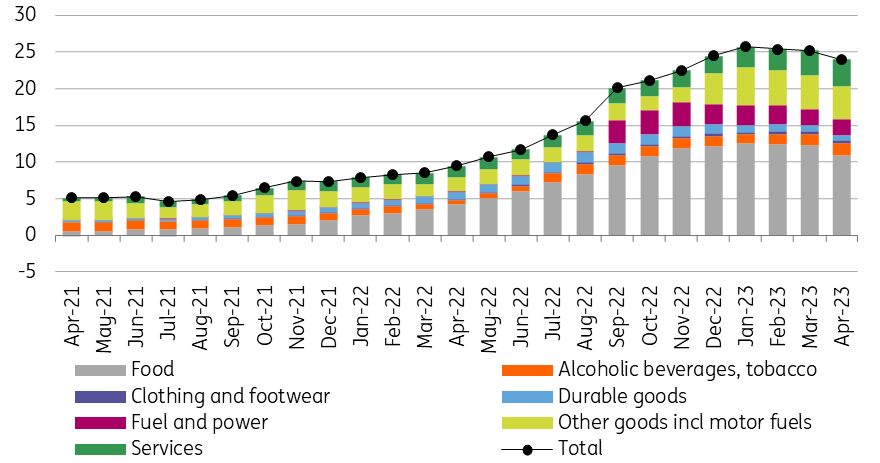

The composition of headline inflation (ppt)

The structure of inflation has started to improve (again)

In January and March, the path of core inflation disappointed markets, while in February underlying price dynamics painted an appealing picture. The latest April release resembles the improvement seen in February as core inflation dipped to 24.8% YoY, which is the result of a 1.1% MoM increase. No economist can say for certain that “this time is different”, however judging by the decline in real wages (the sixth month in a row), consumption has been constrained to such a large extent, that we believe that there is no room for further major repricing in the coming months. Therefore, core inflation will retreat both on a monthly and on a yearly basis. This view is supported by the downtick in the National Bank of Hungary’s sticky price inflation index, which declined by 0.5ppt to 18.9% YoY in April.

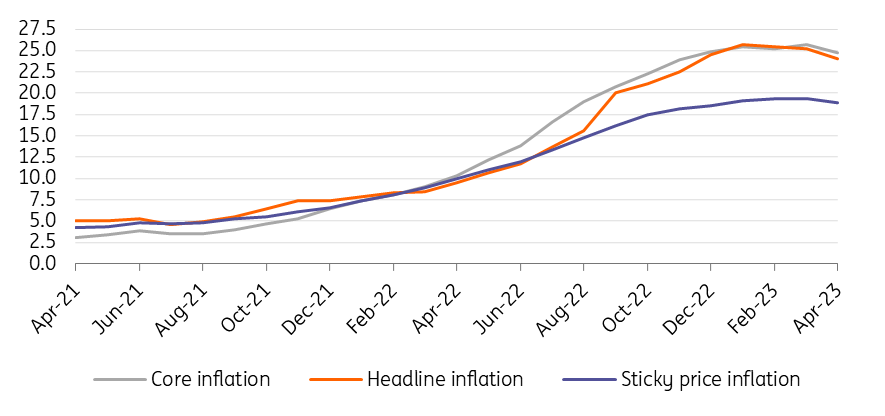

Headline and underlying inflation measures (% YoY)

We see further easing in price pressures ahead

Going forward, we expect both headline and core inflation to continue to retreat in the coming months. Given the slump in the volume of retail sales due to constrained purchasing power, we see further moderation in food, durable goods and clothing prices. As last year was crippled by HUF turmoil, recent forint strength will help the disinflationary process as well for these items. Barring a large spike in global energy prices, we expect motor fuel prices to further retreat in the coming months, along with household energy prices.

In the short term, we see another jump in services prices due to pre-announced price increases by financial and telecom services providers, along with seasonal repricing in holiday packages, which impacts domestic recreational services. However, as the loss of purchasing power is starting to really weigh down on household consumption patterns, we believe that repricing in the services sector is somewhat limited.

In light of April’s release, the government’s goal of reaching single-digit headline inflation by December 2023 is still achievable. At the same time, we expect the full-year average inflation to be around 19% in 2023, well above the government’s 15% expectation. Even though headline inflation might dip below double digits by the end of the year, the risk of a persistently high inflation environment has not yet been averted. We believe that the very dynamic wage growth could translate into positive real wage growth in the last quarter of the year. A combination of the companies’ typically retrospective pricing behaviour in Hungary (carrying out price increases based on past inflation releases) and the rise in real wages could trigger further repricing.

On the other hand, we assign less probability to a renewed boom in consumption at the end of the year as households’ savings have been significantly drained in recent months to offset sky-high inflation. Therefore, we believe that the positive real wage growth in the fourth quarter will rather trigger households to replenish their depleted savings, which in turn might have negative effects on growth prospects and on the repricing power of corporates. Nevertheless, this scenario will eventually play out and is very sensitive to the behaviour of Hungarian society.

April’s inflation release is welcome news for the National Bank of Hungary, as the door for a rate cut has been opened wider. Even though the central bank has been differentiating between the issues of price and market stability, an improvement in the former prompted positive development in the latter. Therefore, as the possibility of potential rate cuts in the effective rate (currently sitting at 18%) is tied to improving market sentiment, we believe that the time for the first rate cut has come. In case HUF strength remains intact in the upcoming two weeks, we believe the odds are heavily tilted towards a cut in the rate of the quick deposit tender at the next NBH meeting on 23 May.

Download

Download snap