Aluminium: Strong smelting margin drives supply growth

Record-high smelting margins boosted higher capacity utilisation rates, particularly from China, and it has been driving the world aluminium production growth. Robust imports of aluminium and alloys have been adding to the strong supply in the China market, while the demand strength is set to face a reality check in the near future

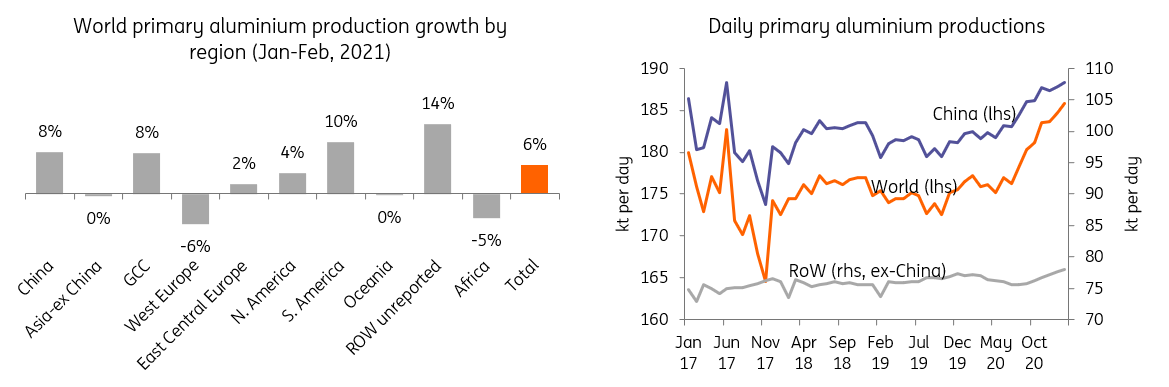

After a brief dip into negative territory during last March, primary aluminium smelting margins have been rising along with the metal's price recovery whilst the input costs change have been relatively limited. As of late March, primary aluminium margins have increased to the highest on record. It is no surprise that production growth has risen robustly incentivised by the strong margin. According to the latest data from International Aluminium Institute (IAI), world primary aluminium production increased by almost 6% year-on-year during the first two months of this year, chiefly driven by China's strong growth. Strong margins in spot terms have seen Chinese primary aluminium production grow by over 8% YoY during the period, whilst the rest of world production combined declined moderately by 0.7% YoY. Yet, the latest IAI data didn't reflect the recent administrative curtailments from Inner Mongolia in China. However, the strong capacity utilisation rates from provinces outside Inner Mongolia seen during March should imply that production could be still elevated this month. The seasonal stock building in the China market has not yet peaked, and that it currently stands at 1.26 million tonnes, some distance from the peak levels in previous years.

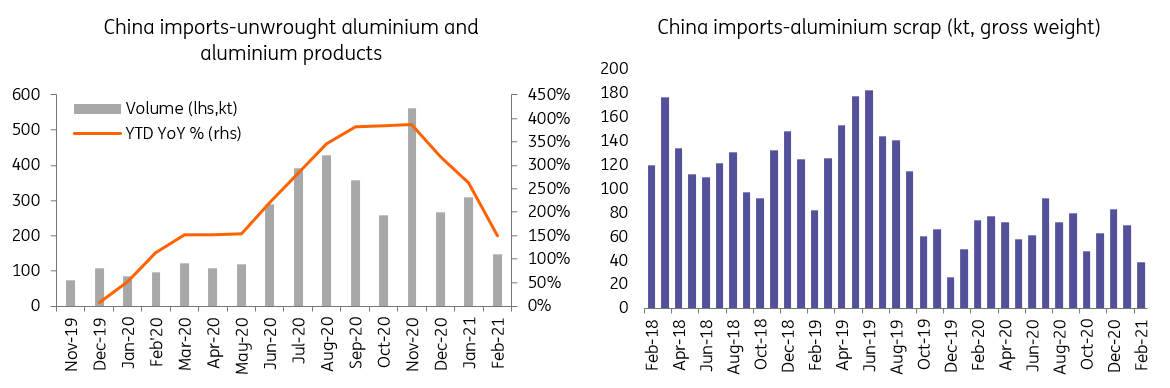

Meanwhile, Chinese unwrought aluminium and aluminium products imports remained elevated during the first two months, driven by physical import arbitrage opportunities. The stronger momentum in the recent Shanghai market had pointed to further arbitrage opportunities. Thus it shouldn't be a big surprise if imports come out at an elevated level this month. The robust Chinese domestic production combined with strong imports suggest an ample supply in this market, and the underlying demand strength is set to face a reality check in the next couple of months. Should there be no surprises, the current stock building should peak soon, and then we would observe a gradual drawdown, but the pace will be focused.

Worth noting that scrap supply in the remainder of the year will remain a key to watch as well. Remember that last year, the disrupted scrap supply chain due to lockdowns combined with Chinese scrap import restrictions had led to reduced scrap imports by China. Thus buyers seek primary aluminium to fill the void, which indirectly helped the primary metal consumption. There is large uncertainty in terms of the import volume after the China authorities came up with new scrap import rules, and this is also dependant on the supply chain recovery. The latest scrap imports figure for the first two months has been somewhat disappointing. However, should this climb substantially, this would partially act as substitutions to primary metal consumption – somewhat a reverse to what we saw last year. But before this takes place, strong imports in secondary alloys continue to grow in the absence of some scrap imports. After a substantial rise of 190% in 2020, Chinese imports of secondary alloys jumped by another 18% YoY during the first two months of this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

AluminiumDownload

Download snap