Aluminium: Nowhere to roll

LME aluminium prices have surged 18% since news that Rusal would face US sanctions. Available buyers for the metal remain uncertain leading to some dramatic price forecasts. We urge caution

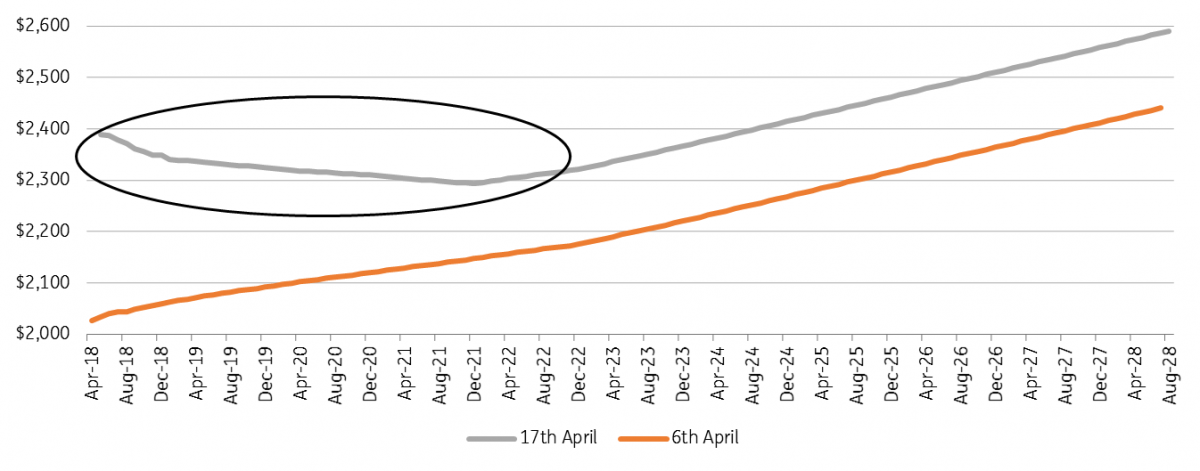

No where to roll: LME aluminium curve is in backwardation to 2023

Aluminium is surging but keep calm and trust the curve

We have always emphasised that for aluminium the curve matters more than it does for any other market. The size of the aluminium inventory overhang, physical market size (c.60MT), versus a relatively low penetration by the funds (eg. much smaller asset allocations vs copper) means trading activity for LME aluminium is dominated by the spreads rather than outright prices. In other words, more buying and selling of positions in the aluminium market is based on the ability to profitably roll positions than we see in other markets. (A backwardation is costly for shorts to roll, profitable for longs, and the opposite for a contango).It was our original conviction that the LME aluminium contract was bound to experience repeatedly tight spreads which formed our original bullish view on aluminium prices (2018 aluminium outlook). As spreads flipped last week (cash-3M hitting highs of $54 backwardation) the squeeze on the short positions drove prices higher. Now the impact on stock holders could also provide the cap to prices.

Tempting to liquidate

Massive oversupply through 2008-2011 has built an off-warrant aluminium overhang that we estimate still stands at five million tonnes. Consultancies like Harbor think this could be much larger, at around 10MT. Whatever the precise levels- although no doubt a fraction of previous highs- the consensus is that they are at least as high as Rusal's annual production (3.7Mt). These off-warrant inventory positions are hedged periodically by a short position on the LME. As such, when the hedge approaches expiry the trader has the choice to either roll the hedge, or to liquidate and sell the material (onto the LME or more likely the spot market). Backwardations encourage stocks to liquidate because it is costly to roll the short hedge but the trader will also try to navigate the curve to see if a further dated contango is possible. But no such opportunities exist now. For the first time in memory, the LME aluminium curve has a backwardation as far as three years out rendering it impossible for traders to roll forward without cost. With the US premiums now above 20c/lb (customs cleared), and EU, MJP premiums also on the rise it has never been more tempting for traders to liquidate these stocks.

Beware of overshoots

In short, a higher aluminium price is fundamentally justified but rallies do have a history of overshooting. For the fundamentals look to higher alumina prices and the deepening ex-China deficits (2MT even pre-Rusal losses), as per our original view. But aluminium’s inventory means this metal may actually hold the quickest potential supply response if spreads stay backwardated as far out. We will be looking closely for any weakness in the premiums, spreads and trade data for signs of this metal appearing on the spot market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap