A ‘Perfect storm’ in copper’s ‘phase-two’ rally

Copper has embarked on a bull run along with an appetite return to risk assets, and a bear dollar has been also helping

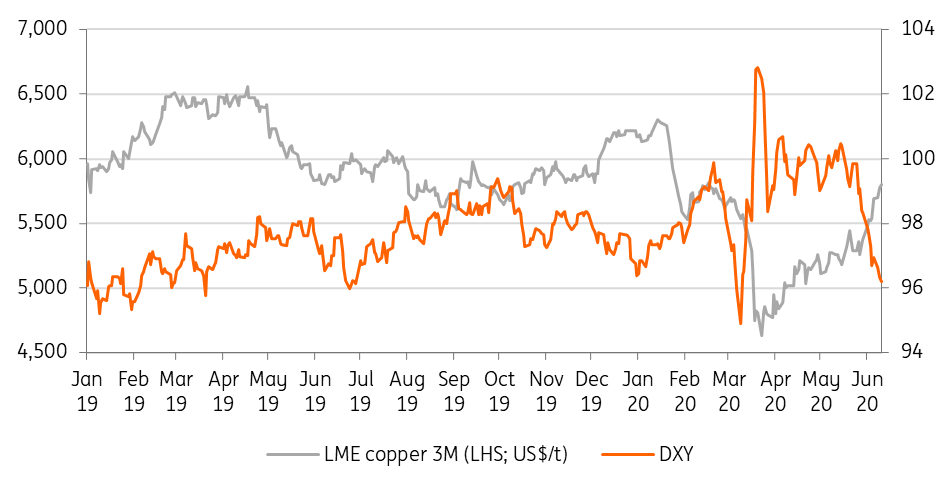

In a ‘Perfect storm’ in copper’s ‘phase-two’ rally copper has clawed back its losses from the Covid-19 pandemic, and rallied more than 25% from the recent low in late March. The LME 3M price broke US$5,900 today amid investors’ appetite return to risk assets in the financial market. If copper still holds its doctor degree in economics, then such a quick turnaround seems to be telling us of a 'V-shaped' recovery in world economic recovery. However, this is very sceptical, and hardly any of us would agree.

Ever since China came out of lockdowns and economic activities gradually returned starting from March, we have seen a round of a China recovery-led rally. And back in mid-May, we reckoned that such a narrative had been pretty much priced in, and thus we saw prices snap back from the bottom to around US$5,200/t. But what's next?

Well, it's been a 'just in time' when the dollar's bear trend has been built, and that inverse relationship has become closer than ever. In copper's 'phase-two' rally, the global liquidity and fiscal stimulus have taken the baton just in time and have been bolstering momentum signals and further supporting copper's rally to the current level. There seems to be an illusion that Covid-19 has not done any harm to demand.

Along with the 'phase-two' rally, doubts are rising as there seems to be a short-term dislocation between copper and the appreciated status in economic fundamentals. Also, signs of a strong demand story in China will gradually losing steam. However, with global central banks' quantitative easings and fiscal stimulus still unfolding, along with the dollar's bear trend, it's hard to see copper retesting it's prior low.

We would not be too surprised to see copper testing the US$6,000/t level.

In such a liquidity-driven market, copper usually stands out against its base metals peers due to its superior identity as a financial asset versus its identity as an industrial metal. It also becomes a paradox that despite dire economic data, many think that global monetary and fiscal policies will remain accommodative.

Fig. 1 Copper prices vs dollar index

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CopperDownload

Download snap