October Economic Update: Looking for a silver lining

From trade protectionism to the US mid-term elections, the Italian budget to emerging market woes, financial markets have a lot to consider in the fourth quarter. Read more in our latest economic update

While global growth is certainly respectable, political risk is casting shadows. Trade protectionism remains a key theme, and while a US-Canada-Mexico deal is encouraging, US-China-EU tensions linger. US mid-term elections in November could lead to President Trump focusing even harder on this issue. Europe has its own problems, with concerns about the Italian budget negotiations and “no-deal” Brexit noise growing. Emerging markets aren’t immune with rising US borrowing costs and the strong dollar compounding fundamental domestic problems in key markets. Financial markets have a lot to consider in 4Q18.

Despite these concerns, the US economy continues to roar, and with inflation pressures rising, the Federal Reserve remains in tightening mode. Moreover, the US central bank continues to brush aside criticism that it doesn’t consider the international implications of its policy decisions enough. We agree that there isn’t a great deal the Fed can do to address the domestic challenges facing many emerging market economies, but a strong dollar and higher US borrowing costs certainly won’t help their situation.

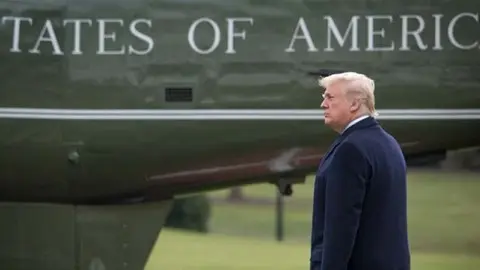

Politics-wise, the focus is on the 6th November mid-term elections, with opinion polls suggesting the Republicans face an uphill battle to retain control of the House of Representatives. This will make life more challenging for President Trump in terms of getting his legislative agenda passed. It also means he may focus even more attention on trade policy and getting other nations to treat the US “fairly”.

With a proposal to refrain from any deficit reduction over the next three years, the Italian government has put the markets on high alert again. The bond yield spread with Germany jumped to above 300 basis points, though we still believe that a compromise with the European Commission can be found before year end. However, the lack of further Eurozone integration means that this kind of tension will return, especially in the case of growth slowdown. While Eurozone growth is still expected to descend next year, the downside risks to the economic outlook have clearly increased. At the same time, underlying inflation remains subdued, limiting the scope for monetary tightening in 2019.

On Brexit, the UK government is reportedly set to propose a compromise on the contentious Irish backstop issue, but as ever, there is no certainty that MPs will back the Prime Minister’s direction. We still think a fudge can be found that avoids the ‘no deal’ scenario, but we’re unlikely to know for sure until 2019. This only promises more uncertainty in the short-run.

The upside potential to EUR/USD in the remainder of the year seems limited, but we still look for more gains next year as the European Central Bank gets closer to the deposit rate hikes. Sterling remains caught in the Brexit negotiations, and we are cautious about the extent of the potential upside to EM FX as the trade war rhetoric may return.

Market rates are on the rise, and it’s no real surprise. The Fed may be at neutral, but still has some hiking to do, while phraseology at the ECB has turned more upbeat. And crucially some of the risk factors coming out of Turkey and Italy have been tamed, at least for now. More of this and rates should be tempted higher still.

Written by the Global Economics and Strategy Team

Download

Download report

5 October 2018

Global Economic Update: Looking for a silver lining This bundle contains 8 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).