Netherlands General Election: What to watch

The Netherlands goes to the ballot box on 17 March 2021, for regular elections for the House of Representatives. In this report, we look at what the polls are showing and the possible implications for economic policies.

Fall of government implies switch to caretaking mode just a bit earlier

On 15 January 2021, the Dutch government stepped down because of the so-called “day-care allowance affair”, in which the government unjustly treated thousands of households as fraudulent. The government is currently continuing as a caretaking government, as expected anyway in light of the regular elections, only just a bit earlier than anticipated.

In this publication, we discuss what to expect from this election – taking recent polls as a given - and outline the positions of the political parties most relevant for the next coalition on economic topics that are of most importance to an audience outside the Netherlands for the next four-year term.

Political landscape remains scattered

The leading Dutch Polling Indicator suggests no dramatic change in Dutch politics. Based on this composite of various polls, the Dutch political landscape is likely to remain scattered, with 14 parties polling for at least one seat in the lower house and six parties with a medium number of seats.

Much support for VVD and its current coalition

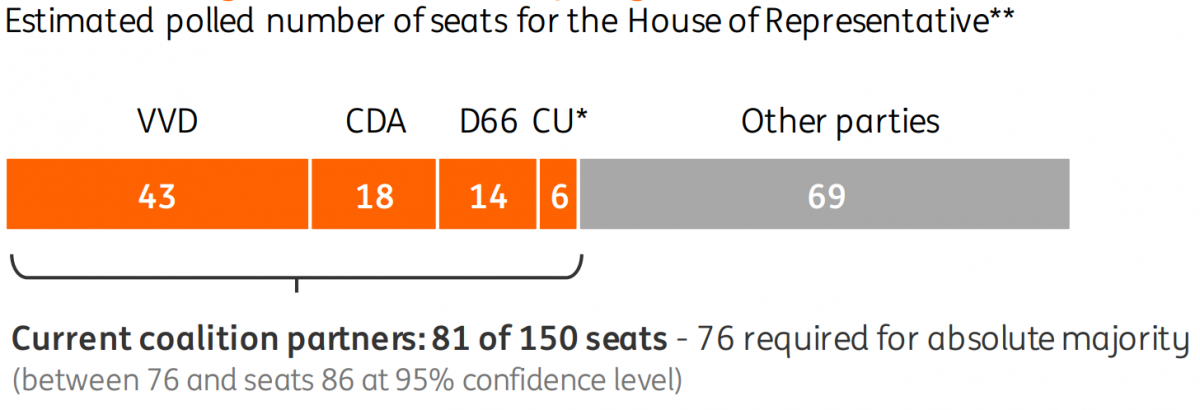

Prime Minister Mark Rutte’s VVD remains the party with by far the most support of the electorate, polling between 41 and 45 of a total 150 seats. It might actually grow substantially compared to its current 32 seats. This combined with a small loss of support for coalition partners D66 and CDA and a minor gain for ChristenUnie provides ample room for the current government to win another term.

Substantial majority support for current coalition

Change of leadership could have effect close to the elections

Since CDA, D66 and PvdA all recently chose new political leaders with no experience in election debates, large last minute swings in polls cannot be excluded. While the ruling government just fell due to the so-called “day-care allowance affair”, it continues as a caretaker government and the polls show no significant shift in support for coalition parties as a consequence so far.

VVD could form centre-right or centre-left coalition

As it stands, it could be expected that the VVD will take the new initiative to form a new coalition government with at least three parties. Besides the current centre-right VVD-CDA-D66-ChristenUnie coalition, a similar VVD-CDA-D66 coalition and centre-left government of VVD-CDA-GroenLinks-PvdA are among the most evident options. The current lack of a Senate majority for all these options is not likely to be seen as an insurmountable hurdle.

VVD by far the party with most support in the polls

No huge policy shifts expected, but austerity less likely

A government of such traditional parties would not imply a huge regime change. Nevertheless, the Dutch mood specifically regarding quick domestic austerity seems to have changed compare to the previous crisis period: a focus on long-run sustainability seems more likely than a push for short-term debt reduction. Meanwhile, there is also a lot of support for more public investment.

Definitely no break with Europe, but no unconditional solidarity

With regards to European fiscal policies, the next government is expected to remain in favour of conditionality and sanction capabilities in return for solidarity. Opinions about the necessity to change the European Stability and Growth Pact differ among the coalition candidates. The election manifestos of the parties that are most likely to join the government suggest that radical steps away from European projects such as leaving the European Monetary Union or the European Union seem very unlikely.

For more in-depth analysis, please download the report.

Download

Download report

4 February 2021

The only way is up, baby This bundle contains 8 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more