Above-potential growth in the Netherlands: The Dutch Economy Chart Book

A solid domestic foundation supports above-potential growth for the Dutch economy. Overnight deposits offer room for consumer spending, production capacity is becoming an issue while the recent house-price increase is not credit-driven

This and more is shown in the ING Dutch Economy Chart Book, which provides an overview of the most important developments in the Dutch economy in more than 100 charts.

Catch up underway in GDP development

The aftermath of the global financial crisis has been deeper and longer for the Netherlands than for a number of other European economies. The Dutch economy experienced a second considerable dip in 2012-2013, one which was avoided by most of its neighbours. Dutch private consumption performed especially poorly in international comparisons because of the (deeper) housing market crisis, adherence to a funded pension system and a larger austerity operation. In recent years, however, the Dutch economy turned from a growth laggard into a growth leader, making up much of the lost ground in terms of GDP development since 2008. Even though the Dutch economy is not immune to global tensions and weakening optimism, we expect that Dutch GDP figures will continue to stay higher than the Eurozone growth rate in the quarters ahead.

After years of lagging behind in GDP-development, the Netherlands is catching up

Gross domestic product, constant prices, index 2008 = 100

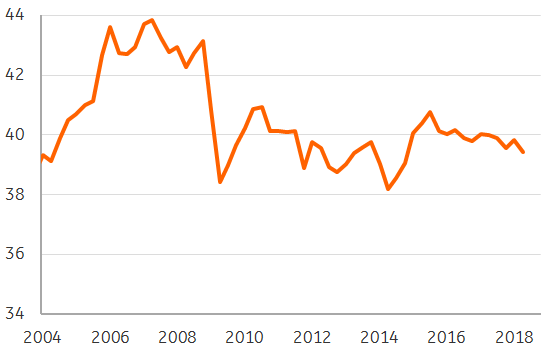

Profitability of non-financial corporations stagnating

While total (gross) profits of non-financial corporations measured in euros are currently at record levels, the picture changes once profits are presented relative to the size of the economy. It then appears that while the gross operating surplus as a percentage of gross value added is higher than during the crisis, it is nowhere near the level of 2006-2008. In fact, the profitability of non-financial corporations is stagnating. While the labour market shows increasing signs of tightening and stronger wage increases are expected, the mediocre profitability performance limits the room for wages to make a huge jump.

Profitability stagnating

Gross operating surplus as percentage of gross value added of non-financial corporations (excluding small unincorporated businesses) at basic prices, seasonally-adjusted

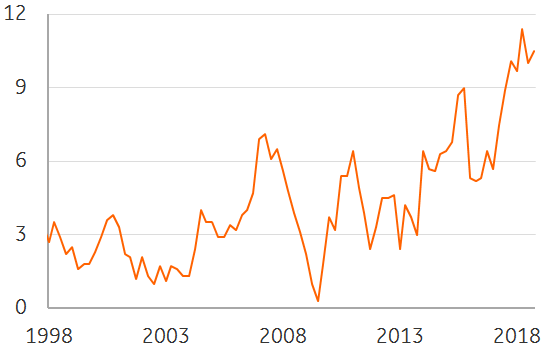

Capacity increasingly becomes an issue

The Dutch economy has shown seventeen consecutive quarters of growth, which is increasingly translating into more scarcity. The share of firms in industry reporting shortages of materials and/or equipment as an important factor limiting current production has increased sharply. For that reason, investment projections still remain quite upbeat.

Equipment and materials more scarce

Percentage of industrial firms reporting a shortage of materials and/or equipment as a main factor limiting production (seasonally adjusted)

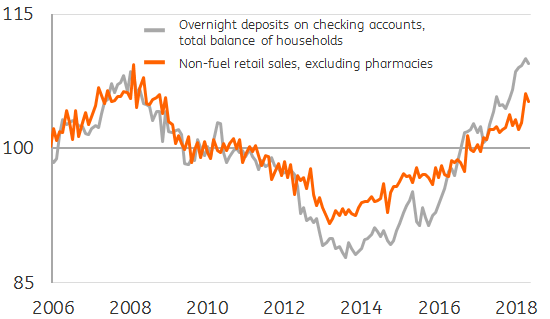

Overnight deposits offer room for consumer spending

The amounts of overnight deposits on checking accounts of households are at record highs. Higher deposits often go together with higher retail sales' volumes (excluding fuel and pharmacies). This indicates that consumer spending will continue to rise in the period ahead. For many years private consumption had been the weakness of the Dutch economy.

Overnight deposits offer room for consumer spending

CPI inflation-adjusted index of overnight deposit balance of households and volume index for retail sales, both 2010=100 and seasonally adjusted

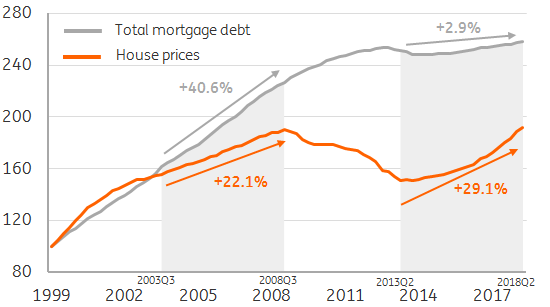

Current house price increase not credit-driven

In the period prior to the global financial crisis, house prices rose fast. This was fuelled by an even stronger growth in mortgage debt. In the past few years, house prices have again shown a sharp increase, but without an accompanying credit boom. Policy measures introduced after the start of the global financial crisis, such as a lowering of the maximum LTV-ratio and a reduction of the extent of mortgage interest rate deductibility, have curtailed mortgage debt growth, while the share of investors buying homes with equity has increased strongly.

Previous sharp increase in house prices was credit-fuelled, this time mortgage debt barely increased

Mortgage debt stock and house prices, index, 1999 =100

Conclusion: solid domestic foundation for growth

“The Dutch Economy Chart Book shows a solid domestic foundation for continuing above-potential growth for the Netherlands,” according to Marcel Klok, macro-economist at ING Economic Research. "Accordingly, we are forecasting strong economic growth for this (2.9%) year and next (2.4%) year, which like in 2017 is driven by growth in almost all industries. Obviously, there is a number of risks looming outside the Netherlands, such as a hard Brexit, a debt crisis in Italy and an escalating trade war. In fact, the Q3 GDP figure for the Eurozone of 0.2% was already below our expectations. However, we expect growth in the Netherlands to outperform the Eurozone in the near term. We are looking forward to the 3Q figures for the Netherlands, which will be released in two weeks time.”

Download

Download report

31 October 2018

In case you missed it: Change of guard This bundle contains 9 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more