Covid-19’s long term effects on the automotive industry

The global automotive sector was already under pressure even before the coronavirus pandemic. So how will it survive this crisis and what structural changes lie ahead? Download the full PDF report below

Executive summary

In this special report, we look specifically at the following:

Could there be a ‘renaissance’ of individual transportation, ie, a return of the own car and a (temporary) reversal of trends like car sharing due to social distancing?

What is the cyclical impact from higher unemployment and reduced income on the automotive industry?

Will demand for electric vehicles fall due to the currently low oil price environment?

Will supply chains be adjusted due to Covid-19?

What is the impact of Covid-19 on OEMs and auto part suppliers in a period of transformation?

US consumer confidence and car sales

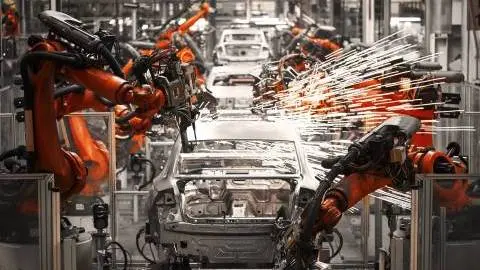

Covid-19 has triggered unprecedented lockdowns across the world, resulting in a supply and demand shock globally. Production closures as well as job and salary cuts are already weighing on the economy, while lending could be restricted to businesses and consumers despite generous government and central bank support. With the lockdown measures being only gradually relaxed, Covid-19 might have long-lasting effects on our behaviour, the society and the economy. One sector that had been under pressure even before the pandemic, is the automotive industry. Already weak sales in China, the largest automobile market in the world, the trade war, the search for the future of motoring, changing mobility concepts and the call for more climate protection had been leading to both cyclical and structural pressure on the industry. Now, with many economies having been in a complete lockdown, disrupted supply chains, dropping demand and short-time working schemes, the auto industry faces even greater challenges.

The auto industry faces even greater challenges

China, where the outbreak of Covid-19 began at the end of December, was the first country to go into lockdown, restricting travel, cancelling plans for Chinese New Year and shutting factories. While light vehicle sales had fallen by 18.6% YoY in January, February saw the biggest fall ever recorded in the time series, with sales contracting by 79.1%. Nevertheless, April sales recovered with light vehicle sales crossing the 2 million vehicle mark compared with sales of only 1.4 vehicles the month before, increasing by 4.4% YoY thanks to an uptick in commercial vehicles.

In Europe, demand for vehicles fell sharply in March with the EU light vehicle market contracting by 44% YoY as lockdown measures, closed dealerships and consumer uncertainty caused a drag, while in the US new passenger car and light truck sales plummeted by 47.9% YoY in April. These monthly declines resemble the industry downturn in 2008 and 2009 or are even worse. However, back then, production and public life did not largely come to a halt. So how will the automotive industry get out of this unprecedented crisis and will there be major structural changes?

EU consumer confidence and car sales

Download

Download report

18 May 2020

Covid-19: Where we are right now This bundle contains 8 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more