Wot, no hikes?

Fed signals policy on hold all year (and possibly longer), Trump suggests tariffs on China won't be removed at once, the UK steps a little closer to the abyss as Brexit saga drags on, and Asian central banks to hold rates steady today (possibly RRR cuts in the Philippines).

No hikes

James Knightley has done an excellent job on the Fed decision and to spare you having to listen to the "monkey", when you can go straight to the "organ-grinder", here's a link to his note.

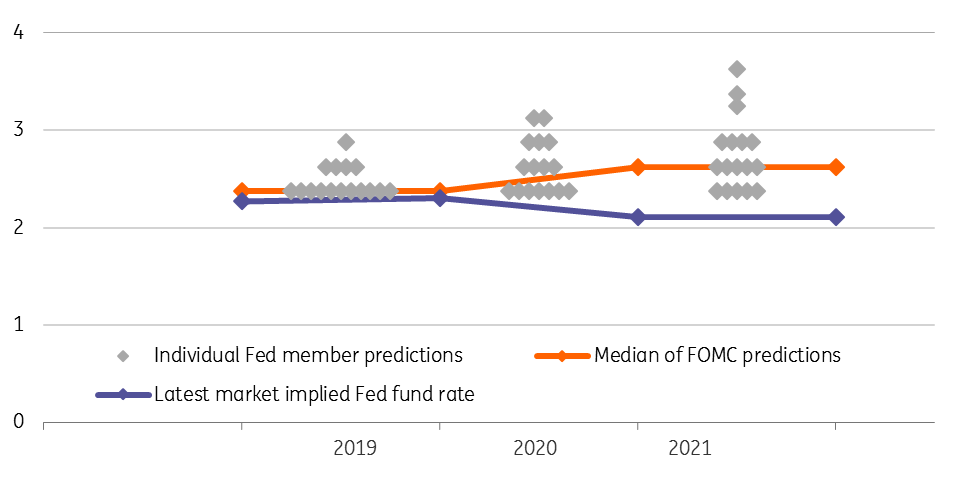

I've very badly redrawn the dot diagram below (one of my younger and abler colleagues will no doubt improve on this later today), but you get the picture. All it would take would be a few dot downgrades next time to suggest no tightening bias at all.

Further interest can be found in the intentions on the balance sheet roll down, which ends sooner and is tapered down to zero - but it's all covered in Knightley's note...

Very Dovish. EURUSD is up at 1.1427, and would be higher but for the Brexit nonsense that weighs on both the EUR and GBP.

New Dot plot

Good President, Bad President

The mood on trade has been a little fractious lately, and the latest comments from the US President take us back to what we imagined all along would be the outcome - namely, the existing tariffs would remain, and their removal would be contingent on China adhering to the deal.

This is classic Trump. It's how he has been playing North Korea. China won't like it, but if they want a deal, they may still sign up for it, depending on the conditionality. This seems to be the sticking point, and it is not surprising. China will want this to be a two-way system. I'm not sure the US will be offering this.

And this is also why it's important to realize that any trade "deal" is not an event, but part of a process, a step on a long journey if you will. We may still be writing about this in years to come. This trade shift may be helping to provide a little support to the USD today, which I imagine would be even weaker without it.

Slowly to the cliff edge

As my Easter vacation in Europe beckons, the prospects of a no-deal Brexit, which had been diminishing, seem to be back again, as the EU quite reasonably plays hardball over the UK's request for an extension, and as UK PM Theresa May (perhaps unreasonably) tries to keep her much-loathed draft bill in play. Sterling's odd sense of calm in recent days is evaporating, as well it might.

We may not get any more movement on this until early next week. My nerves may not take it. I'm not writing about this anymore.

Asian Central Banks

There are a lot of central banks on the calendar today. The most likely source of any action will be from BSP (Philippine Central Bank), where we could see reserve rate requirement (RRR) cuts as early as today. Elsewhere, rates on hold is likely to be the story from Indonesia's BI (Bank Indonesia) and CBC (Taiwan's Central Bank). But give it time. With the Fed now super-dovish, the USD weakening, inflation in the region weak, and growth not as strong as it should be, scope for rate cuts in the region later this year is high. To the central banks above, I would also add the Bank of Korea, and although it flies in the face of the commentary from two of its members, I would also suggest Bank of Thailand should be on this list.

Australian employment data was not as good as had been expected with full-time employment falling 7,300 in February and the headline jobs figure only rising 4,600 thanks to an 11,900 rise in part-time jobs. The RBA has signaled that the labour market is a key variable for them in their rate-setting process, and so today's data, while not awful, nudge the dial slightly away from neutral towards easing, which could weigh a little on the AUD.

Download

Download opinion

21 March 2019

Good MornING Asia - 21 March, 2019 This bundle contains {bundle_entries}{/bundle_entries} articles

Robert Carnell

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years.

Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Robert Carnell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more