What a difference a day makes

Optimism over a US government spending deal turns to pessimism - this remains a coin toss - watch this space

Will they? Won't they?

There used to be a time when being an economist meant looking at economic data, building a model and coming up with a moderately informed view on future events. That was before politics became the driving force behind economics and markets. Now, we are confronted, almost daily it seems, with a never-ending list of binary events, most of which have about a 50:50 chance of happening. We are still asked to provide a view. It just happens that most of these views are worthless. Moreover, forecasters in the private sector face various unspoken challenges in predicting catastrophe - that could form the basis of a PhD thesis in forecast bias.

The US government shutdown is just such a binary event, affecting not just US markets, but global markets including those in Asia. The split of Republican and Democrat voters on both sides of the argument makes this close to a 50:50 call, especially with some Conservative Republicans not convinced in signing up for a continuation bill and some Democrats likely to weigh the costs of shutdown in terms of voter sentiment more negatively than letting it pass.

As we wrote yesterday, markets are caught up in this. Risk sentiment has roughly reversed since then, with equity markets and the USD in full retreat. One tweak, however, is that bond markets are still selling off, as another factor has grabbed investors attention.

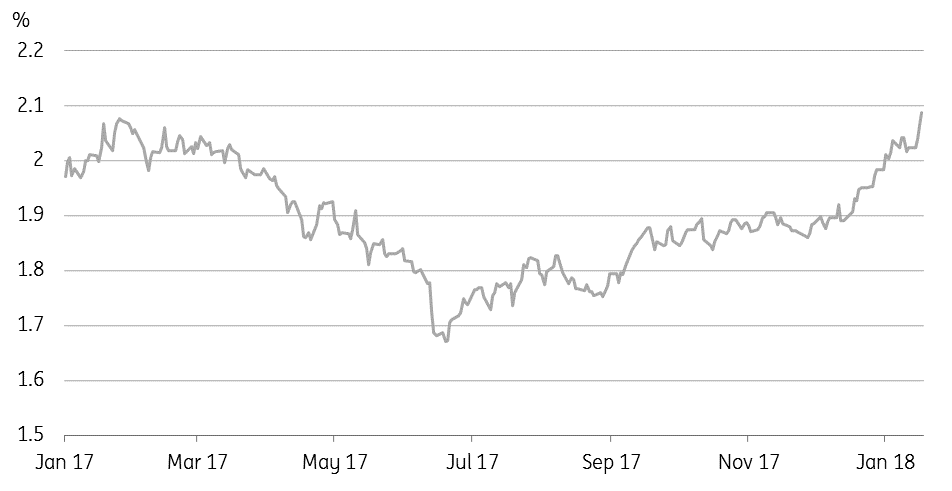

| 2.08% |

Breakeven inflation rate on 10Y zero coupon US Treasury bond |

Inflation - It's alive!

The negative correlation between stocks and bonds has broken today, with both selling off - the new factor, it seems, is new-found respect for inflation risk, as investors make a rush for inflation protection. This is illustrated in the breakeven rate for 10Y US Treasuries, which is spiking higher, even as the term premium remains in negative territory. If anything, this inflation expectations spike is likely to encourage the FOMC to deliver more tightening, not less. So for a time at least, this could become a self-fulfilling move, with rising yields pushing thoughts of rising short-term rates.

Also, it transpires that much of the offshore earnings talked about following recent tax reform, is parked in the US Treasury market, not offshore in any real sense at all (maybe only in an accounting sense). This too has raised suspicions that it is in Treasury yield space, not FX space, that we may see the biggest market effects of this policy.

Of course, by Monday, all this may have swung back again if a deal is reached. Do you still want a forecast? Heads or tails?

Break-even inflation rate for 10Y US Treasury

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

18 January 2018

Good MornING Asia - 19 January 2018 This bundle contains 2 Articles