If it’s just the economy, stupid, Trump’s in a good position for 2020

Swing States win elections, and given the strong economic performance of the big 5, any challenger is immediately going to be on the defensive

The economy, stupid?

In our US Politics Watch: Presidential election 2020 and beyond report, we highlighted what we felt were the five key swing states that will determine who wins the Presidency - all of which went to President Trump in 2016. Michigan, Wisconsin, Pennsylvania, Florida and Arizona in total have 86 electoral college votes (out of 538) and for Donald Trump to win re-election we think he would need 50 of those 86, assuming the states accounting for the other 452 vote as widely expected. We believe the Democratic candidate would need to pick up 38 of the 86 for victory. Bearing in mind the campaign mantra "it's the economy, stupid", first coined by Bill Clinton's strategist, James Carville, this will be a tough challenge for the Democrats.

Donald Trump has a strong platform for his re-election campaign

Of course, economic performance is not the only factor that determines how people vote, but looking at the numbers for these key swing states, it gives Donald Trump a strong platform for his re-election campaign. All five of these swing states were in the top half of the 2018 growth league. If better-than-median GDP growth was what purely drove the Presidential election result, carrying Arizona, Florida and Michigan would give President Trump the electoral college votes needed, even if he lost Pennsylvania and Wisconsin to the Democratic candidate.

As for employment, all 50 states have experienced job gains since President Trump’s inauguration. Arizona and Florida are both in the top 10 states for employment growth, but while Pennsylvania, Michigan and Wisconsin lag well behind this can largely be explained by slower population growth. Importantly, all five have seen sizeable declines in their unemployment rates.

We are still a long way from 3 November 2020 and the situation could change, but given the strong economic performance of these swing states and the fact that equity markets are at all-time highs any challenger to Trump is going to start their campaign on the defensive. As such a challenger may need to focus more of their initial campaigning on healthcare, environmental policy, regulation of big tech and identity politics to convince the electorate that political change is required.

The Five swing states that hold the key to the 2020 election

Swing States are key

The President is not technically elected by voters, but by what is called the Electoral College. Each state is allocated a number of members based on how many members are in its Congressional delegation with each state deciding for itself how its votes are apportioned in the Electoral College.

The majority of states use a winner takes all approach. For example, this means that although Donald Trump won 49% of the vote in Florida at the 2016 election while Hillary Clinton won 47.8%, all of Florida’s 29 votes in the Electoral College (the same as the 27 House members plus the two Senators) went to Trump.

Although Clinton received three million more votes than Trump across the country, Trump won in the Electoral College by 306 votes to 232. Therefore, the election is ultimately not determined by national trends, but by the trends that are most salient in the ‘swing states’, those that can swing back and forth between the parties and deliver the election.

Swing states outperform

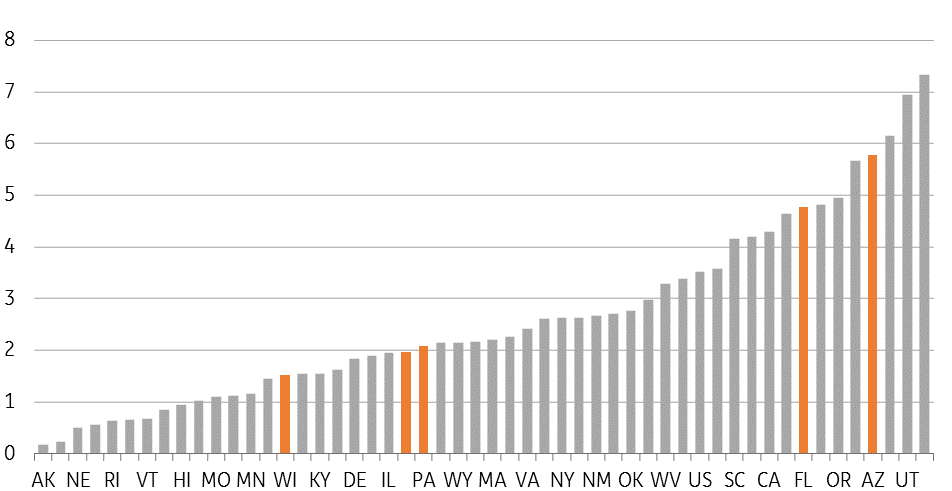

The US economy expanded 2.9% last year and as the illustration from the Bureau of Economic Analysis below shows, western states clearly outperformed. Only one state saw an economic contraction and that was Alaska, reflecting a lagged response to the oil price slump. But given Alaska last backed a Democrat Presidential candidate at the 1964 electoral college and oil prices have risen sharply in recent months it would be difficult to bet against it going to the Republicans again in 2020.

Only one state saw an economic contraction and that was Alaska

Washington was the best performer, growing 5.7%, well ahead of second place Utah on 4.3%, but looking at the swing states the news is rather mixed at first glance. Arizona and Florida were two of the top performing states ranking 4th and 5th out of the 50 states with growth of 4% and 3.5% respectively. Michigan is broadly in line with the national average, having grown 2.7%, but Wisconsin (2.5%) and Pennsylvania (2.1%) were a little weaker. Nonetheless, Wisconsin still came in as the 17th fastest growing state while Pennsylvania scraped into the top half of the table by being ranked 24th. The New England states, the Mideast states and the Plains all underperformed, averaging 2% growth.

US GDP growth by State

Jobs: everyone is a winner

In terms of employment, every single state has seen job gains since President Trump’s inauguration in 2017. As the chart below shows, Arizona and Florida are near the top of the list for performance once again, which is understandable given the robust growth seen in those states, but Pennsylvania, Michigan and Wisconsin lag well behind. Nonetheless, it is important to point out that these are still strong performances by historical standards, especially when we look at population changes in US states. Arizona and Florida have seen large inward migration which is creating more economic activity while also generating a greater pool of labour - Arizona's population increased 1.7% last year and Florida's rose 1.45%, whereas Pennsylvania's population increased 0.1%, Michigan's grew just 0.2% and Wisconsin grew 0.4%, according to the Census Bureau.

Employment growth since January 2017

Therefore to get a more complete picture of the dynamics within the local labour markets we also need to look at the unemployment rates. These show that Arizona’ unemployment rate fell 0.2 percentage points since President Trump came to power, while Wisconsin’s fell 0.7 percentage points, Michigan 0.9pp, Florida’s dropped 1.1pp and Pennsylvania’s fell 1.3pp versus a national decline of 0.9pp.

Key economic performance indicators of the swing states

Trump in the driving seat... for now...

While obviously recognising there are a number of factors that determine how people vote, the economic backdrop right now in the key swing states offers good news for President Trump. All five key swing states are growing faster than the median (if not the national average of 2.9%) and all five have seen employment grow and unemployment fall since President Trump took office. Pennsylvania, Wisconsin and Michigan have all seen slower employment growth than the US as a whole, but they have also experienced slower population growth, meaning that unemployment rates have clearly fallen.

Wisconsin appears to be the weakest performing economically of the five. It accounts for 10 electoral college votes and is clearly going to be a primary target for the Democrats, but they will need another 28 electoral college votes. Florida on its own will give them 29, but they would likely have to focus on non-economic issues given the rapid GDP growth and the strong jobs' performance. Pennsylvania and Michigan have not been as strong economically, but again they are better than average and barring a downturn, the Democrats will likely need to make a broader case for political change.

Given the importance of the economy to election outcomes we will be providing regular updates on these state-by-state figures in addition to other updates in partnership with Oxford Analytica.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

9 May 2019

What’s happening in Australia and around the world? This bundle contains 7 Articles

James Knightley

James Knightley is the Chief International Economist in New York. He joined the firm in 1998 in London and has been covering G7 and Western European economies. He studied economics at Durham University, UK.

James Knightley