Tick tock, tick tock…

More Brexit tension - more dot diagram anxiety - can anything break markets out of their current ranges? It's not obvious…

9 days to go, or is it 3 months, 9 months, 2 years?

With just 9 days to go until the technical ejection of the UK from the EU, we still have no idea what the UK government is up to. Will PM May opt to get her now thoroughly discredited draft bill through parliament a third time, using the cliff-edge as leverage, and noting the alternative for a long Brexit delay as the alternative? Does she do this merely to avoid the anger of some of her cabinet, who would prefer no deal to no Brexit? Or will she try to find ground which has more support, a softer Brexit perhaps, or go back to the people in a second referendum?

Short answer...we don't know. We don't know if PM May knows. That's worrying. EURGBP seems oddly becalmed at about 0.855. Something's gotta give. My patience with all of this most likely.

Fed's December Dot Plot

A nasty does of the dot-plots

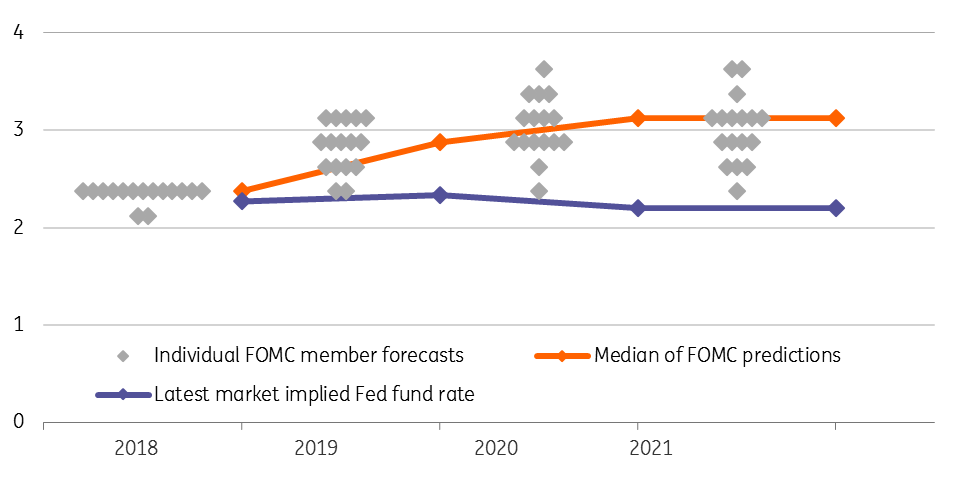

As well as some trade tension creeping into the US-China trade talks, which is giving markets a few jitters today, concern is mounting over what will happen to the Fed's dot-plot diagram due out after Thursday's FOMC meeting. With markets pricing in some chance of cuts in 2019, will squeezing out only one hike in the 2019 dots be enough? Would removing the implied hikes altogether look as if the Fed were throwing in the towel and spark a panic?

There are a number of possibilities here. But remember, markets price based on weighted probabilities, so what's priced in currently in Fed funds futures isn't so different to the dot plots, allowing for some low outliers. I think the market can cope with a conservative shift down in the Fed member projections that still leaves one hike in place. After all, they would look pretty silly if they took out all hikes this year, only to have their hand forced later in the year by some pick up in growth or inflation.

Asia Day ahead

There isn't all that much going on today in Asia, except for the Bank of Thailand. With an uninspiring growth backdrop, very low inflation, a huge current account surplus, and one of the strongest currencies in Asia, the prospects of a further hike from the BoT look close to zero. They should be. The upcoming election is another reason for the BoT to do nothing. It is quite simply beyond comprehension why two members of the monetary policy committee were reportedly calling for a further hike at the February meeting. This isn't a question of justifying "wait-and-see". There simply is no compelling argument for a rate hike. Central bankers ought to be made to adhere to a financial version of the Hippocratic oath. "First, do no harm!'

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

19 March 2019

Good MornING Asia - 20 March, 2019 This bundle contains 2 Articles