The euro may need to cheapen a little more

EUR/USD is close to the lows of the year, largely as a result of widespread dollar strength. The EUR trade-weighted index is not far from cyclical highs, largely due to weakness in the Chinese yuan and British pound. Neither investors nor corporates may think the EUR is especially cheap at the moment, suggesting it may need to drop some more

How weak is the EUR?

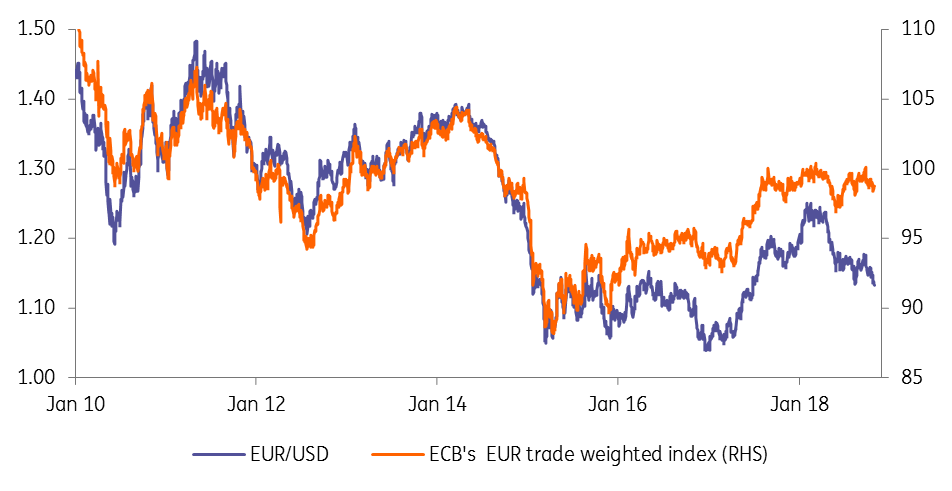

While EUR/USD is very close to the lows of the year, the EUR trade-weighted index is not. This is a result of the large weights given to the Chinese Renminbi (23%) and GBP (13%), both of which are suffering on politics and trade concerns. The dollar holds a 17% weighting in the ECB’s trade-weighted EUR index, with the divergence of the dollar driving a wedge between EUR/USD and the EUR trade-weighted both in 2016 and 2018.

EUR/USD weak, EUR trade-weighted less so

Eurozone growth disappoints, investors lukewarm

De-synchronised global growth is very much the story of 2018. The US fiscal/monetary policy mix has delivered strong US outperformance, while eurozone growth has disappointed. An important factor in any EUR/USD recovery story will be growth differentials and what they mean for international portfolio flows – particularly equity flows. The US has delivered strong growth in both 2Q and 3Q 2018. The 6 November US mid-term elections will have a say in whether this fiscally-powered growth extends into 2019.

The most recent eurozone growth figures have disappointed, with 3Q18 growth at 0.2% quarter-on-quarter – a far cry from the 0.7% QoQ readings seen since last year. Our team believes that local political uncertainty may be weighing on investment trends, higher oil prices are hitting consumption and the open economy of Europe is suffering, as world trade slows. These trends are showing no signs of slowing.

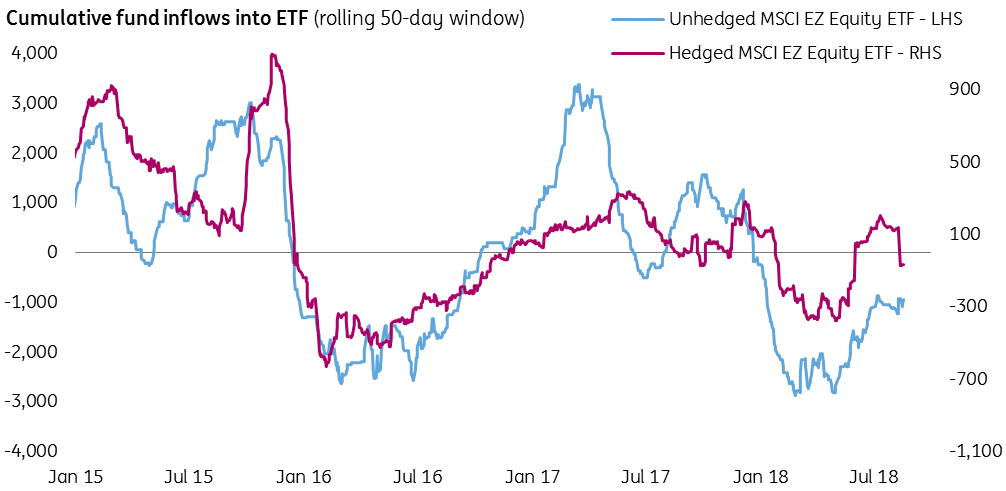

For investors, the uncertain eurozone growth outlook raises doubts about rotating away from US equities (peak US corporate earnings?) and into Europe. We’ve updated one of our favourite charts below showing flows into iShares Eurozone Exchange Traded Funds (ETF) – tracking flows into both the non-FX-hedged and the FX-hedged ETF product. Compared to the surge in demand for unhedged eurozone equities last summer, 2018 has only seen lukewarm demand for FX-hedged exposure to eurozone equities – and even that has reversed recently.

Demand for Eurozone equities wanes

European corporates may wait for a weaker EUR/USD

One of the major supporting factors for EUR/USD is the eurozone’s large current account surplus, near 4% of GDP. And despite President Trump’s protectionist push, tax cuts will only widen, not narrow the US trade deficit – presenting a greater supply of dollars on the trade account.

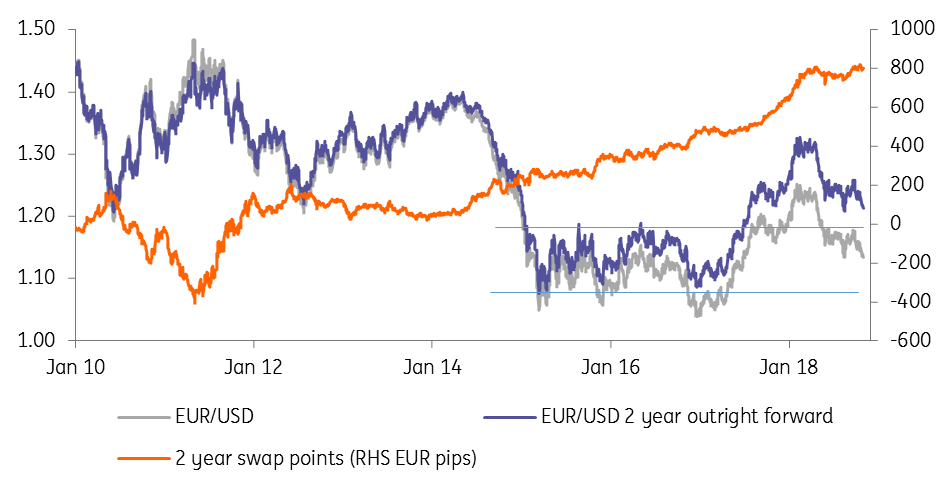

Near 1.13, EUR/USD also looks historically cheap. But when hedging USD receivables, European corporates take a longer-term view and the shape of the forward curve plays a significant role.

The current interest rate differential between the EUR and USD in the two-year part of the curve has never been wider than it is today at 330 basis points. That converts into 800 EUR pips in the FX forward market, meaning that the two-year outright forward near 1.22 is far more expensive than EUR/USD spot levels would suggest. European corporates in the market to sell their expected USD receivables two years forward (as many do) may not see the EUR/USD as especially cheap compared to the 1.08-1.18 levels that prevailed in the 2015-2017 period.

US mid-terms will have an important say in the dollar story for 2019. But the EUR story does not look especially encouraging right now and we are more worried by a potential break under 1.10 than we are by a move over 1.18.

EUR/USD not so cheap in the FX forward market

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

31 October 2018

In case you missed it: Change of guard This bundle contains 9 Articles

Chris Turner

Chris is Global Head of Markets and Regional Head of Research for UK & CEE. Together with his team, he provides short and medium-term FX recommendations for ING's corporate and institutional client base. Prior to joining ING in 2005, he was a senior partner and head of FX research at IDEAglobal, a research consultancy specialising in independent financial market research for the investment banking, hedge fund and central bank community. He holds a BSc in Economics and Accounting from Bristol University.

Chris Turner