SOFR in arrears or term? You choose

Now that we (effectively) have a term SOFR rate, a burning question is which way the market will swing. Does it remain drawn to the purity of SOFR in arrears? Or does the familiarity of term Libor rates bring term SOFR to the fore? Term SOFR is the preferred rate for loans fallbacks, while SOFR in arrears is used for ISDA fallbacks. Pick a side already…

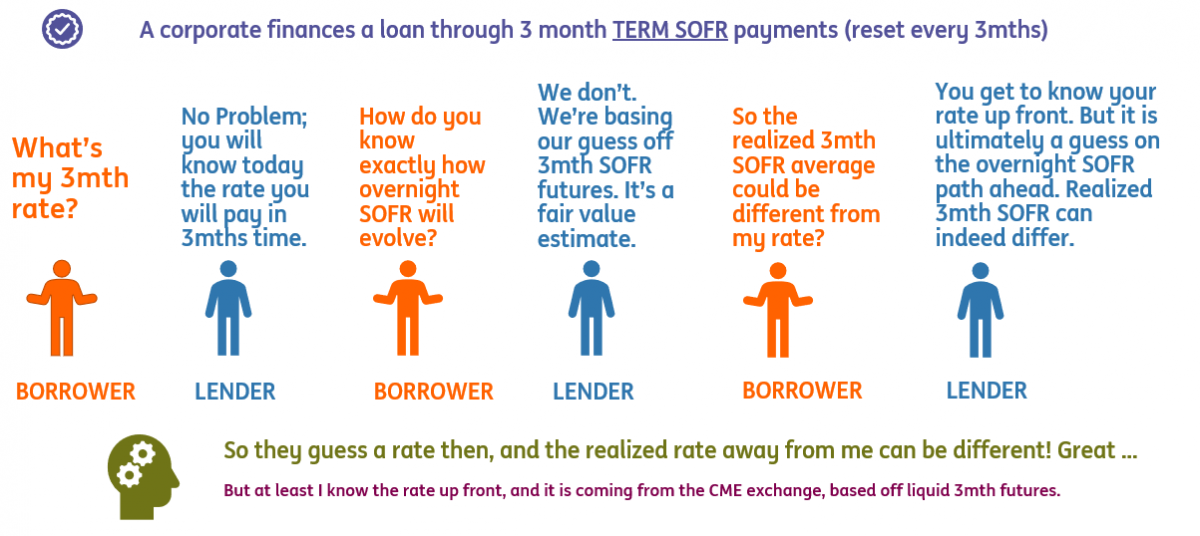

Term SOFR - the thought process

Term Secured Overnight Financing Rate (SOFR) is the preferred reference rate on the transition of legacy loans product from Libor. Which makes a degree of sense, as Libor itself is a term product. So taking term SOFR and adding a fixed spread to that at the moment of transition should not just leave the economics unchanged between the borrower and lender, but would also allow for a continuation of the practice of settling one payment today and then knowing in advance what the next 3mth rate will be.

While term SOFR is preferred in the transformation of legacy loans product, SOFR in arrears is, in fact, expected to be the reference for new loans business. At least that has been the direction of travel. This is certainly what the official sector would like to see, as it has been constantly pushing this as the preferred risk free reference rate for both loans and derivatives.

SOFR in arrears - the thought process

SOFR in arrears minimises the implied guess work (primarily through futures) required to determine the term rate, and allows the rate paid to be a pure reflection of the journey that overnight SOFR has seen throughout the 3mth period in question. The only mild complication is whether those daily rates are compounded, or calculated as a simple average. There is a difference, but it’s small, and would tend to even out over time. Although it would be higher in a higher rates environment (compounding effect is greater).

SOFR in arrears is theoretically the closest we can get to a pure risk free rate.

SOFR in arrears is theoretically the closest we can get to a pure risk free rate. In contrast, using a term SOFR rate involves some degree of supposition about the future. There is nothing shady about this, as such estimates would be fair value ones. But at the same time, guessing the future was something the official sector wanted to avoid when it came to re-framing the reference rate landscape away from Libor.

In contrast, using a term SOFR rate involves some degree of supposition about the future.

It appears that SOFR in arrears calculated through the daily simple methodology has the dominant position, at least in the US. That was certainly the case when there was no term SOFR rate guaranteed, with some in fact warning that there may never be one. Now that we know we will have one, the conversation have shifted towards entertaining the notion of referencing loans to term SOFR. This has not tipped the balance of preference away from SOFR in arrears through daily simple, but it has become a much more rounded discussion.

Key question - is there a cost difference between term SOFR and SOFR in arrears?

We find that term rates have had a tendency to overstate the level of future rates in the past, and are thus in all probability liable to do so again in the future. Not only does the term structure tend to be upward sloping, but most of the time the money curve is upward sloping too, even though most of the time the Federal Reserve is not hiking rates. Even if there is a neutral outlook to policy, the money curve will not be flat, it will slope upwards.

The 3mth term OIS has tended to overstate the actual Fed funds rate by 2bp (median) to 4bp (average) over the past 20 years.

Our calculations show that the 3mth Term Overnight Index Swap (OIS) tends to overstate the actual Fed funds rate by 2bp (median) to 4bp (average) over the past 20 years (see the chart below). In addition, during periods of stable low rates the overprediction from term rates tends to be higher, as the market sporadically predicts rate hikes to come that might not materialise - a natural reaction as the next change in rates is liable to be up.

How well 3mth OIS does at predicting the average fed funds rate over 3mths

If that is the case, in most circumstances there is an incentive for borrowers to favour SOFR in arrears over term SOFR. It may be just a few basis points here and there, but at the margin it is cheaper.

It’s not a huge saving though, and we could well go through periods where the markets do the opposite and produce an overestimate of rate cuts. If these don't materialise, this could result in term SOFR being a lower rate than SOFR in arrears. But such periods are not the norm.

Some will be happy to pay a very mild implied premium for the privilege of having certainty from term SOFR.

In any case, many players will like the forward looking nature of term SOFR, happy to pay a very mild implied premium for the privilege of having that certainty. This is in addition to situations where there is a short term liability that needs to be discounted up front with a term rate. For example, in trade and working capital finance, the use of a forward looking term rate is inevitable for this reason.

And what will be the preferred route from a derivatives perspective?

SOFR futures anticipate how the path of daily rates will evolve over the period ahead. So for example a 3mth SOFR future is a fair value guess on how daily rates will evolve over the 3mths ahead, where the absolute rate is a compounded average of those daily guesses, over the full 3mth period. In other words it's a guess on what the 3mth SOFR in arrears rate will be in 3mths time.

As these evolve out the curve we'd have a 1mth, 3mth and 6mth term rates, all structured in a similar manner (and eventually a 12mth too). They are all attempting to anticipate what the actual in arrears compounded rate will be at the end of the respective period. That, in effect, is the beginning of a full term structure. But here's the important point - should the interest rate swap (IRS) curve that evolves be one that has a term SOFR or SOFR in arrears payment on the floating leg?

The dominant ISR curve right now is one referencing SOFR in arrears on the floating leg.

The dominant IRS curve right now is one referencing SOFR in arrears on the floating leg, and so fixed rates right out to 30yrs and beyond are priced based off that. This provides a pure hedge for players that have referenced loans to SOFR in arrears (and the basis versus daily simple is tolerably low).

However, for loans that reference term SOFR, such an IRS curve would provide a good hedge, but not a perfect hedge. There would be a basis between the loan and the IRS. Most of the time it would be tolerably low. But on occasion it could be noticeable; around large unexpected changes in official rates. For example, let's suppose overnight SOFR was unexpectedly cut to -100bp due to dramatic events today, and a floating loan referencing a 3mth rate was reset in a few days before. Here, the payment due on SOFR in arrears would be significantly affected by the rate change (as it will be dominated by future overnight rates). However, term SOFR would remain at an elevated level, missing the impact of the -100bp fall in rates.

Most of the time the basis would be nowhere near this extreme. But then again, events like we had at the outbreak of Covid show that big unexpected jumps can indeed occur.

The term SOFR IRS curve would likely sit slightly above the in-arrears SOFR IRS curve.

There are two ways to solve this. One is to have a basis market between term SOFR and SOFR in arrears, where players that use term SOFR for loans can add an additional basis hedge on top of their IRS hedge so that they are 100% protected. Second, a SOFR curve that references term SOFR on the floating leg could evolve. This is not something that the official sector would welcome, as it could coincide with increased volumes in term SOFR (the official sector prefers SOFR in arrears).

If there were an IRS curve that referenced term SOFR, it would sit on top of the IRS curve referencing SOFR in arrears most of the time, and especially for longer tenors. The term SOFR IRS curve would likely sit slightly above the in-arrears SOFR IRS curve reflecting the tendency for term SOFR to be very slightly higher than SOFR in arrears (as described above). There could also be bigger deviations in the 2yr to 3yr maturities where there could be greater clarity on the path for rates in the relatively near term. We're typically talking quite mild deviations here, usually within a basis point, or perhaps a few basis points at times. But there will also be extremes (even if once in a decade) where it could be a lot more, as described above.

Bottom line, SOFR in-arrears should be the preferred rate for new loans business, and this should be bolstered by an interest rate swaps market structured in the same way. At the same time, term SOFR is in fact bolstered by a futures market, which generates good liquidity in term, adding to its efficiency. There is a strange derivatives combination here of a futures market that helps generate a term structure for SOFR out to 12 months. And then the in-arrears IRS SOFR curve steps away from term, and concentrates on realised outcomes. But in the end, the circle could or should be squared with a basis in term versus in-arrears and/or a term SOFR IRS curve.

And if that were not enough, there is the overlay conversation on whether or not to explicitly add a bank spread to SOFR like that obtainable from AXI (a.o.), or not. Or just go for simplicity and choose the all-in Bloomberg Short-Term Bank Yield rate (a.o.). More detail on that has been covered here.

Download

Download opinion

Padhraic Garvey, CFA

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Padhraic Garvey, CFA

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more