Signs of weakness emerging in Asia

Weak Korean GDP in 3Q18 could be a barometer for the outlook elsewhere in Asia

Korean GDP expands at only a 2.0% YoY rate in 3Q18

Korea has felt a bit like a 2% economy for a while, along with some others in the region. And while the 2.0% YoY 3Q18 GDP growth out-turn was on the lower side of expectations (consensus was 2.3%, ING f = 2.1%) it was not wholly surprising.

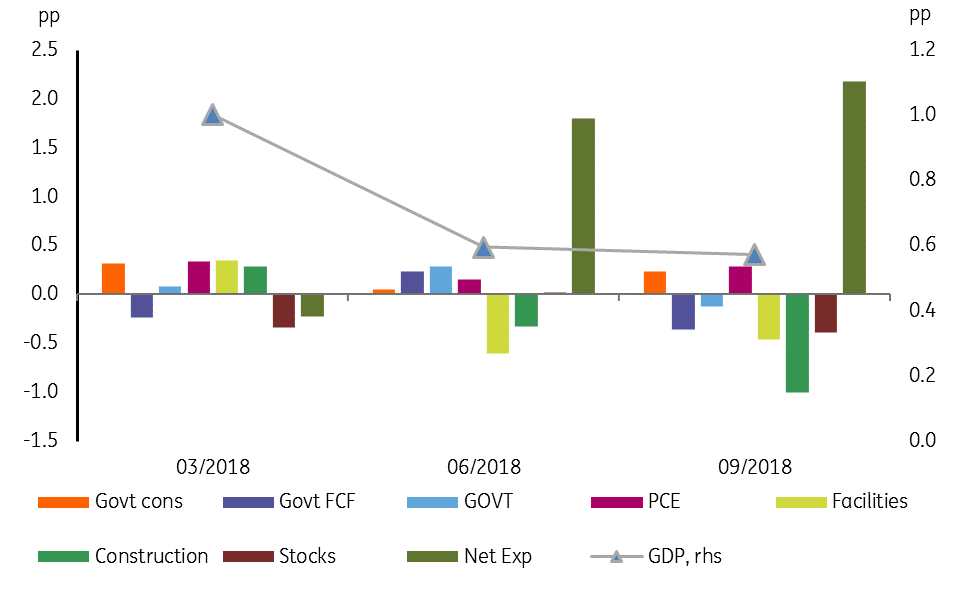

Indicators of capacity have been indicating an excess for some time, and a further negative gross fixed capital formation (investment) result had been on the cards. The scale of it, at -4.5%QoQ was, however, unexpectedly large, and alone stripped 0.4pp from the 0.6% QoQ growth total. Within that gross fixed capital total, construction spending was also extremely weak, falling 6.4%QoQ, and the only positives in this segment of GDP were intellectual property (IP) products. Some years ago, research and development and other components of IP were not even part of GDP. If we had been compiling the figures on the old basis, the year on year growth rate would have been below 2.0%.

As usual, personal consumer spending was one of the stronger elements of the release, providing 0.3%pp to the total QoQ growth And net exports provided their usual safety net, offsetting the falls in fixed capital. Without the net export boost, GDP growth would have been closer to 1.0%.

Contribution to QoQ GDP growth - Korea (pp)

Downward revision to GDP - implications for BoK

We are revising down our 2018 GDP forecast for Korea to 2.5% from 2.6%. The Bank Of Korea (BoK's) recent Economic Outlook revised the 2018 forecast to 2.7% from 2.8%. This would now need 0.8%QoQ in 4Q18, which we don't see happening. We are also revising down our 2019 forecast to 2.0%.

In the light of this weakness, the recent excitement over a possible November rate hike seems entirely misplaced. Absent an upside shock to the October CPI figures released on 1 November, we will stick with our "no change" call for the November meeting.

We ought to keep an eye out across the region given this weakness. Taiwan and Singapore share some, though not all, of Korea's economic characteristics. The only bright spot in this outlook is net trade. Given the current circumstances, feels rather worrying.

Global stocks and FX

While Asian stocks managed a mixed performance yesterday, with the Shanghai Composite even managing to end the day in the green, the rout in US stocks overnight suggests that today will be somewhat different. In currency space, the CNY still seems to be creeping higher and the 7.0 USDCNY level is still our target for the year-end, though we now see this being breached in 1Q19 and reaching 7.30% by the middle of the year.

Elsewhere, Asian FX seems to be holding up reasonably well, especially the high yielders. Falling oil prices could be providing them with some fundamental support. This is more than can be said for the EUR, which now has a 1.13 handle. The market may be selling US stocks, but it is still buying US treasuries, and that is keeping the USD supported, relative to the Euro.

At today's ECB meeting, ECB President Draghi will probably try to put a brave face on the outlook and suggest no re-think on the ECB's normalization schedule. Italy is likely to be centre-stage of the Q&A session, and it is hard to see how Draghi can say anything helpful here. If Italy begins to accede to the stability and growth pact rules, then the ECB can lend assistance, if not, it can't. As for Italian Banks, and using Italian Treasury bonds as collateral for liquidity, this could be an issue of Italian sovereign debt gets downrated to junk, but under such extreme circumstances, we imagine the ECB would be imaginative with its rules on eligibility. It has been before. But it won't indicate this today.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

25 October 2018

Good MornING Asia - 25 October 2018 This bundle contains 2 Articles