Sentiment supports uneasy market gains ahead of Jackson Hole

Asian FX gains against the USD, commodities rallying, bond yields rising and equities claw higher. But a hint of taper could undo all of this. Eyes down for Powell later this week.

Sentiment lifted by US budget progress

It is undoubtedly a statement of the blinding obvious that sentiment is driving markets currently, as it always does. That said, these days it is harder and harder to find an underlying cause for swings in sentiment, which appears most days to have a life of its own. Today though, one development may be helping, and that is the US House of Representatives adopting a $3.5tr budget resolution, which should also aid the passage of the $550bn infrastructure bill and spare us from Filibusters in the Senate. That's good news in terms of the outlook for US growth. And this probably helped US Treasury bond yields to stage a decent rally yesterday by recent standards, with the 10Y yield rising a little over 4bp to 1.294%.

What happens today is a little harder to call, with sentiment positive but vulnerable to shifts ahead of the Jackson Hole conference which features Fed Chair Powell on Friday. Part of the sentiment improvement may lie with recent thoughts that this weekend's conference will not deliver any further insight into the timing of any Fed taper. Or possibly that it may temper some recent suggestions that this taper will be more imminent than first thought likely. I suspect we will still be no wiser in terms of the Fed's intentions by Monday morning, and that may be enough for the optimists to keep sentiment positive.

Positive sentiment is also presumably behind a slightly weaker USD over the last couple of days. EURUSD has risen to 1.1756 from about 1.1740 this time yesterday, and we've also seen some reasonably broad (if minor) gains in Asian FX. The THB is the standout here on suggestions that it may relax its movement restrictions and learn to live with the virus. But with low levels of vaccination, and still high cases and death rates (Thailand ranks 12th globally today for daily Covid-19 deaths on Worldometer's figures) this seems a contentious decision. In any case, we doubt even vaccinated tourists will be rushing to the beaches of Thailand anytime soon just because they open their borders. Potential tourists also have to consider how they will be greeted on their return home. 2 weeks of mandatory quarantine in a hotel can really spoil that holiday feeling. Prakash Sakpal states that he is not "rushing to revise our end-year USD/THB forecast of 35.00 just yet given that the underlying economic fundamentals remain extremely unfriendly for this currency (spot 32.89)"

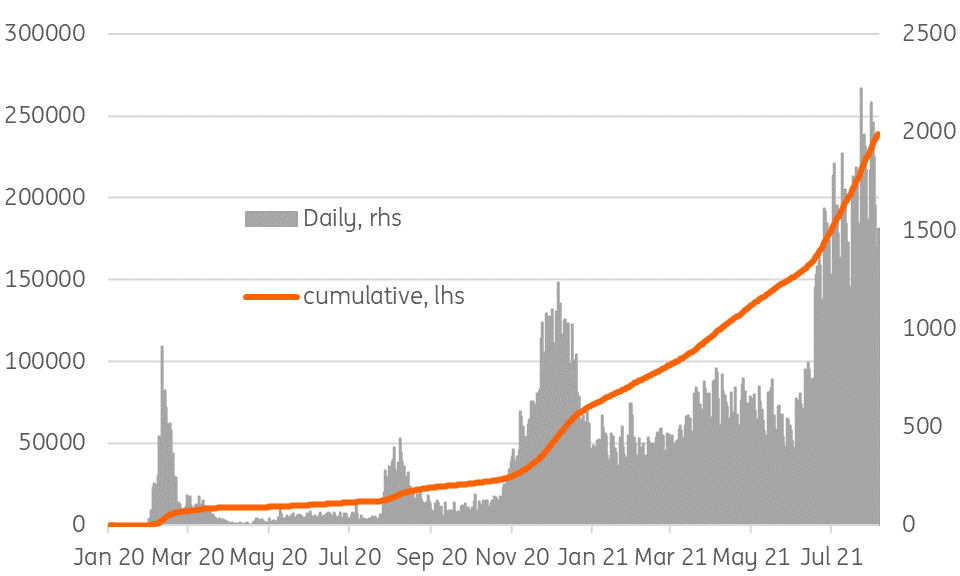

The KRW was also at the top end of the pack in terms of Asian FX, ahead of a very tightly considered rate decision by the Bank of Korea tomorrow. 10 of 19 economists surveyed by Bloomberg (including ourselves) are suggesting that the BoK will hold fire tomorrow, (perhaps taking their lead from the Reserve Bank of New Zealand) against the tricky backdrop of the rising Delta variant across the region). South Korea's current daily Covid-19 case tally is more than 1,500. That is high for Korea, but it is down from the 2000+ it was recording a few weeks ago. You could argue that this is enough to allow for a rate hike tomorrow, especially given yesterday's release of some further rapid increases in household debt. But it is a very close call. A BoK hike is certainly coming, so if not now, then within a month or two.

Korea: Daily Covid cases and cumulative total

Quiet day ahead for Macro data

There isn't much on the economic calendar in either the G-7 or Asia-Pacific to get your teeth into today. Some import-dominated trade data has pushed the July NZ trade surplus into deficit by more than expected this morning (-NZD402m), which is weighing on the NZD. We have seen quite a few trade figures across the region illustrating that pattern of more rapid gains in imports than exports, which may reflect the impact of re-opening. That's encouraging on some levels, but it may put some of the more fragile currencies under strain as they emerge from the latest wave.

Prakash Sakpal gives us his thoughts on Malaysian inflation for July also due today. "After hitting a four-year high of 4.7% YoY in April this year, Malaysia’s inflation slowed to 3.4% in June. We expect today’s data to show a further drop to 2.9% YoY, in line with the market consensus. This deceleration stems from softer domestic demand amidst the worst Covid-19 outbreak currently, while base effects also fade. By product types, housing and transport have been the main inflation drivers here. We see inflation settling down between 2-3% in the second half of 2021, putting the full-year average near the low end of Bank Negara Malaysia’s 2.5-4.0% forecast range for the year. Still, elevated inflation doesn’t have any bearing on the BNM policy, which we expect to remain in a holding pattern well into 2022".

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

25 August 2021

Good MornING Asia - 25 August 2021 This bundle contains 2 Articles