Rising unemployment rate isn’t always bad news - Korea

South Korea's unemployment rate rose from 3.8% to 4.5% in May, but employment is increased too on a monthly basis, so if such a thing is possible, this is a “good” rise in the unemployment rate

When is weak data actually good data?

The unemployment rate is one of the quirkiest numbers in economics, in a very quirky pool. Why? Well for one, it is calculated from two potentially unrelated pieces of data. The rate is calculated as the numbers of unemployed divided by the labour force (economically active members of the population, including those who are unemployed but ready, able and looking for work) and expressed as a percentage.

The numbers of unemployed are simple enough, though it is worth pointing out that changes in the number of unemployed are not the same as the negative of changes in the numbers of employed (though again, confusingly, it can be). The labour force, in contrast, is a complicated beast, and can swing all over the place, and can rise or fall in good and bad times alike. In good times, more people can enter the labour force if the prospects of working and the rewards from doing so increase. But likewise, this can rise because of hardship too, as people are forced to look for employment to make ends meet. Equally, bad times can drive people back out of the labour force as they give up looking for work after becoming despondent about their chances or the rewards from working. Or they may drift back out of the labour force again in good times since household earnings may be adequate with just one worker in the family.

So what is going on in Korea right now?

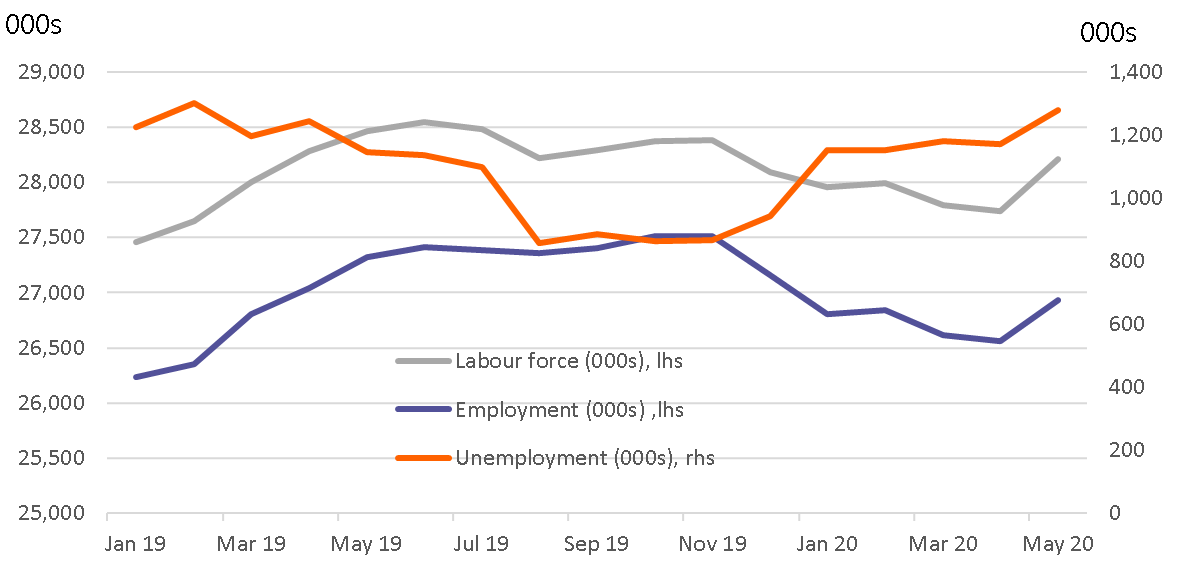

We are used to looking at figures in Asia in a year-on-year comparison, but given the impact of the coronavirus, we really ought to look at employment in terms of actual numbers (levels) and see how they are moving relative to recent months. Doing this, we see that total employment in Korea rose from 26,562 thousand in April to 26,930 thousand (up 368 thousand). Sectors seeing a strong recovery included business / personal services and construction. Now admittedly, all of these employment levels are down from where they were a year ago, but it is going to take a little longer to regain pre-Covid-19 levels of employment, so let's look at this realistically. That said, another month like May would take us within spitting distance of such pre-Covid-19 employment levels. Though realistically also, May probably contains the bulk of easy job gains as the economy returned to a more normal footing having successfully suppressed their Covid-19 outbreak in March and April.

Despite the rise in employment in May, there were still flows into unemployment. As employment/unemployment is a two-way flow, not the flip side of a coin, as well as the rise in employment in May, we also saw unemployment rise by 106,000. The numbers of the economically-active population (labour force) also rose, and as stated earlier, this isn't always a bad sign. But the increase of 405,000 from (27,734K to 28,209K) was smaller as a percentage increase than the percentage increase in the number of unemployed (see chart below for some comparison). In simple maths-speak, the denominator rose proportionately less than the numerator, and that is why the unemployment rate rose.

In short, you could put this down as that counterintuitive result of a "good rise in the unemployment rate". There's nothing here for the Bank of Korea or the Korean government to get worked up about and respond with policy changes. The recovery is underway - it may not be fast, but the direction is acceptable.

Korean labour force data

The day before the Fed

By the time we wake in Asia tomorrow, Fed chair, Jerome Powell and his colleagues will have decided what, if anything, to do with US monetary policy. And to summarise the views of James Knightley's linked note here, it will be mainly about offering soothing words that the Fed isn't likely to do anything silly (like tightening) any time soon, and is more likely to do further easing.

The form of such easing is likely, in JK's view, to be yield curve control (like in Australia) rather than negative rates, which was the market's view until recently. Bond yields have risen recently in the US, but as that was in response to better economic data, this isn't something the Fed needs to fight against, at least not just yet.

Will markets be happy with a Fed meeting that doesn't deliver massive further stimulus? It's hard to say. I feel they need more than this to go up substantially further, but it may be sufficient to prevent an actual sell-off if it looks like the easy money is going to be here to stay for months, if not years

Elsewhere in Asia

In Japan, core Machinery orders were down 17.7%YoY. This is an April figure though, giving us a snapshot of business investment at the height of the global pandemic. As such, it is a bit historic, though hints at the scale of the downturn in the business investment component of 2Q20 GDP. Orders were 12% lower from March.

And moves towards reopening in Asia are gathering pace, as Prakash Sakpal notes below:

Malaysia: The next phase of relaxation of the Covid-19 Movement Control Order (MCO) in place since mid-March begins today. In the so-called “recovery phase” lasting until 31 August nearly all activities in social, educational, religious, economic, and business areas, as well as domestic travel except to the disease hot-spots, are allowed to reopen. International travel, pubs, nightclubs and theme parks still remain shut until end-August. The disease is under control, though the recent rise in infections among migrant workers has raised the odds of a second wave of outbreak.

Thailand: The government is considering more measures to stimulate consumption and domestic tourism as part of its economic recovery plan for the second half of the year. The resumption of international travel by 4Q with countries recovered from Covid-19 pandemic is also under consideration. Yet, with weak domestic demand, plunging exports and virtually no tourism, the steepest GDP fall since the 1998 Asian crisis remains the baseline for the year; our 2020 GDP growth forecast is -5.4%".

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

10 June 2020

Good MornING Asia - 10 June 2020 This bundle contains 2 Articles