Poland: Moody’s preview

We expect Moody’s to maintain Poland’s current rating assessment (A2, outlook stable) during Friday's review, but it may hint at a change in outlook in 2H18. Given positive surprises on the fiscal side and supportive macroeconomic conditions, we expect Moody’s will improve the rating outlook in 2H18.

During the review the agency should upgrade its Economic Strength assessment based on stronger GDP (both nominal and per capita) and lower volatility of growth. Maintaining solid GDP dynamics (we expect 4.4% YoY in 2018 vs. 4.6% YoY a year ago) should significantly improve the assessment during the next review in 2H18, as Poland’s economy converges towards developed economies.

Institutional Factors

The institutional assessment should not deteriorate strongly despite political controversy. Both the rise of CPI volatility and the drop in World Bank Governance Indicators tracked by Moody’s were too benign to weigh on the rating. Further deterioration of this pillar is still possible and poses a downward risk for future reviews.

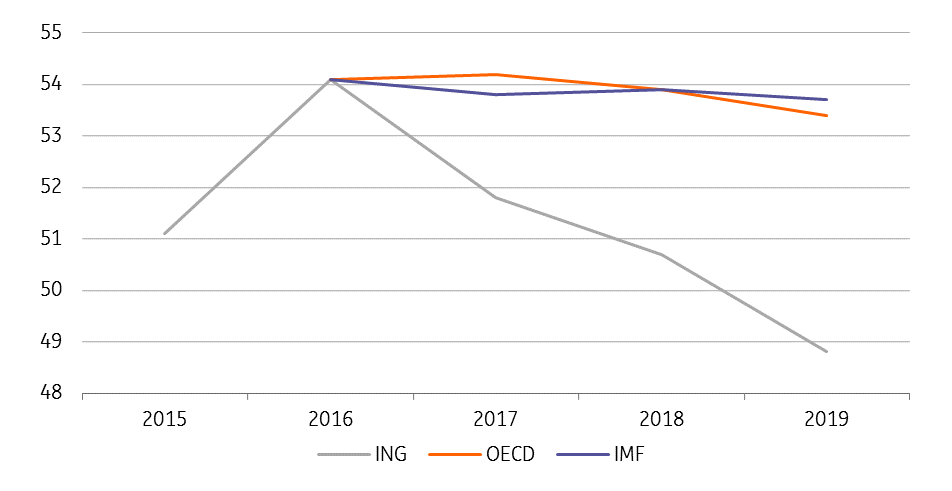

General Government Debt/GDP (%) - Forecasts

Poland's sound fiscal standing calls for an outlook improvement during the next review. The 2017 general government deficit is expected to be lower, by even 1ppt compared to global institutions’ forecasts (we expect 1.7% of GDP vs. IMF at 2.7%, OECD at 2.1% and EC at 1.7%). A similar situation occurs in the case of 2018 forecasts – international institutions, except the European Commission, do not perceive the tax collection improvement as persistent (the IMF forecasts the general government deficit at 2.6%, OECD at 2.3% and EC at 1.7% vs. ING at 1.5%).

We expect Moody’s to take a more conservative approach this Friday, as the official (and likely upbeat) 2017 general government deficit will be published in April. The agency’s fiscal forecasts are likely to present a debt-to-GDP ratio around 50-55% of GDP for the projection horizon. Secondly, the agency will likely take conservative assumptions of debt service costs based on a more aggressive interest rate path compared to the MPC forward guidance (policy remains "status quo" in the official institutions’ recommendations).

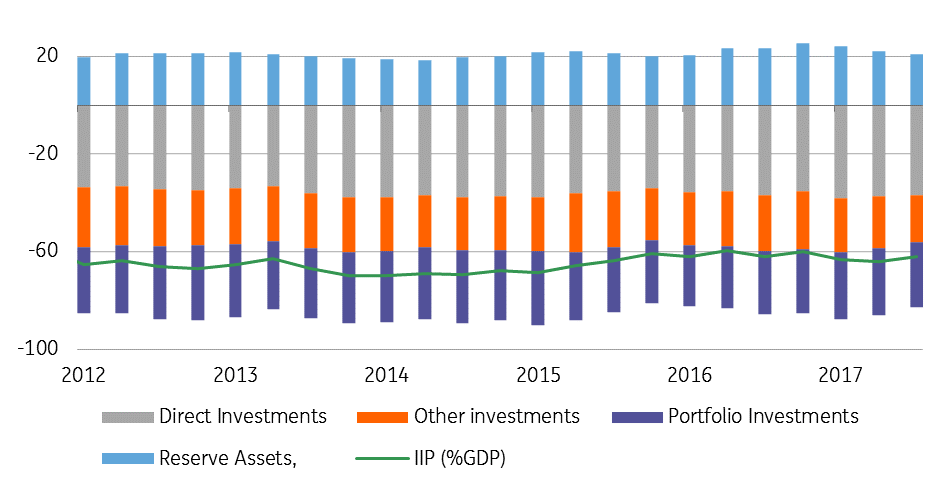

Net International Investment Position (%GDP) - structure

Thus we see positive surprises from deficit utilization in 2017 and 1H18 data as factors that should convince the agency to improve its fiscal forecast throughout the year. Given that, the fiscal stance is also likely to achieve a higher grade.

The assessment of susceptibility to event risk is unlikely to change as the negative net international investment position remains stable at -62% of GDP, whereas the European Commission highlights 30% of GDP as a low risk level (Moody’s classifies this as a medium risk). On the other hand, Poland has lowered risks related to government liquidity (lower share of foreign financing) and banking sector stress (assets-to-GDP and credit-to-deposit ratios have improved).

Consequently, we expect Moody’s to upgrade Poland’s rating outlook (currently stable) to positive during the next review in September. The agency may hint at such a change this Friday, but an actual upgrade (both in terms of the outlook and the rating) is unlikely.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion