No turning back

They've only gone and done it! Tariffs, that is.

Trade war starts this lunchtime - early lunch anyone?

I have to confess that now the canoe is very clearly headed over the edge of the waterfall, I am not sure why US equities staged a small rally yesterday. Were they taking some cold comfort from Fed minutes that noted that the trade war increased global risks? If so, it is a bit like the rallies that preceded the global financial crisis as the Fed cut rates at the back end of 2007. Short-sighted? Well yes, really. By 12:00 today, Singapore time (and thereby Beijing time and most of the rest of Asia) tariffs on $34bn of Chinese goods will be implemented, and at about 12:00:01, Chinese tariffs on a like amount of US goods will follow. We may look back on this period as one of the greatest acts of economic folly in our lifetime, though send me an email if you can think of worse. That will make interesting (though probably quite brief) weekend reading.

Sure, we will all wake up on Monday and the sun will still rise. Most of us will still have jobs to go to. And our incomes will still likely be enough to provide basic food and shelter for ourselves and our families. This is not economic armageddon. We will not have to hunt our food with pointy sticks. But it is applying the brakes to a global economy that has less durable momentum than appears to be the case. And which is still saddled with heaps of debt, and which has few policy tools left in the box to answer a slowdown of this sort, save to undo the damaging policies that could lead to a recession. It's too late to hope that reason will prevail, but hopefully, this period of economic nihilism will be short-lived. I wouldn't bet on that though. There is every chance that it gets worse before it gets better.

On a separate note, if you have access to Bloomberg, please read an excellent piece by Cameron Crise on 'Daybreak' (<DAYB> Go). writing about forward-guidance. It isn't related to my rant above, but it needs spelling out, and he does it brilliantly.

| 2.8% YoY |

Expected US June hourly wages growthUp from 2.7% in May |

US jobs report

Yesterday's ADP survey, still the best of a very bad bunch of month on month forecasting tools for figuring our US non-farm payrolls (jobs to the rest of us), came in at 177,000. This is a little lower than the 189,000 recorded for the previous month, and a little lower than the 190,000 consensus payrolls forecast for June. But here's the point, NOT MUCH. And without doing the statistical tests to prove it, pretty obviously not statistically significant from the consensus view, even if indeed it proves to be an accurate forecast this month. Nor is it worth getting too excited over wages growth. As we wrote yesterday, even if we do see wages growth picking up to 2.8% as expected, and to 3.0% by August's release (seems highly likely) wages growth will still be historically very low, and very low adjusted for the rate of unemployment, and require no change in Fed policy other than to keep cautiously hiking. And that adjective, 'cautiously', encompasses everything from only one more hike this year to two, and everything from two to four hikes next year. The data will tell us how much. Not the Fed (there, I did manage to get in a reference to forward guidance after all).

May - make or break, though probably break

UK PM, Theresa May, meets her cabinet colleagues at the official retreat, Chequers this weekend, to try to thrash out a deal on Brexit. Having failed to satisfy everyone, my guess is that she will present version of Brexit that looks much like the 'Norway' option, in other words, membership of the single market for goods, but opt-outs and cherry picking on everything else. My guess is also that in trying to appease everyone, she will anger everyone. The EC will hate this, and so will her cabinet, though not for the same reasons. The EU is stepping up preparations for 'no-deal'. I think they are very wise to do so.

Asia today

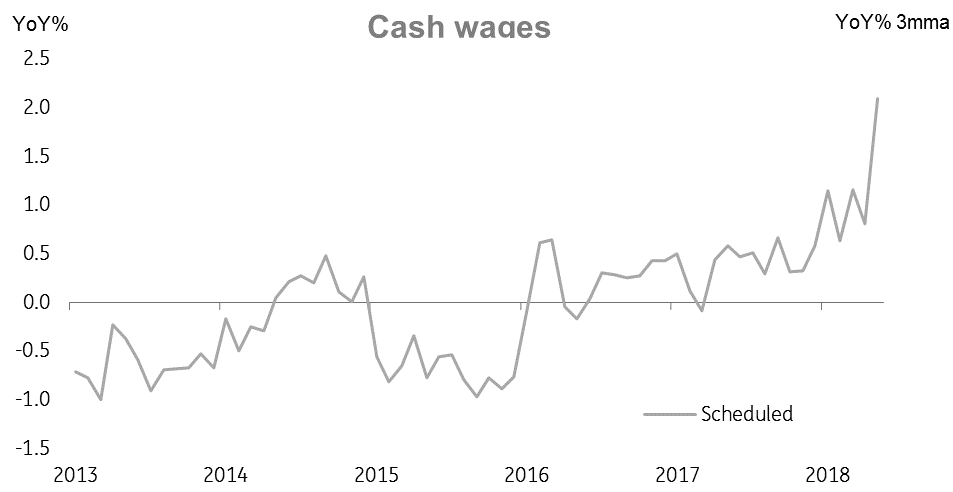

Japan's labour cash earnings are a good measure to watch, and they have picked up recently. They are one of the reasons we are clinging on to a moderate growth forecast for Japan this year (1.0%), despite the loss of momentum shown by indicators like this week's Tankan survey. But notwithstanding a decent 2.1% YoY increase, they don't seem to be providing much of a boost to household spending, which fell a very nasty 3.9%YoY in May. We need a bounce in these figures, and soon, or we will be taking the axe to the Japan GDP forecasts, and looking hard too at the consumption tax hike scheduled for October 2019.

Elsewhere in the region, the day offers little more than some foreign exchange reserve data - not too interesting except for the current account economies, Philippines and Indonesia.

Japan: Labour cash earnings

Download

Download opinion

6 July 2018

Good MornING Asia - 6 July 2018 This bundle contains {bundle_entries}{/bundle_entries} articles

Robert Carnell

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years.

Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Robert Carnell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more