nCov - Caution kicks in

Markets look nervy, though the rate of new cases is not accelerating

A look at the latest nCov data

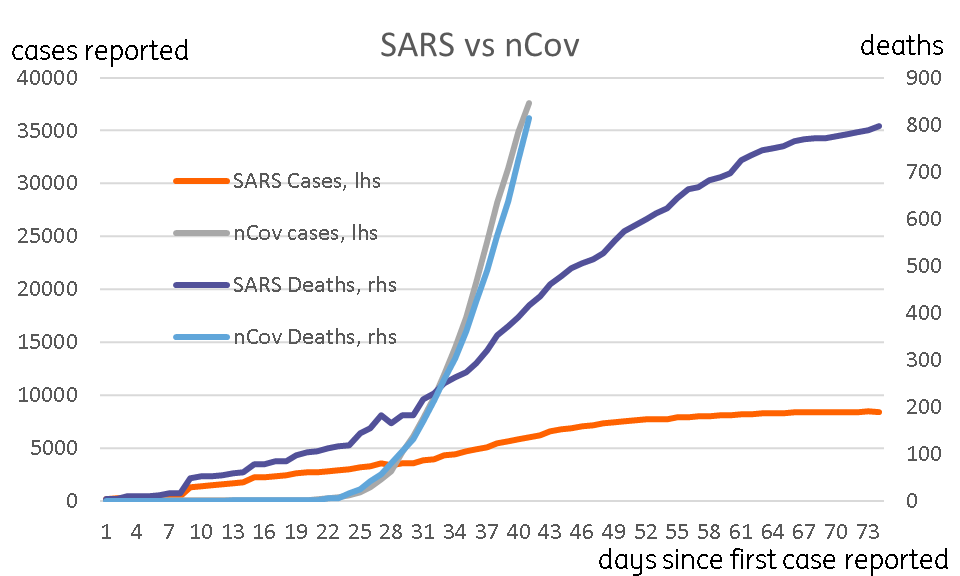

There are two ways of looking at the spread of nCov, one is to focus on a snapshot of latest data - Worldometer has been a reliable supplier of these numbers, adding to the World Health Organisation (WHO) daily tally some additional figures that are reliably published subsequently elsewhere. At the time of writing, this total stands at 40553, with 910 deaths. On both counts, this is now well in excess of the SARS epidemic of 2003 (in the charts below, I use different axes to compare the figures, so take care when interpreting the lines).

nCov2019 and SARS

Rate of change probably more important

The second and probably more important consideration than the total number of cases and the death toll is the rate of increase in new cases. This tells us if the disease if spreading out of control. I take these figures from the World Health Organisation daily situation report - this is published at the same time each day, so we can consider it as a reasonably reliable guide to new cases in the last twenty-four hours. And very helpfully, we can create a time series from this news. Moreover, despite the markets' apparent caution today, considering how upbeat it got on unsubstantiated claims of vaccines last week, the news isn't all bad.

The total number of cases is increasing at a slower rate - put another way, the numbers of new cases each day is slowing.

New Cases - Total and Ex-China

Consider the numbers as distinct cohorts

Considering that the cases of nCov are so completely dominated by China and Hubei in particular, it is a good idea to consider the numbers as distinct cohorts. On the one hand, we have the origin of the nCov epidemic in Hubuei is where the vast majority of cases are recorded, and as we know, it is in lockdown. Given the travel restrictions elsewhere in China, we can therefore likely consider cases in China independently from the rest of the world. Outside China, is it more than two weeks since the travel restrictions came into force, so any new cases cannot be put down to Chinese tourists getting sick, or to evacuees from China to other parts of the world becoming ill, as these should have already moved outside the asymptomatic incubation period of 2-14 days.

Now, any new cases outside China are increasingly going to be driven by community transmission. So this is perhaps the most obvious way to tell if the disease is getting a toe-hold in other parts of the world. The infographic below highlights this segmented approach to looking at the data.

nCov cases form discrete populations

Ex-China cases not accelerating

As the chart preceding the infographic showed, new cases outside China are not accelerating. I won't say they are decelerating since the data is very choppy, and given that the total numbers are in any case still quite small, only 307 according to the WHO situation report number 20, it will take a bit more watching of the numbers before we can make such a bold claim. But the absence of a clear accelerating trend is also a cause for some optimism. Things can change very quickly though, and given the tendency for this disease to lie hidden in populations before becoming symptomatic, we are still treating these ex-China cases with extreme care.

But even within China, the aggressive containment measures seem to be paying off, with figures for most big cities and regions showing a slowdown in new cases. We show some of them (not necessarily those with the most cases) below.

In short, the market's caution may be warranted, but it is an interesting change of heart from its recent behaviour, where it needed unambiguously bad news to trigger risk aversion.

New nCov cases in China provinces

Asia today

The main news from Asia today has already happened, with the PBoC and Chinese government providing targeted assistance to firms affected by the coronavirus, and in some cases, in the front line fighting the virus. Iris Pang has covered this in the linked note.

Other data, including China's aggregate financing data for January and PPI are unlikely to be particularly market moving.

Download

Download opinion

10 February 2020

Good MornING Asia - 10 February 2020 This bundle contains {bundle_entries}{/bundle_entries} articles

Robert Carnell

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years.

Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Robert Carnell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more