Markets - still happy

We wrote yesterday that markets seemed happier. Today, the Pollyanna market trend continues stronger than ever with a big sell-off in the US Treasury market. Brexit, US macro and trade-related news are all feeding this feel-good factor. I can't help feeling that there are two sides to all these stories.

First, the US data...

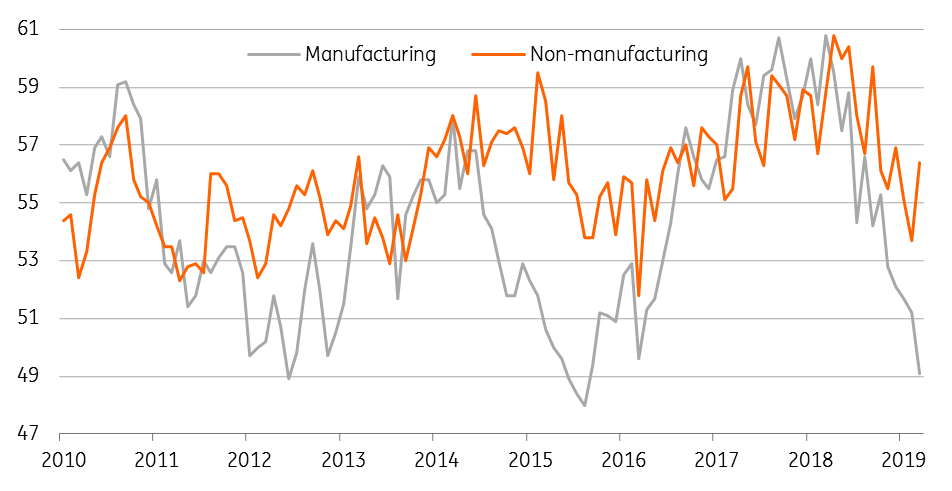

A surprisingly strong non-manufacturing ISM index yesterday is good news and undoubtedly helped fuel the sense that things in the US are still holding together remarkably well. but this divergence with the manufacturing sector, which has dipped into contraction this month, is unusual. OK, the manufacturing sector is not the powerhouse it once was, but the service sector still usually dances in tune with it, for no better reason than that manufacturing often drives demand for services - transport, insurance, storage etc. Divergence can occur - as it did back in 2015 - and can persist for some time. Back then, the non-mfg ISM eventually descended to come into line with the mfg series. I suspect that will be repeated this time too. So whilst welcome, I'm a bit cautious about how long this situation can last.

We also have some more colour on the impact the trade war is having on the US in the form of the Challenger Gray and Christmas labour survey. This long-standing report is now asking a question in its monthly survey about jobs that are lost due to trade-related difficulties. Last month, this apparently accounted for more than 10,000 job losses, though I should add that we lack any history for this to make sensible deductions about whether this is particularly bad, or quite normal. It sounds high though.

Strong ADP data too (+195,000) are helpful ahead of today's non-farm payrolls. It's worth bearing in mind though, that any outsize payrolls figure today could contain an upwards distortion from hiring for the 2020 census - according to some reports I have read, this could amount to a 40,000 contribution to today's number. The private/total payrolls split will be worth a second glance later.

Anyway, for the expert view, please refer to James Knightley's note (see link).

Manufacturing and non-manufacturing ISM

Trade talks in Ocotber

Markets are also taking a pre-weekend happy-pill from confirmation that the US and China will resume trade talks in October. But while talks are better than no talks, ask yourself this question: "Is the US about to scale back its demands on China to secure a trade deal?" If not, "Is China about to relinquish its stance on state-owned enterprises or intellectual property?". if the answer to either of these questions is "No", then this is not a rally you should probably be chasing (I think the answer to both is no, and that October may result in a further increase in tariffs and retaliation).

Indeed, the US has reason to believe that its tough stance on China is having results, at least if the bilateral deficit with China is any guide (see also this from Knightley).

Furthermore, as my colleague Iris Pang points out this morning the US is not making it easy for China to be more flexible: She says, "The US has just sent nine Chinese students from Arizona State University back to China after they were detained at the airport. And, the US has also claimed that Huawei’s case will not be discussed at the October meeting. This suggests that the US may not be ready to give any concessions to China. Recently, China’s stance has been very firm on 1) requesting the US to respect China setting its own pace to enhance its own laws, including on intellectual property law; and 2) to lift all imposed tariffs before a deal can be reached. These two items make the room for discussion very small".

Moreover, it is not like we have not been here before. Financial markets are behaving like a dim-witted but adorable puppy that you keep giving a rubber bone instead of the juicy steak it thinks you have for it. It is very sweet that it keeps falling for the same gag over and over again, but really...?

Brexit - is this really good news

Even the Brexit farce seems to be playing into the market's optimism today, and the GBP has pulled back from GBPUSD1.20 to closer to 1.24 today.

But this seems to be because the UK may not now crash out of the EU on October 31. It may still crash out. And I can't see how an election helps. But here is James Smith for a possibly less jaundiced view of all of this.

That's it for 2 weeks!

This will be the last note from me for 2 weeks or so, as I board the flying bar that is the non-stop flight from Singapore to Newark, US tonight. I'm looking forward to catching up with Knightley et al, and returning with my tales from America in 2 weeks time.

Until then, good luck!

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

6 September 2019

Good MornING Asia - 6 September 2019 This bundle contains 4 Articles