Markets at a crossroads

Correlations between bond yields and equity prices are turning negative - could this be a sign of a looming market correction?

But first...EM inflection point reached?

As promised yesterday, here is a more detailed consideration of the excellent speaker comments at the recent EMTA meetings in Hong Kong and Singapore. My thanks to the panelists from both buy and sell-sides, and to the audiences who provided me with such rich information in terms of their market views.

Now, what about those markets?

10Y US Treasury yields are little changed today, but US stocks have fallen further. In recent months, that pattern has not been observed. Instead, we have seen the usual, equities rise, bond yields rise, equities fall, bond yields fall. In other words, it has looked as if markets are being driven from the equity side. Bonds come along for the ride. Their increase in yield never really threatening the valuations of the equity markets.

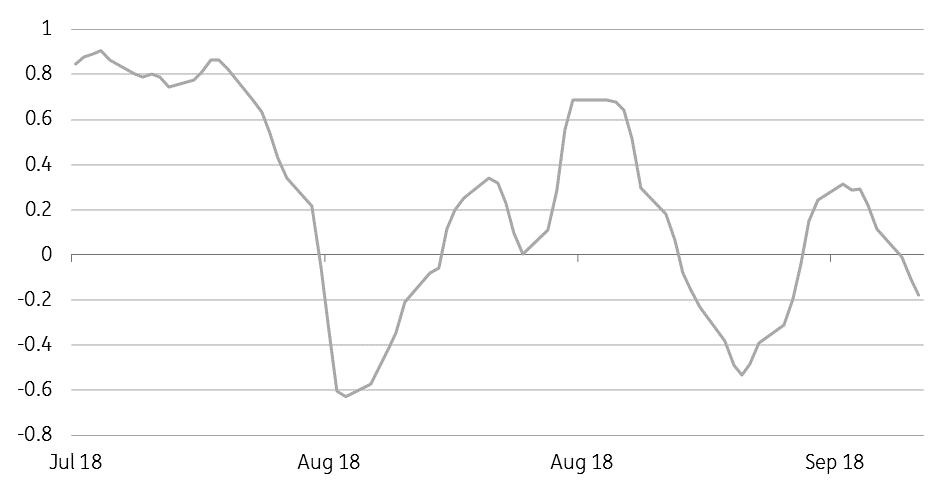

To see if there is any possibility of that relationship changing, the chart below looks at the 10 business day change in 10Y US Treasury yields and tracks its 20-day correlation with the change in the S&P500 over the same period. Right now, it is slightly negative. In other words, equities can fall, and bond yields can still hold up, or put another way, a rise in bond yields can push equities down, and not simply be snuffed out in a circle of positive correlations, which drag bond yields back down again.

To be fair, this isn't particularly pronounced just yet, so it is premature to be calling the next big crash. But big crashes start life as small movements, so this is worth watching.

We've seen two similar periods of bond yield generated corrections in equities in recent times. The first the big November 2016 reversal in bond yields, which saw about an 80bp increase in yields. The more recent June 2017 move was only about 20bp, though quite sharp. On both occasions, the 20-day correlation between the 10-day change in bond yields and equities approached -1.0. Right now, the correlation is only -0.17. But if it gets to -0.5, things could look a bit more interesting.

20 day correlation of 10-day change in 10Y Treasury yield, S&P 500 price

Asia Day ahead

With G-7 equities on the slide, but bond yields holding up, the Asia market backdrop should be somewhat negative, though in currency space, it looks mixed rather than outright negative right now.

Japan released some very strong core machine orders data for August, building on the good July figures. Together with decent household spending figures, strong investment should deliver a robust 3Q8 GDP figure. Another reason for the BoJ to keep edging away from quantitative easing

Philippine August trade data is also due out later today. Consensus expectations are for little change to the July deficit of $3546m. The Peso has actually been performing remarkably well in recent days. Signs that markets may be getting more relaxed about the backdrop for EM, or potentially, a reward for past and expected policy action.

China could release money supply data today. If so, we would anticipate an increase in new yuan loans from last month.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

10 October 2018

Good MornING Asia - 10 October 2018 This bundle contains 3 Articles