Japan: Abe’s gamble

Japan’s PM Abe has gambled that a snap election will return him as PM, and give him the mandate to push through his policy agenda

Why did PM Abe call the snap election?

Prompting the snap election was a sense that PM Abe had benefited from a recovery in public opinion, following North Korea’s recent display of belligerence. He is also no doubt aware that the opposition party, the Democratic Party of Japan (DPJ), is in deep disarray.

Recent Japanese data has also been strong. Abe will claim credit for this, though Japan’s strength is mirrored elsewhere in the region, and Japan seems to be riding on the crest of global demand for Asian goods, including its own. Japan’s GDP is strong (for Japan) and unemployment is very low. Even the inflation rate seems to be slowly heading higher, it remains well below what we see as the BoJ’s utterly non-credible 2.0% target.

A controversial policy move

If he wins the election, Abe has pledged to raise the consumption tax rate by 2ppt to 10% (not an obvious vote winner) in 2019. Instead of using the proceeds of the tax hike to work down Japan’s deficits, as previously promised, Abe has promised to spend the money on enhancing education, especially pre-school care for would-be returning mothers.

Japan’s weak potential growth is a function of a shrinking labour force.

As a policy move, this makes some sense. Japan’s weak potential growth is a function of a shrinking labour force. Japan’s female participation rates are lower than they could be, though on an international context, Japan compares favourably with some of the bigger European countries on this metric.

From a macro perspective, such policies will provide a boost to potential output, but probably a very small one. The construction of facilities to provide these services will, however, deliver a bigger short-term bounce.

Even so, it is difficult to see a rise in the consumption tax being neutral with respect to the economy, and at best, we envisage the re-distributed revenues and ensuing activity dampening the hit to demand.

| 10% |

Pledged consumption taxup by 2pp |

Will it actually happen and what could the consequences be?

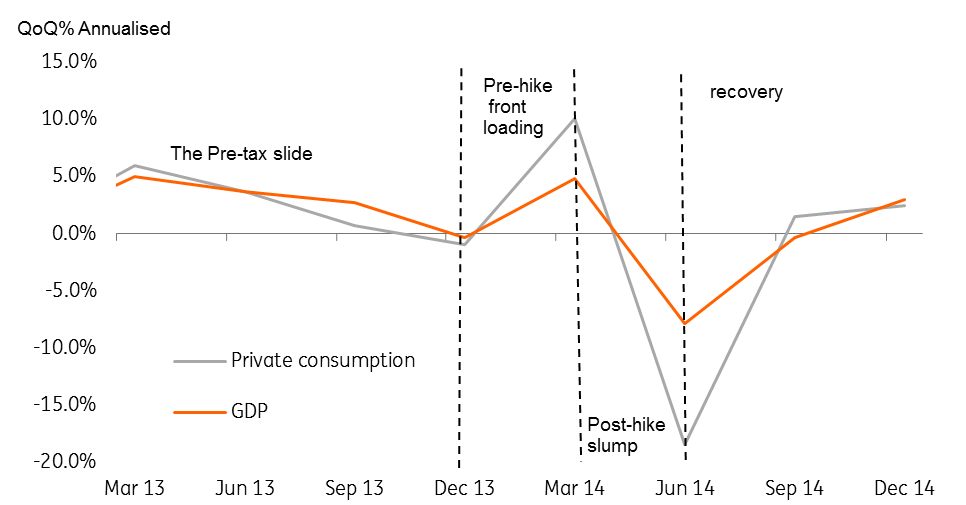

Having been through these tax hikes before, there is a well-worn path for forecasting the outcome, which entails a pre-April 2019 spike in consumer spending and construction to front-run the tax hike (anything from new homes to toilet rolls will be pre-stocked), followed by a slump, and a slow grind back to previous growth rates.

Abe has pulled back from implementing tax hikes before, and it is possible he does so again. He has built in an opt-out into his pledge, saying that the tax hike will go ahead unless it is likely to weaken the economy. And there remains considerable scepticism in the region about a 2019 tax hike. But with growth currently strong, we are now formally incorporating the consumption tax hike and spending pledges into our growth and inflation numbers.

The 2014 consumption tax hike

A win for Abe?

Despite no coherent opposition, this election is still a gamble for Abe. As we wrote two months ago, a new political order is shaping up in Japan, resulting in the sweeping Tokyo election victory for Mayor Juriko Koike. Her Tokyo movement is now trying to join forces with the disbanded DPJ to form a national “Party of Hope”, to challenge Abe.

In four years’ time, the Party of Hope will likely give the LDP a run for its money.

With the election on 22 October, we think her chances are slim, even though there are some parallels between what she is trying to do, and Emmanuel Macron’s “En Marche” victory, and also between Abe’s gamble, and the failed gamble of UK PM May earlier this year. Moreover, in terms of policies, there is very little to separate Koike from Abe on policy grounds. This is more about personalities, and so far, Koike is about the only personality in her fledgling party. In four years’ time, the Party of Hope will likely give the LDP a run for its money. But they face a very difficult task at this election.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion