Is the pandemic easing off?

Global case numbers no longer accelerating, second waves peaking, but reinfections also proven. Where do we go next?

Market response already happened

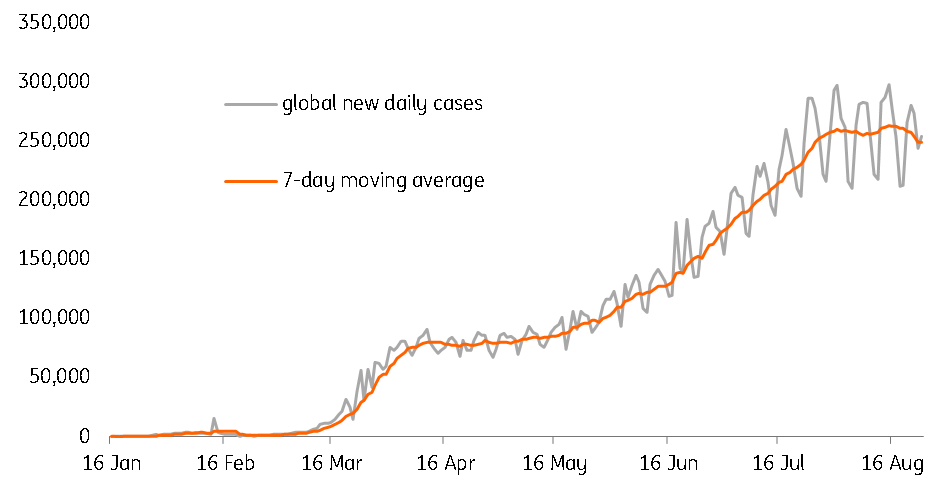

When Covid-19 was still a new thing, and we were all still referring to it as nCov, the received wisdom was that markets would rally once the second derivative of the new case numbers began to decline. In other words, when the acceleration lessened. Right now, globally, the numbers of confirmed cases daily are declining, the 7-day moving average is dropping, as are the new deaths figures - which is a lagging indicator, but nonetheless, a useful back up that the new cases figure is being reported accurately, or at least, that the error of reporting is systematic and not trending. That is almost as good.

However, given what markets have done for months now, I think the prospect that they take any solace from this on top of what they have already done, is limited.

But forgetting markets for a moment, this is also important for daily life, as it suggests that we are entering the phase of this pandemic where we can begin to live with Covid. No, it isn't fun, and there are still considerable restrictions. But as time goes on, we will no doubt see these restrictions also easing bit by bit. Schools re-opening, a recovery in international travel with shorter quarantines, but bolstered by testing. I think we are all prepared to live with this, and it is potentially good news for the macroeconomy too, and markets probably won't be too bothered so long as central banks are not tightening, which they won't be for years.

One note of caution though. The news that a Hong Kong man has been proven to be reinfected with Covid-19 means that the assumption of the market that it is only a matter of time before a vaccine comes and brings back the old life again, is more questionable. True, this individual had no symptoms (on either occasion), so a vaccine might still save us from the worst symptoms of an infection. But perhaps we should be tempering our optimism. In any case, and despite the suggestion that the Astra-Zenecca vaccine may be fast-tracked by the US President ahead of the US elections, the likelihood of widespread rollout of any vaccine before 1Q2021 is still looking quite slim. We're getting there. but it is a long slog, and I still wonder if markets have the endurance for that given that monetary policy and fiscal policymakers alike are running out of policy-"nandralone"?

Global new Covid cases and 7-day moving average

And another thing....grrrrr

While we are on the topic of policy setters, we have of course got to endure this year's Jackson Hole convention later this week. I was irritated earlier in the week by the suggestion that equities were rallying ahead of that, in anticipation that central bankers would hint at further stimulus (like what exactly?).

In case it isn't patently clear by now, let me spell it out. The moment that central bankers start to tell you that they have plenty of ammunition left in the bag, and then start that list with forward-guidance (a pint of beer on Powell mentioning this on Thursday in his opening speech if anyone wants to take me on) is the moment you know that the magazine is empty, the emperor is wearing no clothes, the horse has already bolted (you get the picture).

So, yes, no doubt Friday morning, I will have further material on which to make my acerbic commentary, but for the markets, this should be regarded as a virtual non-event (and indeed it is "literally virtual" these days - a sentence I didn't ever think it would be possible to write - with participants attending online.

Recent price action - a bit weird

The trend price action in recent weeks has been, dollar weakness, offsetting gold strength, equities rally. yesterday, it didn't quite work like that. Equities still rallied. And the dollar did initially start out weak, with the Asian FX complex almost all gaining on the day. But it didn't end that way. And though stocks still finished up, gold and most FX pairs including those in Asia, gave back almost all of their gains for the day.

This isn't perhaps all that meaningful, but the pattern of correlations is something we shouldn't ignore. Neither the USD, nor EUR, or DXY, from the FX perspective, was looking particularly overbought/sold yesterday. Neither were equities, nor gold. So it is hard to put this down to a short-squeeze on EUR or the DXY, or stock markets to make room for the trend to resume.

I don't want to make too big a deal of this, but I am beginning to wonder if we are moving towards a new trend of correlations between markets, whatever that may be...?

Asia today

It's a very light calendar for macro releases in Asia and the G-7 today. Nicky Mapa has this to say on the Philippines and their central bank.

"Philippines: Bangko Sentral ng Pilipinas (BSP) Governor Diokno reported that the central bank had purchased roughly Php800 bn worth of bonds through its purchase window since March, equivalent to roughly 30% of total transactions in the local bond market. BSP currently holds 15% of all outstanding government bonds and Diokno indicated that they would continue to purchase bonds during the crisis. With BSP still employing quantitative easing, bond yields will remain floored until further notice although we do note emerging risks as Diokno has not outlined an exit strategy from his use of quantitative easing".

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

25 August 2020

Good MornING Asia - 25 August 2020 This bundle contains 2 Articles